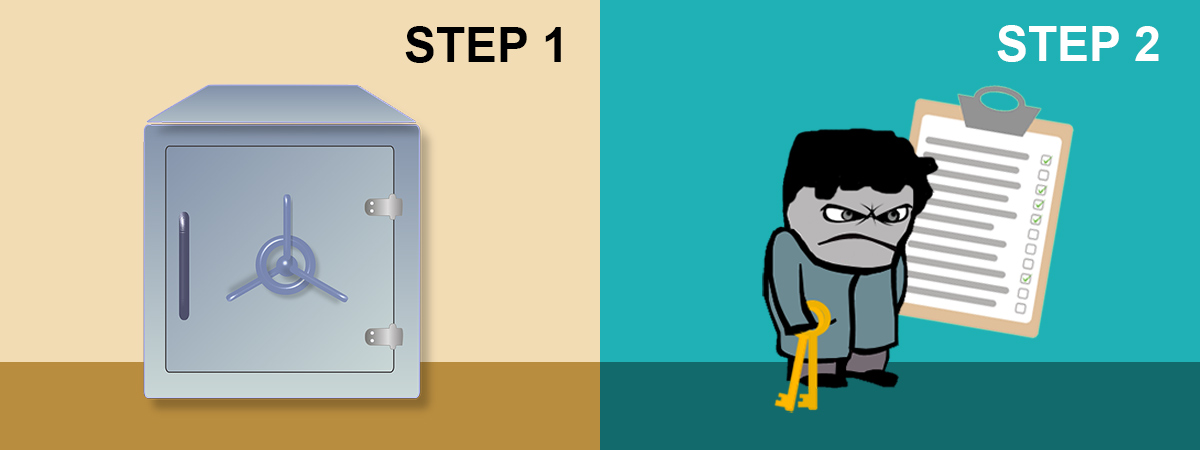

Securing a tenant’s deposit is a pretty run of the mill process for landlords. Nothing new there; seems pretty straightforward; you can quickly secure your tenant’s deposit online, perhaps even simultaneously taking a dump. Job done.

Once upon time that was all that was required in order to comply with the tenancy deposit legislation. Alas, times have changed, now there’s legwork and hoop-jumping required in order to stay on the right side of the law.

On top of securing a tenant’s deposit into a Government-backed tenancy deposit scheme, landlords are also legally required to provide tenants with information regarding the securitisation of the deposit once the deposit has been secured (i.e. “Prescribed Information”).

Table of contents

- What is the Tenancy Deposit Prescribed Information?

- What should landlords do after a deposit has been secured?

- Re-issuing Prescribed information and Periodic Tenancies

- What happens if the Deposit Prescribed Information isn’t provided to the tenant?

- Download Prescribed Information Receipt of Acknowledgement Form

What is the Tenancy Deposit Prescribed Information?

It’s the key information relating to the deposit protection including:

- Which deposit scheme has been used to secure the deposit

- Instructions on how to manage disputes

- Key contact information

The Housing (Tenancy Deposits) (Prescribed Information) Order 2007 legislation says the following information should be provided as part of the Prescribed Information:

- 2. – (1) The following is prescribed information for the purposes of section 213(5) of the Housing Act 2004 (“the Act”) –

- (a)the name, address, telephone number, e-mail address and any fax number of the scheme administrator(1) of the authorised tenancy deposit scheme(2) applying to the deposit;

- (b)any information contained in a leaflet supplied by the scheme administrator to the landlord which explains the operation of the provisions contained in sections 212 to 215 of, and Schedule 10 to, the Act(3);

- (c)the procedures that apply under the scheme by which an amount in respect of a deposit may be paid or repaid to the tenant at the end of the shorthold tenancy(4) (“the tenancy”);

- (d)the procedures that apply under the scheme where either the landlord or the tenant is not contactable at the end of the tenancy;

- (e)the procedures that apply under the scheme where the landlord and the tenant dispute the amount to be paid or repaid to the tenant in respect of the deposit;

- (f)the facilities available under the scheme for enabling a dispute relating to the deposit to be resolved without recourse to litigation; and

- (g)the following information in connection with the tenancy in respect of which the deposit has been paid –

- (i)the amount of the deposit paid;

- (ii)the address of the property to which the tenancy relates;

- (iii)the name, address, telephone number, and any e-mail address or fax number of the landlord;

- (iv)the name, address, telephone number, and any e-mail address or fax number of the tenant, including such details that should be used by the landlord or scheme administrator for the purpose of contacting the tenant at the end of the tenancy;

- (v)the name, address, telephone number and any e-mail address or fax number of any relevant person;

- (vi)the circumstances when all or part of the deposit may be retained by the landlord, by reference to the terms of the tenancy; and

- (vii)confirmation (in the form of a certificate signed by the landlord) that –

- (aa)the information he provides under this sub-paragraph is accurate to the best of his knowledge and belief; and

- (bb)he has given the tenant the opportunity to sign any document containing the information provided by the landlord under this article by way of confirmation that the information is accurate to the best of his knowledge and belief.

- (2) For the purposes of paragraph (1)(d), the reference to a landlord or a tenant who is not contactable includes a landlord or tenant whose whereabouts are known, but who is failing to respond to communications in respect of the deposit.

What should landlords do after a deposit has been secured?

First and foremost, if you take a deposit from a tenant it must be secured in a government approved deposit scheme within 30 days of receiving the deposit.

Landlords must then provide the tenant(s) with the Prescribed Information within 30 days of receiving the deposit.

Each deposit scheme provides landlords with “Prescribed information” download packs, which covers all the information they should be supplying to their tenants. Each tenancy deposit scheme has its own rules setting out in detail how it operates, which you should follow carefully.

Government approved tenancy deposit schemes

Re-issuing Prescribed information and Periodic Tenancies

Please note… there was a time when the Prescribed information needed to re-issued when a fixed tenancy rolled into a periodic tenancy. Since the Deregulation Act 2015 was introduced, the rules have changed; if the tenancy rolls over into a new fixed term AST or a statutory periodic tenancy there is NO need to re-issue the Prescribed Information as long as:

- The deposit was properly protected and Prescribed Information served at the start of the original tenancy

- The property let remains the same

- The tenant(s) remain the same

- The landlord(s) remain the same

- The deposit protection scheme used remains the same

Source of above information: RLA

What happens if the tenancy deposit Prescribed Information isn’t provided to the tenant?

In short, nothing good can come from it:

- The tenant can seek compensation (up to 3 x the deposit amount)

- Landlords cannot serve a valid Section 21 possession notice (meaning it can become very difficult to evict the tenant)

Ayannuga v Swindells

A recent Court of Appeal decision imposed the maximum penalty on a landlord (3 x the deposit amount) because he DIDN’T provide ALL the prescribed information relating to the protection of the deposit to his tenant.

The case in question is Ayannuga v Swindells.

In summary, the tenant allegedly fell into rent arrears, consequently the landlord sought possession.

The tenant responded with a big “Fuck you” and decided to counterclaim against the landlord for not providing him with enough information regarding the secured tenancy deposit (the “Prescribed Information”), presumably because he/she well aware that this would prevent the landlord from repossessing the property via a Section 21 notice.

Unfortunately, this case may have opened the floodgates for other tenants to do the same thing – to counterclaim for all the wrong reasons. It’s hard to imagine that the tenant wasn’t making their counterclaim out of spite to avoid eviction after falling into arrears. Either way, a lesson for all landlords and a stark reminder of why it’s important to comply with the tenancy deposit legislation in its entirety. The law is the law.

Prescribed Information Receipt of Acknowledgement Form

In light of penalties landlords could face if deposits are not secured and the correct Prescribed Information (P.I) being served, I have put together a Tenancy Deposit P.I receipt of acknowledgement form, which I ask my tenants to sign. The form confirms that they have been provided with the Prescribed Information. You can download a copy by entering your name and email address below.

Disclaimer: I'm just a landlord blogger; I'm 100% not qualified to give legal or financial advice. I'm a doofus. Any information I share is my unqualified opinion, and should never be construed as professional legal or financial advice. You should definitely get advice from a qualified professional for any legal or financial matters. For more information, please read my full disclaimer.

Landlord Products / Services

Landlord Products / Services

Good read....but one thing about the 4 page form has go me confused, under the tanants section:

"Contact address to be used by The Landlord at the end of the tenancy:"

how are you supposed to know that, get a time machine?