It got to the point where every day I was hearing about more and more people, including the most gormless halfwits humanly imaginable, striking it rich from cryptocurrency. I haven’t heard those claims – to that extent – about property since early 2004, when Sarah Beeny’s Property Ladder gave many of us aspiring entrepreneurs hope, as we learned that any wally can make a killing in a booming property market.

They call it FOMO. “Fear of missing out”

Apparently it’s an irrational feeling that shouldn’t play any active role in investment making decisions, because it’s based on emotion and not valuation, yet it’s precisely why I said “screw it” and tossed a portion of my savings – enough of it to make me nervous – into cryptocurrency.

Mind you, not as nervous as watching fiat money (e.g. GBP) deteriorating quicker than my hairline, as Governments around the world are hell-bent on minting ludicrous amounts of cheese during the pandemic, navigating us towards a full-on collision with hyperinflation.

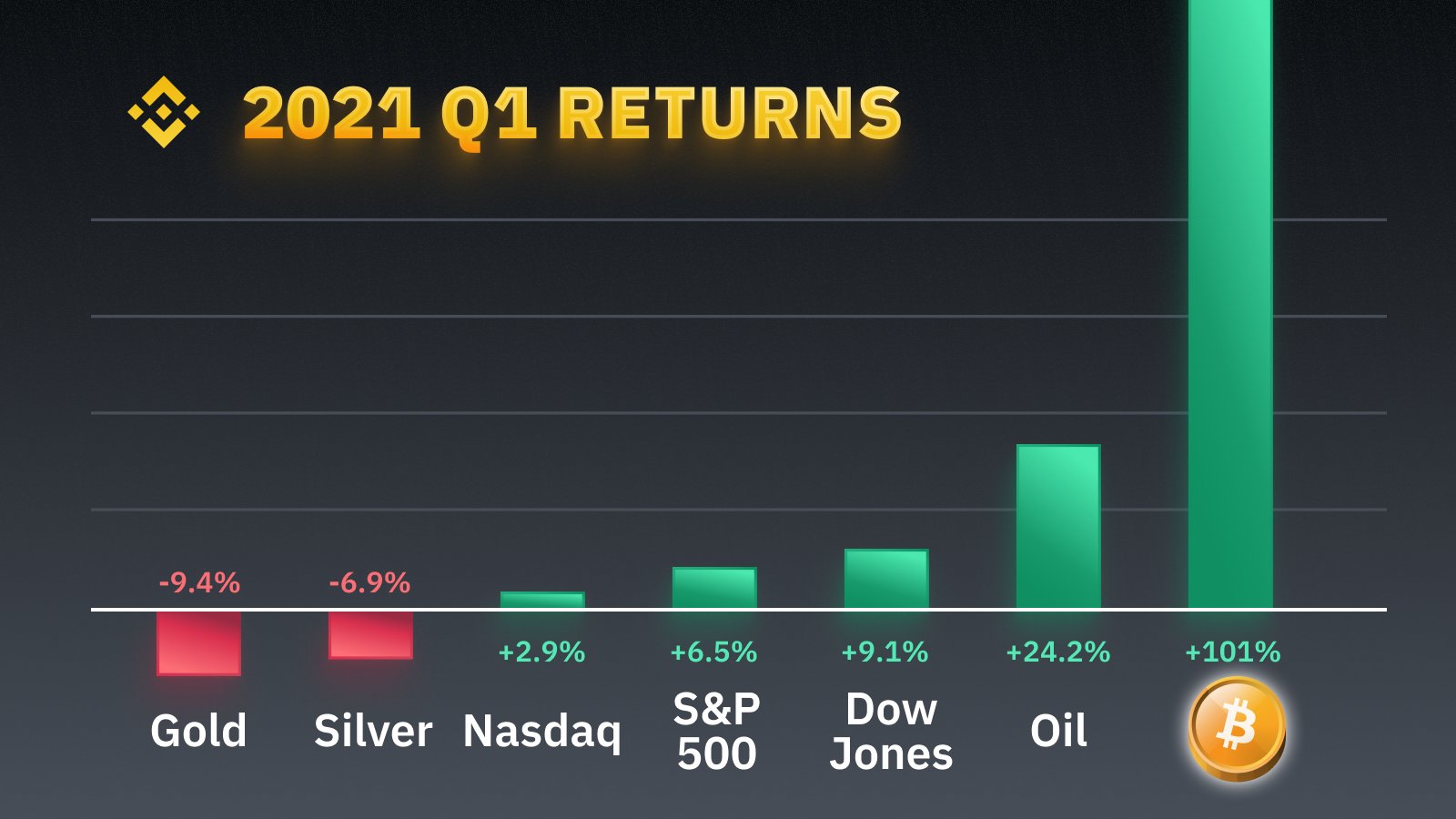

Meanwhile, the value of cryptocurrency is soaring, especially with billionaires like Elon Musk scooping up Bitcoin and touting DOGE coin like he’s a second-hand car salesman! Did you know, there have been few assets in the history of mankind to show the same level of appreciation as crypto? Bitcoin, for example, has appreciated 4,700,000% in ten years. And how about this little tidbit to really make you puke your guts out: if you invested £1000 into DOGE coin in January 2021, you would have banked £210,825.30 today.

However, while there’s clearly plenty to be made, the narrative in recent times has been less about the “easy money”, and more about outperforming the impending doom of inflation. So is it any wonder that millions of people around the globe are frantically stashing their money into the crypto market?

I’m all in!

If anyone hadn’t noticed, I’ve been a bit absent from blogging recently. My super useful newsletter has still been chugging along as per usual, but blogging not so much.

I’m sure you noticed, and I suspect your email of concern fell victim to the jaws of my nasty spam-filter. It’s not your fault.

If you’re following me on Twitter you may have caught wind of my recent flurry of tweets, so you’ll already be aware that I’ve entered into a very dark and foreign place…

If anyone hadn't noticed, I've temporarily side-lined property and gone all in on Crypto!

I wouldn't even recommend this path to my worst enemy.

— The Landlord (@The_Landlord) May 13, 2021

Dear Lord, I cannot emphasise the following enough! Nothing in this post (or website for that matter) should be constituted as financial advice! I’m not advising or recommending anyone to invest in anything, especially cryptocurrency, this is purely for educational purposes! Always do your own research!

So why on God’s green earth am I discussing Cryptocurrency on my landlord blog to you fine property folk? Believe you me, we didn’t arrive here without deliberation.

- In short, I’m hedging against our government and traditional investment vehicles, including property! Crypto is largely decentralised, unlike my other investments, so it’s completely unique in that sense.

- I don’t want you thinking I’m a one-trick pony! I couldn’t bear the thought.

I’m a firm believer in diversification; being married to one or two “wealth creation” methods feels reckless, especially if they’re all tightly regulated by government. I don’t think anyone should go “all in” with one particular investment type, even if it’s as safe as ‘ouses.

- For the most part, landlords don’t have genuine affection for bricks and mortar, but rather, we simply want our money to outrun inflation and outperform the lousy interest rates we’re being offered by our deadbeat banks. Or at least, I sincerely hope that’s the case.

But then again, I once watched a bone-chilling documentary on people that have literal love affairs with their cars. Yes, like, literally.

Apparently these fruit-loops aren’t as uncommon as one would hope. Bloody mental.

- Crypto is creeping into mainstream media, especially thanks to my mate Elon Musk, after he dropped a colossus $1.5bn on Bitcoin, and DOGE coin hitting the airwaves after going parabolic, and turning a ridiculous amount of pubeless children into millionaires.

So I figured there’s a good chance you might be interested in learning more about my recent entry into the crypto-verse. I’m always happy to be your guinea pig.

- And this…

How much have I made from Cryptocurrency so far?

Yes, yes, yes, I know this is what most people will care about. So before you dose off, I’ll put you out of your misery.

£100k

At the time of writing this blog post I’ve been investing in cryptocurrency for around 3 months, and I’m £100k up with £12k investment. I haven’t cashed anything out yet, so depending on my level of sensibility and greed, I could lose it all. Or, I could make more money than sense and become a full-time Instagram “influencer”, dedicating my life to flaunting lush Louis Vuitton man-bags, Gucci belt buckles the size of your head, and fluorescent green Lambos.

Yes, I know, not a bad return at all, but what makes the whole situation so utterly absurd and surreal is the fact that it was all orchestrated by a clueless buffoon, bumbling around on a mobile app, during the span of a couple of months. I really have no understanding of why it’s even possible to make that much money from whatever it is I gambled on.

Anyways, I ‘spose that explains why I’ve shown less interest in blogging about property recently.

The twisted reality is, that’s a pretty modest ROI in the world of cryptocurrency; investors are frequently seeing 100x – 1000x returns, most often by shear dumb luck. That’s not hype either, it’s real, and if I wasn’t “in it” I wouldn’t believe it either.

Question: what was the ROI from your crusty BTL and snot-faced tenants in the last 3 months?

I kid, I kid! We all love property and adore our tenants, even the ones in rent arrears and use the curtains as poop-paper.

What is Cryptocurrency/Bitcoin?

I’m not the best person to ask. In fact, I’m probably the worst person to ask. But I’ll do my best to explain the little I do know (or, at least, the little I think I know) in my own little way.

There are literally thousands of cryptocurrencies available today. For practical purposes, you can think of them like companies in any traditional stock exchange.

Bitcoin is just ONE cryptocurrency out of thousands, and it’s the most recognisable because it was the first. ONE bitcoin is worth a staggering £32,000+ today (it was £44k a few weeks ago), and many speculate it will reach £100k by the end of the year. It was less than 1p when it first started trading back in 2008. My advice is not to attempt to understand it, but to blindly accept it. I’ve discovered it’s easier that way.

If you’re not in the world of crypto you might be surprised by how much money has been thrown into the market, by both private individuals and huge institutions like Tesla and PayPal. It’s mind-boggling.

Most of the outside world think that cryptocurrency is a generic term for virtual currency. It’s not. Bitcoin (and a small handful of others) is a digital currency that stores value, but the vast majority of cryptocurrencies are ‘assets’, designed to securely transfer encrypted information or assist with the process through networks.

Either way, the technical differences mean diddly-squat to the average investor, because the currencies are just donkeys in a race to us, and all we expect is for our picks to put one foot in front of the other.

From what I understand, there’s very little real use case for the majority crypto technology today, it’s at the very early stages of adoption, so the market is largely driven by greed, hot air and speculation. It’s utterly senseless and comical, but it’s happening.

As always, do your own research from reputable resources if you want to learn more.

Which Cryptocurrencies I’ve invested in…

I know some of you will already be invested in Crypto, so the following will actually mean something to you. Here’s what I’ve scooped up (these are my current holdings, I’ve purchased/sold dozens of different crypto along the way):

| Currency | Ticker | Relative risk level (in my opinion) |

|---|---|---|

| Etherium | ETH | Low |

| Cardano | ADA | Low |

| Vechain | VET | Low |

| Polkadot | ADA | Low |

| Polygon | MATIC | Low – Medium |

| Ripple | XRP | Medium – High |

| The Graph | GRT | Low |

| Coti | COTI | High |

| Chilliz | CHZ | Medium |

| Chainlink | LINK | Low |

| ***Hoge Finance | HOGE | Super high |

***This highly-speculative long-shot has been my best earner. I got in super early on a whim! Betting on this crypto to succeed was like betting on a 3-legged donkey at the Grand National. I really can’t explain the success; it’s laudacris, it feels like a practical joke, but that pretty much sums up my opinion of the entire crypto market.

Just in case you’re thinking about it, please don’t blindly shadow my investments, because my entry points will be a lot different from yours if you enter the market today.

Where’s Bitcoin? Why haven’t you invested in Bitcoin?

There’s a couple of reasons for this:

- I feel like I’ve missed the Bitcoin boat. Even if Bitcoin rises to an incredible £100k, I’ll only be tripling my money. I despise myself for saying this, but that’s a tiny return in the crypto world. I’d get laughed out of Crypto Camp if my portfolio only showed a 3x return.

But honestly, you’re likely to get much better returns in other crypto currencies, in my opinion.

- I’ve listened to a lot of ‘millionaire’ crypto veterans discuss their strategies, and the general consensus is that 50% of a well-rounded crypto portfolio should be invested in Bitcoin, because although it’s not going to yield as much return as some of the other coins at this stage, it is the most reliable (in other words, it’s always managed to increase in value). Basically, Bitcoin should be the cornerstone of everyone’s strategy.

My foundation is property, I don’t need or want Bitcoin to replace it.

Just to clarify, you can buy a percentage of a Bitcoin, so the fact one Bitcoin is £30k is irrelevant.

What I’ve learned so far from investing in Cryptocurrency

Silly money

The amount of money being made by speculative assets is both scary and surreal – it’s difficult to make sense of the situation, so I stopped trying. I’m simply shutting my eyes and going along for the ride.

Most of the currencies/tech does absolutely F-ALL; they have no utility whatsoever; they’re still jammed in the developed phase; we’re basically throwing money at vapour, hoping it materialises into something useful and functional. Madness!

Yet still, it actually seems like a very real method of making – I’m going to say it – “life-changing wealth”

Urgh, that was uncomfortable to say.

It’s NOT a get rich quick scheme

While you can make significant money very quickly with crypto, I wouldn’t enter with the hopes of doing so.

The market is too volatile to be reliable, so unless you time your buys and sells absolutely right (which you won’t), it’s best thought of as a mid to long term investment. I would NOT invest money that I might need in the near future, because that means I may need to pull my money out when the market is down and/or at a loss.

I’ve entered with the intentions of keeping my money invested for at least a year, with the hope of skimming profits.

Insane volatility

The market is as volatile as sloppy shit; watching (and feeling) daily swings of 30% is normal and frequent, which my bowel movement and vomit-bucket can attest to. What a wild bloody ride!

I’ve chalked up the volatility to the following reasons:

- The market can be manipulated, and it often is by early investors and organised groups that hold enough “stock” to crash and short the market, squeezing out weak and novice investors, so they can sell high and buy in low again. It’s a problem and it’s very annoying, but ultimately it doesn’t stop the market moving forward in the medium to long term. Fortunately, their power dilutes as more retail investors (i.e. every day people like you and me) enter the market.

- Since the market is still in its infancy and driven by speculation, movement is triggered by current news and the consequential emotional impact. For example, a single Tweet from Elon Musk alone can send the entire market into a mindless frenzy for absolutely no real reason. Which is happening right now.

My response to that…

Elon's Tweet isn't the problem, it's the dumb a$$holes that buy and sell on the whim of a single person #Crypto #Bitcoin

— The Landlord (@The_Landlord) May 13, 2021

You do get used to the swings even though they’re triggered by nonsensical garbage, but you definitely need to acclimatise. As you can imagine, watching a £10k investment shrink to £7k in the space of 24 hours can be debilitating. Of course, watching it swing the other way can be more beautiful than the birth of your first newborn.

It’s not for pussies

Not everyone will have the stomach for crypto. I personally don’t think it’s particularly high-risk, but the volatility is objectively frightening and gut-wrenching.

Now that I’ve adapted and tasted the sweet nectar of the chaotic swings and nonsensical rewards, I’m hooked. Actually, addicted. Alas, I can’t ever imagine getting excited about the traditional and mundane stock market again. What a snooze-fest! Crypto is traditional stocks on steroids. I’m not ready to get off this high just yet, but there is a chance I’ll get thrown off (i.e. liquidated).

I’ve heard many people say the same thing: once you go crypto, you don’t go back!

It’s still early

Crypto is still in its infant stages. Apparently only 1% of the world population has invested in crypto, but it still has a stonking market cap of over $2 trillion! To put that into perspective: gold, which has been around since dinosaurs, currently has a market cap of $11 trillion. It seems inevitable that the crypto market will command and conquer gold.

Who the hell invests in gold anyways?

Cryptocurrency is the future!

While I can’t fathom why or how a single virtual coin can possibly cost £30k, or how we ended up in this eco-system where people are paying for farts, I do understand that Cryptocurrency technology is going to change the world. It’s imminent.

Once you peel away the unfathomable money-making aspects and delve into the technologies and fundamentals behind some of the projects, you’ll realise why it’s not a scam, and why it’s important for the future.

For example, I’m strongly passionate about the Cardano Foundation and their native cryptocurrency ADA. The organisation is working on providing millions of unbanked people in Africa access to digital banking for the first time. They’re also working on digitalising students’ academic records, which will increase higher-education and employment for the 80% of students who live in rural regions.

Bear in mind, this market is powered by sentiment, so the fact ADA has no real utility right now means little – we’re gobbling up the vision. It does help that the organisation is backed by the best minds in the business, of course. Side note, in the past week I doubled my initial investment with ADA.

There are many awesome projects like ADA in the crypto space, pledging to make the world a better place through tech.

Cryptocurrency lingo!

It’s all so silly, but there is a certain charm to all the silliness:

- Diamond hands – someone that doesn’t sell when the the market dips.

- Paper hands – someone that shits their pants when the market dips and ends up frantically selling at a loss.

- “HODL” – hold your crypto (i.e. don’t sell). You’ll hear the community frantically scream this notion when the market is tanking!

- “Buy the dip” – You’ll also hear this being screamed from the rooftops when the market is going to crap. The sentiment is that you should be buying when there is blood in the streets, and when everyone else is too scared shitless to invest another dime (because, in theory, that’s how you make the most gains).

Buying the dip is easier said than done!

Believe you me, when the house is on fire, the last thing you’re compelled to do is continue dancing in the living room. I’ve found the process of “buying the dip” to be a complete head-fuck, and I always regret it when I don’t do it. Also, there’s nothing more infuriating than buying the dip, only for the market to dip even further shortly after! Catching the absolute bottom is rarely done, but when it is, be thankful.

Actually, the market is pretty tragic at the moment, it’s been in a slump for a few weeks (all pretty normal, but terrifying for anyone that isn’t used to the volatility), so I’ve been doing my best to fight my natural urges to cry, sell and abandon fucking ship. Instead, I’ve been buying more and dollar-cost-averaging my existing investments, but it’s so freaking scary.

If there’s ever a good time to get into the market, it’s probably during times like this (at the time of writing this blog post), while the market is going through a major correction.

- Don’t “FOMO” – don’t buy a currency that’s rocketing because you’re fearful of missing out on the gains. Trying to latch onto an airborne rocket usually results in free-falling back to earth without a parachute, face first.

Been there, done it.

Still do it now and then.

- Whales – these are the people that hold huge amounts of currencies, and have the clout to short the entire market and/or certain currencies.

Cryptocurrency investment strategy

My initial approach to investing in crypto was to randomly spread my bets across several currencies and hope for the best.

I’ve noticed that most of the top 1 – 50 cryptocurrencies eventually increase in value, so remarkably, “hit and hope” appears to be a profitable formula.

However, it’s well worth looking into the fundamentals behind each project/crypto. For example, what real-life problem it’s trying to solve, and what their roadmap looks like. Projects with appealing fundamentals are more likely to succeed and yield decent returns in a speculative driven market.

For the parabolic 100x – 1000x gains, you generally need to go far beyond the realms of the top currencies, and invest early into new currencies that are highly speculative (but have good fundamentals). In order to find those gems, you either need to make a calculated decision after some research, or take a wild guess and dart a random horse in the ass (like I did with Hoge Finance). Obviously the risks are greater, but so are the rewards. Most of them will fail, some of them will be scams, and a handful of them will rocket to the glorious moon!

I’ve found that the most obvious approach works best: buy the dips and HODL (i.e. do NOT panic-sell), and regularly take profits! Don’t FOMO, buy coins when they’re down (in the red)! *cough* yes, I know, I’ve yet to follow through with the taking profits step. I’m working on it.

The strategy is dead easy in theory, but insanely difficult to execute when you’re in the moment.

Unfortunately I’ve made every mistake in the book – defied common sense – and literally lost thousands in the process.

Bitcoin is King [for now], unfortunately

I don’t really understand why or how, but the entire market is held hostage by Bitcoin.

What I mean by that is, if Bitcoin drops in value most of the other currencies follow in the same direction. It’s a tedious situation, especially for someone that doesn’t invest in Bitcoin. Why should my coins tank just because a bunch of numbskulls are extracting their money from Bitcoin?

Out of all the currencies Bitcoin has the biggest market cap, and the vast majority of money is invested in it. I think that’s why it’s able to dictate the market, but I don’t really understand how it all ties together.

The answer is probably as preposterous as the entire crypto market, so I’m better off not-knowing.

The market cycle

The property market cycle goes through booms and busts. Similarly, the crypto market goes through bullish and bearish cycles, which historically follows a 4-year cycle pattern. We’re apparently in a bull cycle right now, which, according to history, is expected to end in September.

The previous bear cycle in 2017 saw the market get crushed by a gut-wrenching 90% sledge hammer.

YEAH, FUCK THAT!!

I plan on making a dash for it long before September even though many speculate that the upcoming bear cycle will be significantly less brutal and perhaps even delayed, because there’s much more institutional investment this time around.

Yeah, cool. I won’t be taking that chance.

I will, however, invest again during the bear market, because that’s when most of the gains are made, before the lead up to the next bull-run.

Timing is everything in this game.

Property Investment Vs Bitcoin/Cryptocurrency! Do I think cryptocurrency is a better investment than property?

Don’t be so ridiculous.

Actually, it’s really not a case of one being better than the other, even though property as an investment actually makes sense, unlike the virtual farts.

Yes, my ROI from crypto makes my returns from property look like a fool. A complete joke! But property investment still reigns.

At least when you invest in property you retain a physical asset even when prices crash. I'm not even sure what I own on a good day when it comes to cryptocurrency.

— The Landlord (@The_Landlord) March 24, 2021

As said, property is my foundation; it’s solid, reliable, consistent, and that’s why it’s the best investment I’ve ever made. Crypto has none of those qualities.

The reality is, if I didn’t have my financial bedrock lined with property investments (and liquid cash in my piss-poor ISA account), I wouldn’t touch crypto. Nope, not even with your dirty, gangrene 10ft pecker.

Cryptocurrency is a hedge, and more of a side-hustle. I’m enjoying the learning process like it’s a hobby. It’s really quite fascinating when you start looking into the details, and discover how much misinformation is out there (i.e. Bitcoin is mostly used by criminals to launder money, it’s bad for the environment etc).

Bottom line: unlike property, I wouldn’t rely on crypto or make it a substantial part of my investment strategy.

How to start investing in cryptocurrency

I haven’t decided if the sheer ease of investing in crypto is a good or bad thing. It’s so damn easy to start, and it’s even easier to get hooked.

But then again, perhaps it shouldn’t be difficult. Maybe we’re so used to everything being difficult because we’re so used to centralised and government controlled opportunities.

Out of my circle of friends, I was the first to start investing in crypto. After they caught a glimpse of the success I was having, they naturally wanted a piece of the action. I was genuinely fearful of recommending or advising them to follow the path I was on, because the guilt of any incurred losses would weigh heavy. It’s a fast paced environment, so while you can make a lot of money very quickly, you can lose it all even quicker! And so many do.

But at the end of the day I can’t stop them, they’re fully grown chumps after all – capable of making their own mistakes. With that said, I did take it upon myself to part with some wisdom before they started their journey, which I’ll also share with you (most of it is good old common sense):

- Don’t invest what you can’t afford to lose. This particular advice landed on a set of frightfully deaf and hairy ears; a certain friend literally invested his entire divorce settlement money, which was meant to be used for a deposit for a house. No, I’m not joking!.

- If you REALLY want to start investing, then invest a very small amount (e.g. £100); buy and sell a few assets and get to grips with the system and the market conditions This nugget was completely ignored by all but one of my friends. “All or nothing” was the favoured approach *slaps forehead*

- New crypto investors generally don’t practise patience and they have woefully unrealistic expectations. As with 99% of investments, you’re not going to become a millionaire overnight! Patience is key! Specifically, if your crypto isn’t popping off, do not get frustrated, do not panic-sell, just be patient!

- Dollar-cost-average (DCA) into your investments! Don’t go all in from day one; keeping money on the side-lines for the imminent dips is a winning formula. For example, if you want to invest a total of £1000 into crypto, start by investing £200, and then slowly increase your position (i.e. spread out your buys).

- Don’t come crying to me if you lose the shirt on your back! I tried warning you, dick-face.

Trading Exchanges to buy/sell crypto

There are tonnes of exchanges to buy/sell/trade cryptocurrencies on, and each will offer a different array of features and currencies to trade. It’s important to use a reputable one that gives priority to security above anything else. Over the years many exchanges have been hacked, and as a result millions of funds have been stolen from user accounts. Crypto is an unregulated market, so the chances of recovering those funds are virtually zero.

I primarily use Coinbase, but I also use Binance. However, unfortunately, since 2023, Binance has stopped accepting new UK users due to regulatory issues. I’ve tried a few others exchanges, but I binned them for various reasons.

| Exchange | Notes | |

|---|---|---|

Exchange | Notes

| Go to website |

This is NOT a sponsored blog post. If you’ve read my policies you’ll know I don’t accept sponsored blog posts in any shape or form. However, the exchange links are referral links, so if you end up using them, many thanks for the support! Highly appreciated.

Please note, I try my best to keep the information of each service up-to-date, but you should read the T&C's from their website for the most up-to-date and accurate information.

This tip isn’t exclusive to using Binance or Coinbase – but ALL your important apps – ensure you enable Two-Factor Authentication (2FA) if it’s supported! All reputable Crypto exchanges will have the feature available, so avoid one’s that don’t!

If you’re a bit of a technophobe or struggle with apps in general, you’ll probably never make this journey. I’m sorry.

Recommended resource to learn more

The amount of hours I’ve recently spent researching and studying the crypto space is likely unhealthy, but it’s been thoroughly enjoyable.

My YouTube “Subscriptions” list has quickly been filled with Cryptocurrency content creators. Many are obviously bell-ends, some are cool. I think the best to follow and learn from is Coin Bureau. The geezer is terrific and very likeable. We’re very similar.

Right, I’m done!

Apologies if you have absolutely no interest in Crypto and reading this has been bloody murder. Don’t worry, I will return to regular property crap very shortly. With that said, if there’s one nugget of information worth extracting from this blog post, perhaps it should be that diversifying is healthy.

Hopefully I’ve made it clear that I’m not a crypto expert, but if you have any questions about the subject, drop a comment and I’ll do my best to give you a response that isn’t 90% inaccurate.

If you’re already a crypto-dork, let’s have a mothers meeting in the comments section! I’d love to know which coins you’ve filled your bags with.

Over and out,

The_Crypto xo

Disclaimer: I'm just a landlord blogger; I'm 100% not qualified to give legal or financial advice. I'm a doofus. Any information I share is my unqualified opinion, and should never be construed as professional legal or financial advice. You should definitely get advice from a qualified professional for any legal or financial matters. For more information, please read my full disclaimer.

Landlord Products / Services

Landlord Products / Services

Dear Lord, I hope some of you bought the dip. The flash-crash was brutal, but this recovery looks beautiful...