It’s not uncommon for landlords to either cash out, downscale and/or liquidate their assets for one reason or another, by bulk selling their rental property portfolio.

For obvious reasons, selling a portfolio of properties – tenanted or otherwise – is easier said than done. The obvious obstacle and question being, what to do with the tenants? Can I just get rid of them?

Essentially, you have two options:

- Sell with the tenants in situ

- Complete sale after possession (i.e. eviction)

Of course, that’s just one glaring and concerning issue, the other is finding a buyer for each and every property. Sounds painful. It can be, and unfortunately it usually is for most people… but it doesn’t have to be!

In this blog post, I’m going to go over two effective options of selling property portfolios (with or without tenants in situ) the less painful way!

The obvious and arguably least effective solutions to selling a property portfolio

So, just to cover the most obvious solutions first (which aren’t particularly optimal when trying to shift an entire portfolio, especially with tenants in situ – which is usually the case when selling a portfolio):

- High-street estate agents – needless to say, this is unlikely to result in the quickest or cleanest solution, especially if your portfolio is scattered up and down the country, because it means you’ll have to deal with multiple agents. But there are some obvious perks; you should be able to negotiate good rates, and agents often have contacts with professional landlords and/or developers that are keen to snap up properties in bulk.

- Online & hybrid estate agent – similarly with using a local high-street agent, using an online estate agent won’t provide the quickest solution. However, you’ll get a better rate, as online agent fees are typically a lot cheaper and charged at a fixed rate. But I ‘spose the biggest advantage is that you can sell all your properties despite their location, via one online agent as they operate nationwide.

- Private buyer – always a possibility, but I couldn’t tell you where or how to find a private buyer that’s in the market for buying in bulk. Without the right contacts, this approach can be like looking for a needle in a haystack!

Two effective ways of selling a property portfolio

Now, onto the good stuff…

- Option 1) Professional “Property Cash Buying” company – super quick cash solution. They buy directly with cash from the seller, and will generally pay between 80% – 85% of the market value.

- Option 2) Specialist Portfolio Estate Agent – similar process to using a traditional high-street agent (i.e. they are the middlemen), but they specialise in selling portfolios with tenants in situ, making them much more effective than your average local agent. Using a cash buying company will likely result in a quicker sale (because they are direct buyers), however, a specialist portfolio agent can achieve circa 85 – 95% of the market value and still work relatively quickly given the circumstances.

Yup, using one these methods will entail selling below market value, but something to bear in mind is that they will, simply, save you a lot of time and make the process easy.

Each method has their pros and cons, with clear differentiations, which may make one option more suitable than the other depending on your circumstances. To help you decide, here’s a look into each option in more detail…

Option 1) Professional “Property Cash Buying” company

I’ve already written an in-depth blog post on Property Cash Buying companies, so here’s a snappy summary:

- “Property Cash Buying” companies buy properties for cash.

- Their biggest selling point is that they make the process quick and easy, particularly because they buy directly from the seller. In many cases, you can expect to get a cash offer within 24 hours, and a completed sale within 7 days. In more complex cases, expect longer timeframes, but still significantly quicker compared to the traditional routes.

- Many will consider buying any property in any condition, including tenanted properties.

- The catch is you should expect to receive an offer anywhere between 80 – 85% of the market value. Essentially, they’ll expect a hefty discount.

- “Property Cash Buying” companies (also known as “We Buy Any House” companies) are growing in popularity and that’s why there isn’t a shortage of them. However, it’s critical to understand that the sector is unregulated, which means the murky waters are infested with sharks, so you really need to be careful if you plan on using one. Do your due diligence, and ensure you use a company that is a member a redress scheme (e.g. The Property Ombudsman) so you benefit from consumer protection (there are more tips available in the guide I linked to above).

Advantages of using “Property Cash Buying” company to sell your property portfolio

- It’s a quick solution (relatively speaking). They can buy all of their properties in one transaction even if they are scattered over the country, meaning you would forego the hassle of selling them individually.

- They can buy the property with your tenants in situ.

- You will avoid the costs involved in serving notices and possibly court fees.

- They will takeover other costs such as (which otherwise you may need to cover):

- Council Tax on the empty property

- Utility bills

- Increased insurance costs for an empty property

- Loss of interest on the capital that you could be investing elsewhere while you are not getting any rent

- Potential mortgage payments where applicable

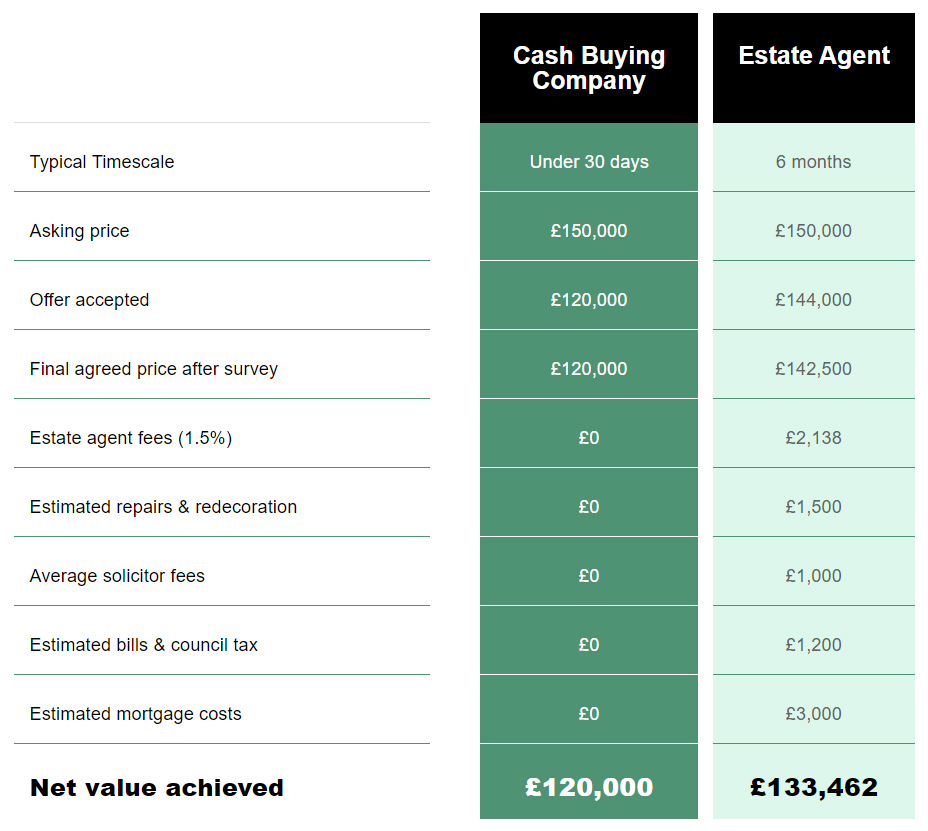

Just to give you an idea of what you can expect in terms of costs/net value compared to an estate agent, here’s an example I found on a cash buying company’s website, so make of it what you will…

Obviously the example only accounts for one property, so presumably you might be able to get a better deal with multiple.

So, should you use a Cash Buyer” company to sell off your rental property portfolio?

Sadly, I can’t answer that for you.

But what I can say is that if you work with a reputable and reliable service provider, you can achieve a quick sale in one clean hit, and you might find that the discount you’ll have to provide is worth the cost of the alleviated stress of having to sell one property at a time, not to mention the added concerns of whether to evict the tenants before selling, or trying to find a buyer willing to purchase a tenanted property (which is a very limited market).

At the very least, you may want to discuss your situation with a company offering the service and listen to what they have to say and how much they’re willing to offer.

Which “Property Cash Buying” company should you choose?

I don’t really want to steer anyone into one direction, because I believe independent research and due diligence is critical.

However, I am comfortable in highlighting Myhomebuyers.com as an example of a well-rated service. Crucially, they’re members of The National Association of Property Buyers and The Property Ombudsman and Trading Standards.

Yes, they are an affiliate partner of mine, but only because they continuously provide useful industry insight and have always been super responsive with any of my enquiries. Make of that what you will.

When I asked Myhomebuyers what the biggest advantage of using a service like theirs is, for any landlord looking to sell a portfolio or multiple properties, they swiftly responded with the following:

I think one of the benefits of a landlord selling directly to us is they cut out the uncertainty of putting the house on the open market and the tenant becoming nervous and either leaving or becoming difficult and stop paying.

Speaking with landlords, none of them want to rock the boat with their tenants. We can get to an offer without accessing the property and if the offer doesn’t work then the tenant was none the wiser and there was no disruption to the tenancy.

| Service | Rating | Features | Offers (up to) | |

|---|---|---|---|---|

My Homebuyers | Rating TrustPilot Reviews | Features

| Offers (up to) 80-85%of Market Value | Get cash offer |

For more options, I’ve created a list of the Best rated Quick House Sale / Cash Buyer Companies that are members of redress schemes. It might be worth talking to a few of them to see if any of them manage to wet your appetite.

Option 2) Specialist Portfolio Estate Agent

- These are estate agents that specialises in selling tenanted properties and full portfolios (unlike the average agent on the high-street).

- The sale process works similar to how a normal estate agent works, in the sense that they will act as the middlemen and find a suitable buyer/investor.

- Their biggest selling point is that they find investors, deal directly with them and any tenants in situ, and manage the entire sale, from the surveys and finance, all the way to completion.

Advantages of using “Specialist Portfolio Estate Agent” to sell your property portfolio

- It’s a relatively hassle free solution. The agent can find you an investor that will buy all your properties in one transaction even if they are scattered over the country, meaning you would forego the hassle of selling them individually.

- They can provide a quicker and more optimised solution than traditional high-street agents, while effectively providing the same type of service.

- You can get anywhere between 85 – 95% of the market value for your entire portfolio.

- They specialise in buying properties from landlords with tenants in situ.

- The speed and simplicity provided can easily compensate for the below market value sale price (bear in mind how complicated it can be to sell a portfolio which includes tenants in situ).

- They manage and work with the tenants (and can even assist with relocation if required).

- Most of specialist agents will buy properties even if they need work.

Recommended “Specialist Portfolio Estate Agent”

| Service | Features | Offers (up to) | |

|---|---|---|---|

Landlord Sales Agency | Features

| Offers (up to) 85-95%of Market Value | Get an offer |

Happy bulk selling, folks!

Disclaimer: I'm just a landlord blogger; I'm 100% not qualified to give legal or financial advice. I'm a doofus. Any information I share is my unqualified opinion, and should never be construed as professional legal or financial advice. You should definitely get advice from a qualified professional for any legal or financial matters. For more information, please read my full disclaimer.

Landlord Products / Services

Landlord Products / Services