Buy-To-Let is a business, period.

Anyone that has a rental property is running a business, even those that push all the responsibilities onto a letting agent and dislocate themselves from the day-to-day operations.

I know many of my fellow peers don’t see it as a business, but rather a long term investment which just ‘works’ on its own accord in the background. While that may be the case, the fact still remains that your investment required investment, and in the short and/or long term you expect a good return, which is essentially the end-game of almost all profiteering businesses.

No one is in this game to come out at the other end poorer and uglier.

In order to measure the success rate of any profiteering business, expenses and revenue need to be tracked. It’s extremely important for landlords to measure how much they are putting into the pot and how much they’re squeezing out.

If a business is running at a loss, what is the point of running at all? More worryingly, what if you don’t know if you’re running at a loss?

How many landlords can tell me how much they spent on their investment in 2022?

How many landlords can easily tell me how much they spent on maintenance over 5 years?

I’m sure the numbers are woefully low.

The extent of how deep you want to go with your analysis is dependent on how far you want to dig, and to extent how big and complicated your property business is. But in reality, the average landlord with one or two properties will have no need for a complicated solution to track their finances. The basics will suffice; knowing the incoming and outgoing costs and expenses, and in return the net value.

But a lot of landlords don’t even do that, so they really have no idea how their investment – most likely their most expensive investment – is performing. That’s concerning and extremely counter-intuitive.

You don’t need any fancy apps or premium accounting software, a simple spreadsheet like the one available for download will get you started to help track your finances!

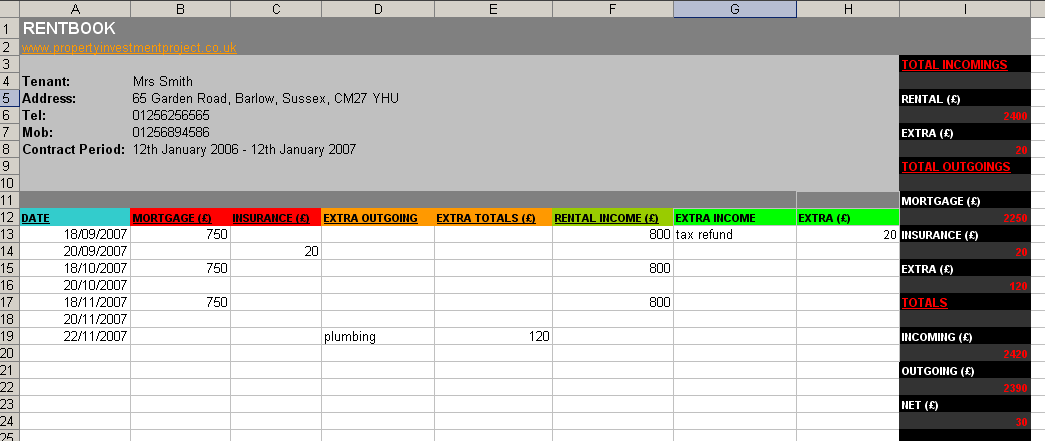

Snap shot of the Landlord Expenses Spreadsheet

It’s extremely rudimentary, it won’t win any awards for innovation, but it will do the job for the average landlord. Something is better than nothing!

It basically holds basic information about the tenant and property (useful for those with multiple properties), and most importantly, calculates all my incoming and outgoing expenses, which will ultimately allow you to know what’s going in and out.

I’m going to make the spreadsheet downloadable so you can use it, or perhaps get inspiration from it. If anyone has any suggestions or modifications they would like to see in the spreadsheet, please let me know.

Spreadsheets Vs Landlord Software – Which?

Using spreadsheets is a good start, and it’s definitely better than using sweet-nothing. No doubt about it.

However, I personally believe most landlords (of all sizes) would be better served using specialist landlord software, and that’s for a few reasons (I won’t go into too much detail in this post, because I’ve already done that in my landlord software post):

- They’re relatively cheap (some are even available for free)

- They make it much easier to track financials

- They provide automated reports and charts

- They provide way more useful features

- They will make it easier to comply with the incoming change to the UK tax system in 2024, “Making Tax Digital”

My personal favourite bit of kit is Landlord Vision (it’s not free, but very fairly priced, in my opinion), and I’ve explained why in my Landlord Vision review. But there are plenty out there in the wild to choose from (once again, you can refer to my landlord software post for more details).

Disclaimer: I'm just a landlord blogger; I'm 100% not qualified to give legal or financial advice. I'm a doofus. Any information I share is my unqualified opinion, and should never be construed as professional legal or financial advice. You should definitely get advice from a qualified professional for any legal or financial matters. For more information, please read my full disclaimer.

Landlord Products / Services

Landlord Products / Services

It looks really good ......

its abit scary when I see how someone is so organised because you just have to be .. I started one and then i got abit side tracked :/ maybe this will motivate my lazy arse , or not