Absolutely, money spent on rent is deader than the era when Charlie Sheen and chewing bubble gum was cool, and that’s coming from a landlord that requires renters’ to survive.

Okay, so before getting into the meat and potatoes of this highly contentious topic, I do want to clarify that my intention isn’t to preach, condescend, or judge anyone’s circumstances, and I’m not going to bore you (or myself) with dissecting the costs of Renting Vs Buying.

My only objective is to share my thoughts on the subject, because choosing whether to rent or buy a house was a pivotal decision I once had to make in my sorry life, so I’m going to retrace and express the thoughts I had at the time. Perhaps it will connect with others on the verge of making the same decision, including yourself, and maybe it will help encourage a couple of middle-aged dorks to finally elope from their parents’ nest.

Genuinely, I appreciate that renting is the only viable option for many, so in the following circumstances I think renting is a sensible move:

- you have a family, you need your own house, but you can’t afford to buy

- you find it unbearable living with your parents. And I don’t mean teeny-bop bullshit like “my mum won’t let play out after 8pm”, I mean issues like, “my mum beats me with a toothpick for joy”

- you’re a student

- you don’t want the responsibility of a mortgage nor do you want to stick around in the same place for longer than one minute. I get it, I understand; I’m hip, I’m cool.

- Asylum seekers, refugees, or anyone sneaking into the country; you have no place to stay and you certainly don’t have enough money to buy.

- you have a very limited income, and you’re in receipt of housing benefit.

For anyone else, I’m sorry, but I can’t make any excuses for you.

Many of my friends (aged between 26 – 36) chose to rent ASAP because they craved their independence, and relished the idea of living without the surveillance of the all-seeing parental cam. They couldn’t afford to buy, but they could afford to rent, so off they went, following freedom.

While I understand the urge, I’ve always struggled to get to grips with the reality of their decision, because it always felt like a short-term fix, and ironically, a longer prison sentence. And it still feels that way.

If I can offer one piece of advice for anyone that’s currently deciding whether to rent or buy, it is to think about the bigger picture.

For example, if you have the opportunity to live rent-free (or at a dramatically low rate) – even if it’s not an ideal situation – which can provide the means to save enough money for a deposit, then perhaps it’s a sacrifice worth making.

Essentially, don’t be a spoilt brat.

It’s easy to get stuck in the renting game once you start!

The reality is, once you start renting, it can be incredibly difficult to get out of that hell hole (because it’s hard to save and rent at the same time). That probably explains why I was one of the last to escape the watchful eye of my parents’, but at least I eventually found refuge in a property I own. ALL MINE!

Meanwhile, a large portion of my friends are still stuck renting, and becoming increasingly bitter about it as each day passes. Many of them realise that if they had grit their teeth for a little longer and remained bound by the mercy of their parents’ overbearing house rules, they most likely would have been homeowners by now. But instead, 70% plus of their monthly paycheque goes towards living expenses, and the light at the end of the tunnel is getting dimmer.

Of course, many of them started renting with the certainty that it’s a short-term fixture. Rarely EVER is it. 10 years later and they’re still stuck in the renting rat race.

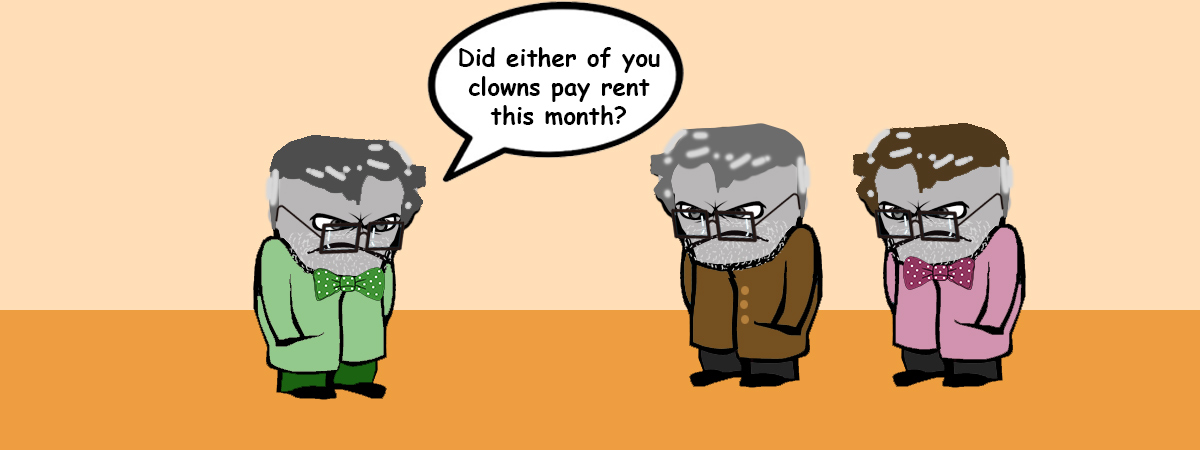

Believe me, renting with your best friends, Tom, Dick and Harry maybe boyishly cute when you’re 20, but it can be extremely unappealing when you hit 28. Unfortunately we don’t have the ability to slow down time, so 28 usually comes around tomorrow.

If you can avoid renting, I say do it. I say suck it up and take advantage of your parents’ roof if you can. Who cares if you’re living with your parents until you’re 30? In this day in age it’s pretty common. There’s no shame in it as long as you have a plan.

The benefits of buying a house

All common sense of course, but just for quick a reminder:

- you’ll always have a valuable and stable asset (one which you can pass onto your children)

- you build equity over time, and the monthly mortgage payments can become less (rent usually always goes up)

- historical data shows that property prices double in value over 10years

- owning a home provides a physiological sense of stability, adulthood and independence

- once you buy a house, it’s easier to gradually upgrade to bigger and/or more expensive homes

Essentially, that’s a breakdown of the thoughts that went through my mind when making the decision, intertwined with my thoughts and position today. In all honesty, not much has changed. I guess I am a little more empathetic towards the situation today, because I do appreciate how much more difficult it is to get a foot on the housing ladder today compared to when I was making my decision. However, at the same time, I do think too many people make excuses and simply aren’t willing to make the sacrifices required, some of which I had to make myself. And it’s usually those very people that wake up at 50years old, wondering where the time went and why they’re still having to hang their mum’s knickers on the washing line.

What do you guys think? Is renting dead money?

Disclaimer: I'm just a landlord blogger; I'm 100% not qualified to give legal or financial advice. I'm a doofus. Any information I share is my unqualified opinion, and should never be construed as professional legal or financial advice. You should definitely get advice from a qualified professional for any legal or financial matters. For more information, please read my full disclaimer.

Landlord Products / Services

Landlord Products / Services

Here's when renting starts getting clever and buying starts getting stupid; when the interest you'd pay on your mortgage (given what you currently have in your pocket to use as deposit) exceeds the rent you would have to pay to live somewhere acceptable.

Mortgage interest charges are also dead money; don't give it to the bank. Rent, and put the excess in your pocket. Then, when you have enough in your pocket to break those interest fees even, buy.

I think you might find that's what all those stupid people are already doing.

V