It’s becoming increasingly difficult impossible to get through a day without having a Yopa (and, of course, their fierce rival, Purplebricks) advert shoved in our face – on TV, the radio, on the side of a double-decker bus, or tattooed on a passing cow.

Yopa are EVERYWHERE.

They first jumped onto my radar back when online estate agents were few and far between – barely anyone was using them, let alone had heard of them — aiming to disrupt the house-selling game by offering a dirt-cheap alternative route to market at just a fraction of the cost of a traditional high-street agent.

Clearly, they’ve had success – fast forward to today, and thousands upon thousands of sellers have successfully used Yopa’s services (and other competing hybrid/online agents) saving a bucket load in agency fees.

But, the reality is, hybrid estate agents like Yopa aren’t for everyone – and many only realise this after the fact, having been lured in by the potential savings before fully understanding what’s on offer.

So here I am, attempting to bridge that knowledge gap and provide a completely impartial overview of Yopa’s services (I promise, this won’t be a shameless puff-piece, though full disclosure, I am an affiliate partner), helping you calibrate your expectations so you can decide whether their service is right for you, whether their price tag is worth it, or if they should be sent packing like a fart in a lift on a scorching summer’s day!

Let’s do this…

Table of contents

- Introduction to Yopa: Service Overview

- How Yopa’s Online House Selling Service Works

- Is Yopa the Right Choice for Selling Your Home?

- How Much Can You Really Save Using Yopa?

- Is Yopa Worth Paying Extra for Over a Cheaper Online-Only Agent?

- When You Might Want to Avoid Yopa

- The Elephant in the Room: Yopa vs Purplebricks

- Yopa vs Other Cheaper Online Estate Agents

- Does Yopa Have Any Hidden Fees?

- How to Get Started with Yopa

Introduction to Yopa: Service Overview

- Yopa is technically a “hybrid” estate agent (not “online”), which means they combine features of both traditional and online estate agency models. What does that look like? They operate online (i.e. marketing, enquiries and sales progression is managed via an online dashboard), and don’t have a high-street presence, but they do provide an expert local agent that can manage the viewings, negotiations and support up until completion.

- The primary basis of Yopa’s appeal (as with all online and hybrid agents) is that they offer significantly cheaper one-off fixed-fee estate agency services compared to traditional high-street agents.

- Yopa’s house-selling service currently starts from £999, with prices varying based on the chosen payment plan (e.g. No Sale, No Fee, Pay Now, or Pay Later) and tiered packages.

- Yopa generates leads primarily by listing properties on the UKs largest property portals, Rightmove & Zoopla.

- They offer a no-obligation, free in-person property valuation to determine the value of your home!

- Yopa have a TrustScore of 4.2 / 5 on TrustPilot and over 7000 reviews.

- Yopa was founded in 2015 and has since helped hundreds of thousands of Brits buy and sell properties around the nation.

- They are the second most popular online estate agent in the UK by the number of homes listed for sale (trailing Purplebricks).

How Yopa’s Online House Selling Service Works

Step 1: Scope out the packages

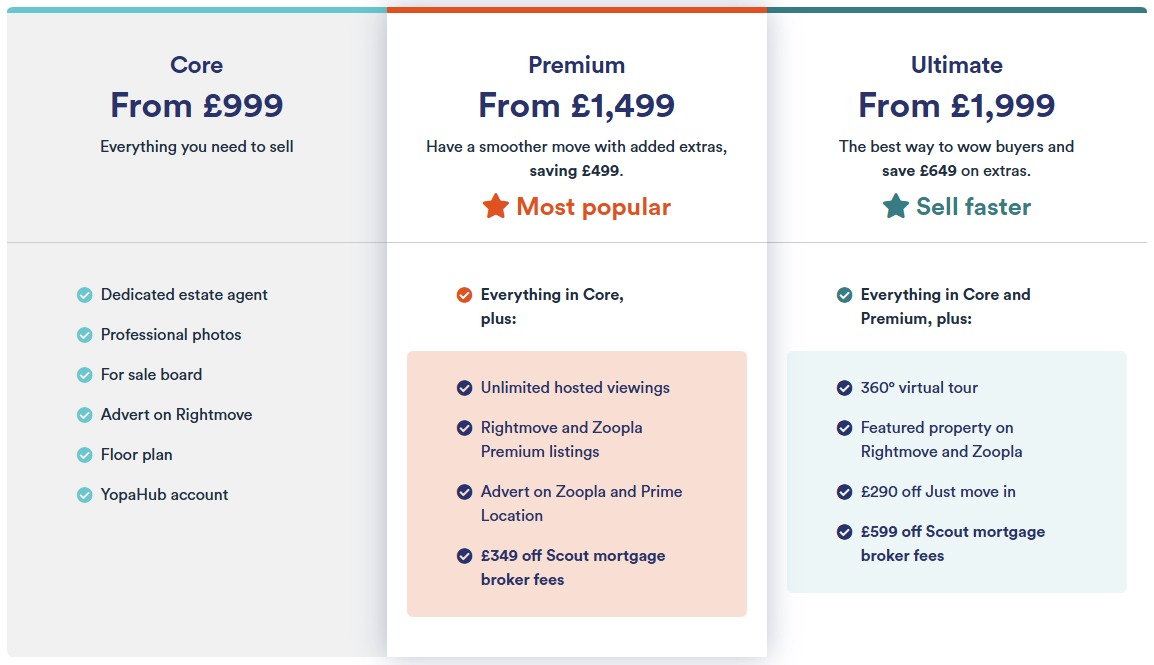

Yopa currently offers 3 tiered house-selling packages – pick your poison:

Plus, with the option to toss on any additional services you may require to assist with your sale, such as Energy Performance Certificates (which is legally required before marketing your property for sale), extra marketing exposure etc.

Step 2: Book a free, no obligation valuation

If any one of the packages appeal to you, you can book a free, no obligation valuation. Yopa will assign a local expert to visit your home when it suits you, give you an in-depth valuation, and answer all your questions

To clarify, there is no obligations to use their service after a valuation is conducted.

Step 3: Instruct Yopa to sell your home

If you’re happy to proceed, you can choose your preferred package and any optional add-ons you’d like to include (e.g. an EPC), then select a payment plan (e.g. No Sale, No Fee; Pay Now; or Pay Later). This will instruct Yopa to arrange professional photography and floorplans, and then begin marketing your home for sale on portals such as Rightmove and Zoopla.

Payment options explained (and scrutinised)

- Pay Now – I’m fairly sure this is the most popular option, and it’s the one I would personally opt for. It’s significantly cheaper than the other payment options and much more straightforward. Paying a one-off fixed fee upfront is what makes online agents different from high-street agents (who typically charge a percentage of the sale price only after completion). Bear in mind that with an online agent, the upfront fee is not refundable if you fail to sell your home – you pay the fee regardless. That’s one of the trade-offs for lower fees.

- No Sale, No Fee – Don’t pay a penny until your home is sold. Sounds appealing, but this is probably the most expensive option. Annoyingly (and concerningly, to be honest), Yopa doesn’t disclose the cost of this option; instead, they simply state, “Ask your agent for details, as prices vary” (which is why I can’t confirm if it is the most expensive, but it very likely is).

My guess is that there’s a hefty premium compared to the Pay Now option. In some cases, it may not even work out much cheaper than using a local high-street agent depending on the value of your property, or there may be very little difference at all. If that’s the case, you might reasonably question why you’d bother using an online agent in the first place.

If this option does appeal to you (and don’t get me wrong, I get it), I’d recommend getting a firm price, comparing it with quotes from local agents, and then making a decision.

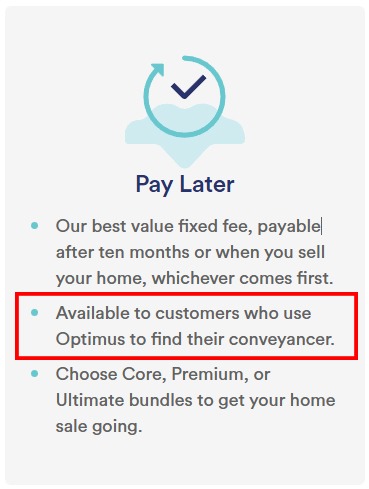

- Pay Later – Yopa describes this as their “best value fixed fee, payable after ten months or when you sell your home, whichever comes first.”

Yup, this option also sounds very appealing and, unlike the No Sale, No Fee option, it’s available at the listed package price (i.e. they won’t charge extra for it, at least not directly).

However, there appears to be a rather disgusting condition attached: it’s only available to customers who use Optimus to find their conveyancer.

In other words, you must source a conveyancing firm through Optimus in order for the Pay Later option to be available. Yeah, that’s a hard pass for me, for a couple of reasons:

- I always recommend sourcing your own reputable conveyancing firm – this way you’re more likely to get a better service and a better price!

- You’re likely to pay over the odds when using Optimus, which is why this option will likely end up being more expensive than using Pay Now and sourcing your own conveyancer (you can get some free conveyancing quotes from here – average saving £490). I’m fairly sure Yopa promotes this route because it’s profitable for them (this is probably disclosed somewhere in their T&C’s).

But, ultimately, it’s your choice. You do you.

Obviously, each option has its pros and cons. However, the bottom line is that if you want to potentially sell your house for the lowest fee, then Pay Now is the option for you.

Is Yopa the Right Choice for Selling Your Home?

Don’t hate me, but I can’t, in good faith, answer this definitively for you. I know, what use am I then?

That said, hopefully, I can help you decide what might be best for you, maybe.

I want to kick off by reminding you that Yopa has a pretty respectable TrustPilot Score – 4.2 / 5, and as with most estate agents – both online and high-street – they have their fair share of polarising, rave, and devastating reviews.

Based on my own research (i.e. scouring through thousands of pieces of feedback – nope, I have no life!), it seems that much of the negative feedback from sellers stems from a basic misunderstanding of what an online/hybrid estate agent actually is. Specifically, some sellers expect to pay a fraction of the cost of a high-street agent while receiving exactly the same level of service. Unfortunately, it just doesn’t work like that.

In any case, I think it’s important to understand the following:

- No high-street presence: Yopa does not operate from physical branches. If you have any issues, you’ll need to make contact via telephone or email.

- Local agent (in theory): Every seller is assigned a local agent, but in practice this usually means one of a small pool of agents covering a wider area (this is more likely the case in more remote and rural locations). They may or may not be based close to you. With a traditional high-street agent, you know exactly where they’re located in relation to your property.

- Agent quality varies: Not all Yopa agents are created equal, just as not all local estate agents are the same. Some are better than others. In many ways, a Yopa agent is a one-man (or woman) branch. The key difference is that while you can research and carry out due diligence on local high-street branches, you can’t really do that with individual Yopa agents. In reality, you might be assigned a dud (i.e. an agent who is less effective than their colleagues). Put bluntly, the agent you’re assigned can be a bit of a lottery. Good luck.

- Upfront payment risk: If you choose the most popular upfront payment option, you’re essentially paying for up to 12 months of marketing and support. If a sale isn’t achieved within that period, you’re out of luck – chalk it up as an unsuccessful campaign. On the flip side, if you do secure a sale, you’ll likely have saved yourself a buttload on agency fees compared to high-street agent fees.

- Portal exposure: Most estate agents, both online and high-street, generate the majority of their leads from the UK’s largest property portals, specifically Rightmove and Zoopla. Yopa lists on both, which is good.

Understood?

As long as you go into this fully understanding the pros and cons of Yopa’s hybrid service, and what their limitations are, you’re much less likely to be left disappointed. If nothing you’ve heard so far has put you off, the odds are that Yopa could be a great option for you (no promises!).

How Much Can You Really Save Using Yopa?

Put simply, a small fortune.

But of course, that’s the whole point of an online/hybrid estate agent – they exist precisely to make it significantly cheaper for people to sell their homes. If that weren’t the case, we’d all still be using the same old, same old – and paying through the nose for it.

But here, you can use this nifty little calculator to crunch the numbers and work out how much you could save compared to a high-street agent.

Side note: interestingly, Yopa has a similar calculator on their website, but when I double-checked their calculations, I concluded that it doesn’t work properly (i.e. it spits out incorrect savings). Something is out of whack with their formula, it seems. Moreover, I’ve added the ability to choose a package – their [limited] calculator only lets you calculate savings based on their cheapest £999 Core package (convenient, because it’s the package that will obviously return the biggest savings!).

Basically, what I’m saying is, my Yopa Calculator is better!

Does Yopa Have Any Hidden Fees?

In short, no. As with almost all online agents, Yopa’s business model – and the basis of their appeal – is that they charge a one-off fixed fee.

However, like most other estate agents, they generate a good portion of their revenue by upselling additional services such as mortgage broking, conveyancing, and EPCs. Generally speaking, these optional extras aren’t great value – you won’t be finding any bargains – and the quality of service is often scrutinised. So I wouldn’t get in the way of anyone screaming stealth or hidden tax. That said, sourcing everything from one place is undeniably convenient, so perhaps a premium for that is justified. You be the judge.

Personally, I’d source my own providers, particularly for mortgage and conveyancing services.

My recommendations:

- Mortgage broker – I’ve been recommending and personally using the online mortgage broker Habito recently. They’re completely free (as they should be!) and they search the whole market for deals, which includes more than 20,000 mortgages from 90 lenders. You can read my full Habito review if you’re interested.

- Conveyancing – I’ve always believed that using a local and recommended Conveyancing service from a trusted friend or family member is the way to go. Alternatively, use a comparison service like ReallyMoving.com – they can quickly provide 4 quotes from expert SRA or CLC regulated conveyancing solicitors and Licensed Conveyancers (average saving is £365).

- Moving services – if you require a moving service, you can also get multiple quotes from ReallyMoving.com;s comparison tool.

When You Might Want to Avoid Yopa

- If you’re not prepared to pay for failure: Most sellers opt for Yopa’s lowest-cost Pay Now option, which simply means you’re paying for a marketing service, not for a completion of sale.

If that risk makes you uncomfortable, an upfront payment model simply isn’t for you – full stop. Obviously you can use Yopa’s “No sale, no fee” option, but then you’re looking at much higher fees, which is why it isn’t as popular. But honestly, in my view, once you go down that route, you largely negate the whole point of using an online or hybrid agent in the first place.

I’ve seen plenty of frustrated sellers who paid an upfront fixed fee to an online or hybrid agent, only to receive little interest and no offers at all.

That said, I firmly believe there’s a buyer for every property. In most cases, when a home doesn’t sell, it’s not because the agent failed, it’s because the property was priced incorrectly from the outset.

- Looking for the high-street agent experience: If you need a physical high-street presence, perhaps for the reassurance of being able to walk into a local branch and speak to someone face-to-face, then Yopa (or any other online agent) definitely isn’t for you. In that case, you’re better off sticking with a traditional high-street agent, and milk them for all the free coffee you can.

- If you’re not saving a reasonable amount in fees: As mentioned, the whole point of using an online agent is that they’re significantly cheaper than traditional high-street agents, largely due to lower overheads. If you’re not making a meaningful saving (you can use my savings calculator above to get an idea), you’re probably better off using a local agent instead. For example, if you’re selling a lower-value property and want to opt for a No Sale, No Fee payment method because you don’t want or like the term of the pay upfront option, Yopa may actually end up costing more than a local agent.

- If you’re uncomfortable with the agent lottery: Yopa assigns you an individual agent rather than a full local branch with an established track record. If you prefer knowing exactly what you’re getting in advance, a traditional high-street agent, whose performance you can research and verify, might be a safer choice. Simply put, Yopa’s performance is measured nationally and doesn’t necessarily reflect the specific agent you may be assigned.

I’m not entirely sure how big of a deal this is, because I’m fairly confident (or at least I hope) that Yopa tracks the performance of their individual agents and probably gives them the old heave-ho if they’re not pulling their weight. That said, it’s still important to understand the difference between hiring a local branch versus an agent who effectively acts as a branch but whose individual performance isn’t easily verifiable.

You get what I’m trying to say, right? Right. Cool.

The Elephant in the Room: Yopa vs Purplebricks

When someone is eyeing up Yopa’s services, they’re usually also contemplating Purplebricks as a viable alternative (and vice versa), which makes perfect sense, since they’re the two most popular online/hybrid agents by a country mile.

I’ve already shone a spotlight on this issue in Yopa Vs Purplebricks (Which Agent Should You Use?), so I won’t get into the weeds again here. But in short, as things stand today, I favour Yopa. I would choose them over Purplebricks for the following reasons:

- There have been numerous reports circulating about the poor state of Purplebricks’ finances, which, let’s just say, doesn’t exactly inspire confidence.

- I don’t put much stock in Trustpilot scores (since I know they can be gamed), but I do pay attention to them when we’re talking about fine margins:

- Yopa TrustPilot – 4.2 / 5

- Purplebricks TrustPilot – 3.9 / 5

- Purplebricks’ has a new tiered pricing model based on the price of the property, and I really don’t like it:

- Under £175k: £799

- £175k – £375k: £999

- £375k – £600k: £1,299

- Above £600k: £1,699

On its own, this isn’t a deal-breaker, though it does leave a sour taste in my gob. More importantly, for most people it means Purplebricks will cost more than Yopa (Purplebricks also add an additional £80 Anti-money Laundering fee on top of their base price). With the average UK house price sitting at around £300k, most sellers will fall into Purplebricks’ £999 pricing tier (+ £80 AML fee).

My opinion may change in the future, and if it does, I’ll update my thoughts, fo’sho.

To be clear, I’m an affiliate partner of both Yopa and Purplebricks, so you can’t accuse me of being biased here!

Book your Free Valuation with Yopa

Yopa vs Other Cheaper Online Estate Agents

While Purplebricks & Yopa dominate the digital estate agency space, there are other types of online estate agents that provide even more cost-effective options, and I’d be remiss if I didn’t mention them before I check out, because they might actually be a better fit for you.

From what I’m aware, Purplebricks and Yopa are only true Hybrid online agents (i.e. a middle ground between online and high-street agents). On the other end of the spectrum, you’ll find pure “online agents.”

In short, the primary difference between an online and a hybrid agent is that with an online agent, you don’t get a local agent assigned to you. In other words, you pay for the marketing, and then you’re left to manage enquiries and viewings yourself. This can be a great option for anyone who wants to pay as little as possible while still selling effectively, and doesn’t mind doing some of the legwork that agents would typically handle.

There are plenty of online agents available, with fees starting from as little as £99. Yes, you can potentially pay just £99 in agency fees – and no more – then go on to sell your house. Thousands upon thousands of people have done this successfully.

Here are a couple of examples of online estate agents, just to give you a taste:

| Estate Agent | Rating | Duration | Includes / Notes | Price from | |

|---|---|---|---|---|---|

Quicklister | RatingGoogle Reviews | Duration 3 months | Includes / NotesSaver package

| PriceDiscount price£79.2 Inc VAT | Visit Website20% Discount Code: lVx4RrDX |

99Home | RatingTrustPilot Reviews | Duration 4 months | Includes / NotesStandard package

| PriceDiscount price£94.05 Inc VAT | Visit Website5% Discount Code: PIPSSTD5 |

I Am The Agent | RatingTrustPilot Reviews | Duration 30 days | Includes / NotesSpeedy package

| PriceDiscount price£184.5 Inc VAT | Visit Website10% Discount Code: propinv21 |

Emoov | RatingTrustPilot Reviews | Duration 12 months* | Includes / NotesEssential package

*Rightmove listing is included for the first month. After that, you have the option to renew the listing for £25 per month. If you continue advertising on Rightmove for a full 12 months, this would amount to an additional £275. | Price£295 Inc VAT | Visit Website |

If that’s piqued your interest, may I suggest checking out my full guide on online estate agents, which includes an exhaustive list of the most popular options.

Is Yopa Worth Paying Extra for Over a Cheaper Online-Only Agent?

Yes.

Well, maybe.

It depends.

This is how I look at it: if you want the assistance of a local agent to support you through the entire process of selling your home and relieve you from some of the work-load (after all, your time is precious), then yes, in my opinion the “hybrid” model is worth stumping up the extra cash for, even if you have to do so begrudgingly. However, if you’re confident you can do without the local assistance, and you’re happy to manage the viewings and negotiations, then a cheaper online-only agent is probably the better option. However, I do want to make a few crucial points before you pull-the-trigger and make your decision:

- Don’t be THAT Dad

Using an online agent, including a “hybrid” one, is already going to save you a shitload of cash comparative to a high-street agency. You’re already winning here.So I wouldn’t try to whittle down the costs of selling a home to the point of creating a false-economy. What I mean by that is, don’t focus on JUST saving money by taking on a project which you’re ill-prepared for. A good analogy is when an unqualified Dad tries to hopelessly save costs when repairing the leaky dishwasher when the extent of his qualifications is streaming a few ‘how-to’ videos on YouTube. In most cases, the end result will be a bodge-job, and eventually lead to more expenses to fix-the-fix.

My point? As much as we all religiously love to believe that an estate agent’s job can be just as equally fulfilled by a chimp (if not better), they mostly do have the knowledge and experience which will allow for an optimal selling experience.

If you actually would benefit from the added local support, don’t talk yourself into being the bodge-job Dad. The law of averages dictates you’ll cause havoc and it will end in tears.

- Online Agents provide support

I don’t want to create a false impression, so let me clarify something before someone jumps on my hairy back and causes a scene.It’s not as though online agents provide no support at all – they do. It’s just that the support isn’t delivered via a local, physical presence.

With a hybrid agent like Yopa, a local agent provides that physical, on-the-ground presence, which is understandably reassuring for many sellers. By contrast, online-only agents typically offer support and guidance through a dedicated account manager or support team based in a central location, contactable by phone, email or live chat. Either way, you shouldn’t be left to fend for yourself.

That said, it’s essential to read the terms and conditions of whichever agent you’re considering and understand exactly what level of support is included. Most importantly, don’t be afraid to ask questions – ideally by email – so you have a clear record of what’s been promised.

So, Interested in Yopa? Here’s How to Get Started

As mentioned, Yopa provide free property valuations (conducted by one of their local agents), so scheduling one of those is probably a good starting point. There is no obligations to use their services after receiving your valuation!

Book a FREE Valuation with Yopa Today

Holy moly, ladies and gentlemen – that’s a wrap!

If you made it to the end, thank you! I hope you found it useful. Feel free to drop a comment, whether it’s to ask a question or share your experience (good or bad)!

Happy selling.

Landlord out xo

Disclaimer: I'm just a landlord blogger; I'm 100% not qualified to give legal or financial advice. I'm a doofus. Any information I share is my unqualified opinion, and should never be construed as professional legal or financial advice. You should definitely get advice from a qualified professional for any legal or financial matters. For more information, please read my full disclaimer.

Landlord Products / Services

Landlord Products / Services

Surprisingly YOPA worked for me and my wife, and this is coming from an old git that's reluctant to embrace technology.