“I need to sell my house quickly for cash… like, TODAY!!”

Using a cash house buying company used to be reserved for “desperate sellers”, or at least that was common conception, but over the recent years their appeal has managed to penetrate into the mainstream market. The reality is, cash house buyer companies have become insanely popular with every type of seller.

Yup, property cash buyers notoriously have a dog-turd reputation (and that’s an understatement), often being labelled as “scammers” due to unscrupulous actors operating in the market, however, there are definitely genuine companies too, providing excellent service:

- Cash offer with in 48 hours (no obligations)

- Complete sale in as little as 7 days

- No fees to pay, they cover all costs (including legal)

- Any property, any condition considered

But what’s the catch? Should you use a cash house buying company? Here are the need-to-knows, including the traps to avoid…

The reason I’m covering this topic (on my landlord blog) is because there’s been a recent uptick in demand for more information on this topic from fellow landlords. I ‘spose it makes sense, because it’s easy to see the appeal in liquidating an investment with relative ease and speed, especially when dealing with tenanted/occupied properties.

In any case, let’s go through the details of how you can go about selling up quickly for cash (whether you’re a landlord or just a regular homeowner looking to sell)…

Page contents

- What are quick house sale/cash buyer companies?

- A list of the best rated quick house sale/cash buyer companies

- The Pros and Cons of selling your house to a cash buying company

- Points to consider when selling your house via quick sale company!

- Common signs of a scam!

- Questions to ask Quick House Sale / Cash Buyer Companies

- Quick Sale Cash Buyer Companies Vs Traditional Estate Agents

- Alternatives to cash buying companies!

What are quick house sale/cash buyer companies?

I’m hoping no one is scratching their ass in complete confusion, because the name is very telling.

Quick house sale companies (also known as ‘We buy any house‘ companies and “Cash House Buyers”) buy houses – typically in any condition – for cash. Even your one, probably.

They can be a great option for homeowners who need to sell their property quickly, and/or don’t want to go through the hassle and expense of making repairs or renovations before putting it on the market.

While there isn’t one reason for why people sell to a cash buying company, they’re often used under the following circumstances:

- Divorce/ separation

- Financial difficulty (e.g. prevent house from being repossessed)

- Selling property in probate

- Inherited a property

- Relocating / emigrating

- Problematic property (e.g. subsidence, Japanese Knotweed, Property with loft foam insulation etc)

Cash buyer companies generally work in two ways:

- The won’t actually buy your home, but simply broker a sale in the background with a cash buyer, and then cream a cut off the top.

- The company will directly purchase the property from you (this is typically the quickest way to achieve a sale, for the obvious reasons, and why I think it’s the better option).

In both instances, you’ll be expected to accept a discounted rate for your house, somewhere in the region of 10% – 25% below the market value. But I suspect (and hoping) that shouldn’t come as a surprise to anyone, because that is the catch of using one of these companies.

Be wary of any property cash buyer that offers 100% of the market value! A genuine property cash buying company will never pay full market value!

Best rated Quick House Sale/Cash Buyer Companies

While I’ve never used any of the companies below (so I can’t personally recommend any of them based on experience), I did shuffle through, what felt like a gazillion “Quick house sale” services, and the below looked to be the most promising (I explain how they made the shortlist below the table).

I’ve tried to accumulate the ‘selling features’ of each service, but I recommend doing your own due diligence!

| Service | Rating | Features | Offers (up to) | |

|---|---|---|---|---|

My Homebuyers | Rating TrustPilot Reviews | Features

| Offers (up to) 80-85%of Market Value | Get cash offer |

Home House Buyers | Rating Reviews.co.uk | Features

| Offers (up to) 80-85%of Market Value | Get cash offer |

House Buy Fast | Rating Reviews.co.uk | Features

| Offers (up to) 85%of Market Value | Get cash offer |

Property Solvers | Rating TrustPilot Reviews | Features

| Offers (up to) 75%of Market Value | Get cash offer |

QuickBuyers | Rating TrustPilot Reviews | Features

| Offers (up to) 75-85%of Market Value | Get cash offer |

Please note, I try my best to keep the information of each service up-to-date, but you should read the T&C's from their website for the most up-to-date and accurate information.

If you have any experience with any of the above companies, or if you’re in the midst of weighing up your options, I’d love to hear your feedback (leave a comment below!).

How did the companies listed make my shortlist?

As I’ve said, I’ve never used any of the companies listed – so I can’t recommend any of them based on personal experience. With that said, I had to come up with a formula to help generate an objective shortlist of the crème de la crème, so that’s exactly what I did. Not a very sophisticated formula, mind you. However, I think it does build a practical and reasonable case to justify my choices.

Simply, when scouring through all the various companies in the sector, I ensured they all met the following prerequisites:

- Genuine cash buyer – they buy the property directly, and therefore don’t need to source a buyer (and essentially act as a middleman/broker) or secure finance before being able to purchase your property, like many of the other property cash buyer companies do. Using a company that buys directly is by far the most efficient option, least of all because it severely reduces the chance of deals collapsing.

- Professional and functional website (sidenote: I was baffled to discover as many butt ugly and unusable websites as I did! The industry seems to be suffering from a condition that impacts their judgement for design and basic usability)

- Highly rated across impartial review/rating platforms (e.g. Feefo, TrustPilot, Reviews.co.uk. The usual suspects)

- Members of redress schemes (e.g. The National Association of Property Buyers (NAPB), members of The Property Ombudsman and Trading Standards etc.)

- Competitive and realistic cash offers (between 75% – 85% market value)

- Transparent contact details, including physical premises

- Registered company on Companies House

- Reputation (as in, they didn’t open their doors last week and start trading)

Now, before you get your knickers in a twist, I’m not saying some good soldiers didn’t slip through the net – I’m sure they did – so if there’s a company you’re investigating (or representing) that isn’t on my list, it doesn’t necessarily mean I think they suck donkey balls (although, it quite possibly could). It’s also worth noting that I hate long lists of anything, because I don’t find them particularly helpful with decision making, which is why I’ve kept the short list to a minimum.

The Pros and Cons of selling your house to a cash buying company

Pros

- Achieve a quick sale (these companies usually have the cash on hand to purchase a property outright, which means the sale can be completed in as little as a few days);

- A lot less hassle than traditional methods, particularly because all the legal work and searches is taken care of for you;

- Quick way of liquidating asset in order to access cash;

- Can help avoid repossession, clear debts, and generally resolve financial issues;

- A good solution for anyone that has been struggling to sell their property via the traditional means;

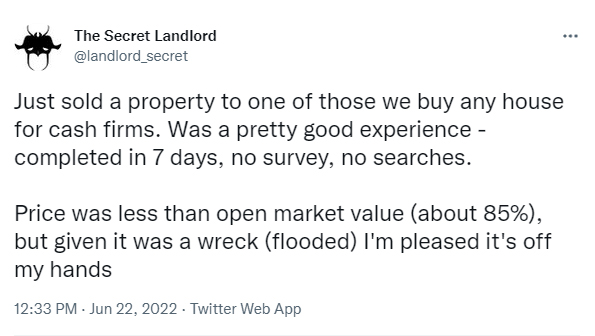

- Effective solution for anyone that wants to sell a “difficult” property. Case in point, here’s a Tweet I randomly bumped into on my timeline, by someone that goes by the alias @landlord_secret:

Cons

- Of course, the main trade-off of using a quick house sale service is that you’ll have to accept a price that’s lower than the current market value (they typically offer between 75% – 90% of the market rate), and they make no secret of that, since it is the foundation of their business model.

However, I’m still surprised by how many sellers are disappointed by the cash offer they receive! Cash buying companies are always going to make below market value offers, so there’s always going to be a natural struggle, since sellers want the highest price possible.

- The cash buying industry is unregulated, so it’s important to work with a reputable company.

- Fee structures can be confusing and unclear, so home-sellers often end up paying more in fees than expected.

- Some companies make false property valuations (i.e. they provide low valuations to get a better deal).

Needless to say, most of the cons can be avoided with due diligence and by using a reputable company.

Points to consider when selling your house via quick sale company!

- Think carefully about whether using a quick house sale company is right for you! It’s important to understand both the pros and cons. It’s also worth looking into all your options, and then deciding which is the best decision for your circumstances.

- Don’t purely rely on the property valuation provided by a quick sale company, do your own valuation. Here’s a guide on how you can value your property.

I have a read a few horror stories of vulnerable sellers have lost up to 50% by selling to quick sale companies, because of undervaluing!!

It’s also worth asking the company how they conduct their valuations. Normally, you will receive an initial preliminary estimate over the phone. They will then send someone to assess your property, accurately evaluate its condition and make an offer accordingly. You will then receive a final offer (which you shouldn’t be under no obligation to accept). But it’s definitely best to check what the policy is before agreeing to an in-person valuation!

- Negotiate! Following on from the point above; don’t be afraid to negotiate!

- “Free service, no legal costs” – almost ALL quick sale companies offer a completely free service to sellers, and they’re definitely not shy in flaunting it: the “no legal costs, we take care of it all” headline is very alluring. But it’s important to note that it’s not really free, because they take the costs into consideration when making you a below market value offer!!

I don’t think it’s a particularly vicious tactic, but it’s worth bearing in mind, and I definitely wouldn’t put too much value on the flashy headline.

- Property cash buyer companies aren’t regulated nor is the industry so consumers aren’t protected when selling a property to one of these companies. That’s why it’s important to use a company that is a member of the National Association of Property Buyers (NAPB), because they require all their members to register with The Property Ombudsman (TPOS), which means homeowners will have to access their independent redress in the event of a dispute.

Just to emphasise the importance of using a reputable company, here’s a news article on the MailOnline reporting a story on The Office of Fair Trading investigating three unnamed ‘quick house sale’ companies for alleged unfair practices that may have led vulnerable customers being left tens of thousands of pounds out of pocket.

Only use a Quick House Sale / Cash Buyer Company that is a member of the National Association of Property Buyers (NAPB) and registered with The Property Ombudsman (TPOS).

- Are they buying directly or acting as a broker and sourcing a buyer? As mentioned already, there are generally two types of services available when it comes to selling fast via a quick sale company. Either they will buy the property off you directly, or they will broker the sale. It’s important to understand the difference between the two, because generally speaking:

- If they buy directly: you will get offered a lower price (e.g. 80% of the market value) but the sale will be quicker (e.g. 7 – 14 days).

- If they source buyers: you will get offered a higher price (e.g. 90% of the market value) but the sale will take longer (e.g. 4 – 8 weeks). It’s also possible that you’ll be subject to a ‘sole agency’ contract (similar to how regular estate agents operate), so that’s definitely a factor you should be mindful of.

- Read the contract(s) carefully, and don’t agree to work with a company unless you fully understand the T&C’s, particularly all the associated fees. Everything should be written down, so don’t rely on verbally agreed upon terms.

- Most companies will have their own internal/recommended legal adviser which they will try and encourage you to use. They can’t legally force you to use their recommended legal services, and it’s generally better to source your own independent legal adviser.

If you don’t already have one (either by recommendation or previous use), you can search for legal representation from the following websites:

- England and Wales – find a solicitor on the Law Society website

- Scotland – find a solicitor on the Law Society of Scotland website

- Northern Ireland – find a solicitor on the Law Society of Northern Ireland website

- Don’t be afraid to ask questions! Ask every question you need before agreeing to work with a company. For example, ask them how quickly they expect to achieve a sale, how quickly you should expect the money in your account, and what their recent results have been like. A more complete list of questions you may wish to ask is further down this page!

Common signs of scams and unethical practices to be wary of!

Rest assured, you can sell your home fast to a reputable and genuine ‘Property Cash Buying’ company, but unfortunately, given that the industry is unregulated, there are scammers providing disingenuous services. Needless to say, they should be avoided at all costs.

Below I have listed some red flags!

- If they are not registered members of National Association of Property Buyers (NAPB) and The Property Ombudsman (TPOS)? You should check on each website to verify an active membership, do NOT take their word for it.

- If they use option agreements and contracts!

If you are using a cash buying company that buys property directly from the seller with their own cash, then stay clear of any house buyer company that uses ‘lock-in’ contracts, option agreements or RX1 forms, because that usually means they’re trying to restrict your options, along with enforcing cancelation fees, not to mention other unethical chokeholds.

Signing a contract with one of these companies may instinctively seem ‘normal’ (which is why many do), but it’s not, because they are NOT estate agents, they are “direct” buyers (at least, they’re supposed to be).

Genuine cash buyer companies will never ask you to sign a contract at any point during the sales process, the only time you should ever sign anything is when your solicitor who is acting for you is asking to you sign the contract and transfer document just before your sale completes.

- If they claim to be ‘regulated’ by a government body. If that’s the case, they are either lying through their teeth or don’t understand the industry they’re operating (I don’t know which is worse, to be honest), because the industry is not regulated.

- If they ask for any form of payment, particularly upfront payments.

- Any company making formal offers before they have conducted a full valuation and are asking you to sign some form of contract or commitment form is a major red flag (as mentioned, a cash buyer with good intentions will NEVER make you sign any contracts).

It’s impossible to accurately value a property before conducting a full valuation, so if anyone does that, it likely means that they have gone in with a high offer that they have no intentions of paying, therefore will likely significantly lower the offer as time goes on. This practise is incredibly common by bad actors in the space.

Genuine cash buyers will only ever make a formal offer on a property once they have completed a full asset management valuation and the offer is fully underwritten. That means any formal offer made is most likely what they intend on paying, and the only time they will reconsider the offer is if something significant is found that affects either the value, mortgageability or the saleability of the property.

- If they ask for any cancellation or withdraw fee within their paperwork/contracts/terms of service.

- If they claim to provide a guaranteed sale for close to 95% – 100% of market value. If they did that, they wouldn’t make any money.

If a company is tempting you in with an unrealistically high offer, then you can be certain that they will be making their money somewhere else along the way (most likely in hidden fees).

- If they do not have a clearly visible Company Registration Number on their website.

- If they act like they’re genuine cash-buyer, when actually they’re just brokering the sale with a cash buyer.

If they’re a genuine cash buyer they will be able to provide proof of funds. don’t be afraid to ask for proof. Any reputable cash buyer will be happy to prove that they are genuine. If they get funny about it, that’s a real red flag.

Questions to ask Quick House Sale / Cash Buyer Companies

- Which redness schemes are you members of?

Many companies (not just quick house sale companies) advertise they are members of various redness schemes when they actually aren’t! You should be able to verify membership on each respective scheme’s website.

- Do I have to sign any option/purchase agreement with you (basically, find out if you’re tied into any contracts)?

- Are you direct buyers with the finance in place or brokering a deal with a 3rd party cash buyer?

- How will you value my property?

- How long until completion?

- How long after completion will I receive the money?

- Is the valuation 100% free and without any obligations?

- The following questions will typically only be relevant if the company requires the seller to sign a purchase agreement (as mentioned, I would avoid cash buying companies that require it), but still worth asking them even if not:

- What fees will I be obligated to pay, including any charges if the sale doesn’t complete?

- Can I cancel our agreement without incurring any fees/penalties?

- Will I be restricted to using your services (similar to a ‘sole agency’ agreement)?

- Can you at any point change your offer, and if so, on what grounds? If you change your offer can I cancel our agreement without incurring any fees/penalties?

- Will you put a ‘restriction’ against the title of my property with HM Land Registry? (if “yes”, then they will be able to register a charge on your property!)

Important: ask these questions via email so you have written proof of their answers!

Quick Sale Cash Buyer Companies Vs Traditional Estate Agents

Ah, some would say the ultimate match-up: Douche-bag Vs Douche-bag

Of course, I’m not one of those people. I’m not a savage.

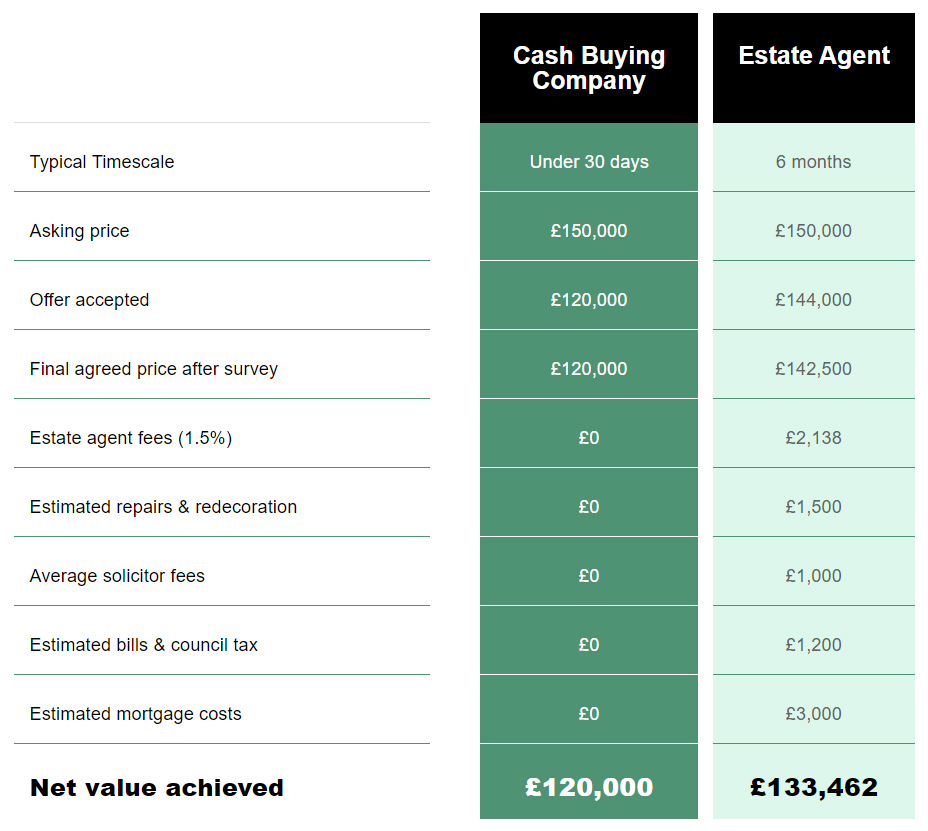

The majority of cash buying companies will occupy their homepage with a nifty little comparison table that highlights their service Vs Estate Agent, which demonstrates a predictably biased overview of why we may want to consider their service over our beloved local high-street estate agency. It goes something like this:

They sure do paint a pretty little picture, don’t they?

How accurate is it? well, it definitely paints an extremely rosy picture for one specific case. However, I think it does highlight one very important point that is undeniably accurate, and that is using traditional methods to sell property on the open market can be a notoriously long process, which in itself comes at a cost that many don’t consider, and I think that’s what the comparison table shows above anything else. Time is money [and cash buying companies can save sellers a hell of a lot of time] .

Alternatives to cash buying companies…

- If you’re looking to sell cheap, and not necessary quick, you may want to try using an online estate agent instead of venturing down the quick sale route. Online estate agents can market your property on the biggest property portals (like Rightmove & Zoopla) for as little as £99.

- Before tossing the idea of using your local high-street agent out the window, it might be worth talking to a couple of them to see whether they can offer you a “quick sale” deal. It might also be worth asking them what their average sale time is.

I’d personally rather work with a local brick and mortar agent over an online ‘quick sale’ service if possible.

- One of the main reasons for selling quickly is to get relief from financial difficulties, mainly suffocating mortgage payments. If that’s your reason, it’s worth contacting your mortgage lender to discuss your options. They might be able to amend your policy so it’s easier for you to manage your payments.

Disclaimer: I'm just a landlord blogger; I'm 100% not qualified to give legal or financial advice. I'm a doofus. Any information I share is my unqualified opinion, and should never be construed as professional legal or financial advice. You should definitely get advice from a qualified professional for any legal or financial matters. For more information, please read my full disclaimer.

Landlord Products / Services

Landlord Products / Services

Thanks for the great information.

I'm currently looking into using one of these companies to sell a few of my btl's. I was just wondering if you know why there is such a big difference in the percentage of the market value they offer? A spread between 75 - 90% can equate to alot of money. Do you have any thoughts? Many thanks