Usually around this time of year, as the summer begins to wind down and I’m putting my Speedos away in storage, I start receiving letters from various banks informing me that it’s time for me to bend over and get shafted – because I’m about to get thrown out of their introductory interest rate period for their savings accounts’, and tossed onto their diabolical standard variable rates (SVR).

I have 3 savings accounts, an ISA, Regular Saver, and a Fixed saver, all of which I opened at approximately the same time. It’s the latter two which usually need shifting to better deals, because ISA rates aren’t as volatile.

Many of you will already be aware that the last few years have been comically cataphoric for savers, with the UK base rate being so woefully low for the last century (currently a pathetic 0.1%. I mean, seriously, what’s the shitting point?).

Who would have ever thought that saving would become so hideous that it actually makes more sense to reduce debt! What in the fuck?

Generally speaking, I think most of us that are riddled in debt would be better off – strictly from a mathematical point of view – trying to reduce it, rather than depositing our disposal income into an uninspiring savings account, where it’s inevitably going to get swallowed alive by inflation.

Ultimately, many of us are in the position where the interest we pay on debt is now significantly more than the interest we’re making from our savings. This wasn’t the case until recently, at least it wasn’t for me. For example, I currently have a mortgage with a 3.79% interest rate and I had a savings account providing a 2.96% return (after tax).

If I had half a brain and wanted to make my money work as hard as possible, I would have used my savings to reduce debt. The reason I gave good-sense the middle finger was because the amount I was losing out on by saving wasn’t enough for me to concern myself with (just under 1%).

Also, psychology undeniably has a massive part to play with our saving habits. Understandably, most of us receive great comfort from saving money, even though we’re mostly screwing ourselves over by not using that money to kill our debt.

So, anyways, while the last few years haven’t been terribly great for savers, they could have been worse.

Today? Well, they’re officially the worst!

So as I was scouring my beady eyes at the best savings accounts available – deciding where to shift my money next, once the SVR kicks in – it quickly became clear that I wasn’t going to get my mitts onto anything other than dog-shit products. Those mediocre 2-3% rates savers were benefiting from are but a distant memory. The average saver should now expect to indulge on a bitterly bullshit 0.5% rate at best. Brilliant.

It’s officially time for me to kill my mortgage debt

As far as I’m concerned, it’s not even worth saving large amounts of cash while I have outstanding debts that’s costing me 1%+ on interest.

The gap between the interest rates for debt and savings have become far too large, so over saving makes very little sense. That’s especially for landlords with BTL mortgages, because we now have to grapple with the recently introduced the Section 24 fiasco.

On a side note, with interest rates being so puny, now is a great time to remortgage if you can! I highly recommend checking out Habito (a free online mortgage broker) if you want to compare the market and see what’s available for you.

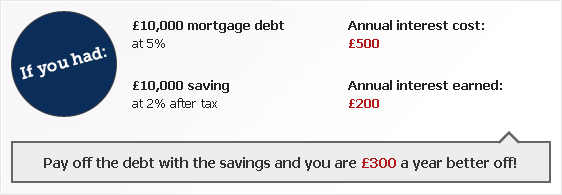

I don’t want to get into the technicalities of “Saving VS Reducing debt” because that’s already been perfectly explained on the the money saving expert website. If you haven’t done so already, I highly recommend scouring through that shizzle on your Friday night and consider it a wild and thoroughly satisfying evening. I did!

But if you can’t be bothered, I’ll understand, and here’s an easy to digest example from Money Saving Expert explaining how in this climate, someone with a mortgage and savings, might be better off reducing their debt:

My specific case

To clarify, I’m not saying reducing debt is the better option in all cases or for everyone. In my specific case, it made much more sense to reduce debt right now, as opposed to hoarding my money in a savings vessel.

Actually, I’m going to take my disclaimer one step further and clarify that I am NOT a financial expert. None of this should constitute financial advice. You should do whatever tickles your balls. I’ll add another disclaimer at the of this blog post – covering how comically unqualified I am – for good measure.

What I will say though, is that if you have debt and savings, perhaps you should consider whether it would be more beneficial to use your savings to reduce debt.

I’ve always been a firm believer in making my money work as hard as possible. Alas, if I was to deposit all my savings into a 0.5 savings account, my money wouldn’t even be sleeping, it would be on its back, dead in the water.

General rule of thumb is that if your mortgage rate is higher than after-tax savings interest, you’ll profit by overpaying it rather than building savings.

I’m still keeping a chunk of my money spread across different savings accounts, so I’m not using ALL my savings to clear debt. Everyone should have access to an emergency fund for all the obvious reasons. However, I am spending more money on reducing debt than I would have ordinarily done simply because of how laughable interest rates are for savers right now.

Anyone else in a similar position or had to make a decision between saving and reducing debt? Let’s hear it then!

Disclaimer: I'm just a landlord blogger; I'm 100% not qualified to give legal or financial advice. I'm a doofus. Any information I share is my unqualified opinion, and should never be construed as professional legal or financial advice. You should definitely get advice from a qualified professional for any legal or financial matters. For more information, please read my full disclaimer.

Landlord Products / Services

Landlord Products / Services

Sounds like a good idea, but there is one more factor to consider - if you reduce your mortgage payment on a BTL by (let's say) £200 the Chancellor with his grubby mitts will show up on your doorstep asking for 20% of it in tax - or 40-50% if you are a higher rate tax payer...