9 times out of 10 I won’t reply to emails that I receive via my contact form, not out of spite, but more likely because they don’t pass my rigorous (but fair) email screening protocol, which I have documented in detail on my about page. So if you’ve been waiting patiently for a reply to an email, you may want to have a gander over my screening process so you can identify why I may have left you out in the cold.

However, on rare occasions, I’ll receive a polite email from someone so hopelessly naïve and pitiful (in a cute squidgy way, like an overweight Bulldog that can barely walk), that I wouldn’t have been able to live with myself if I didn’t respond, despite having failed to pass the screening…

The tale of Shit tenants’ with Qualified Guarantors

The email:

Hello!

I’m hoping you can help me.

I’m a first time landlord who’s just above to rent out a property Kent.

I’ve found a couple who would like to rent my flat, however they are young 20-somethings. I will be charging £XXXX in rent. They have not passed credit checks however their guarantors (their mothers) have.

One guarantor makes XX,000 and the other XX,000, so they can cover the rent if the tenants default.

However, I’m still unsure about renting the flat out to a couple who (according to their income) cannot afford the rent.

I’m receiving mixed advice from people who have said “but their guarantors can cover the rent if they default so you are protected.” – how true is this? And how complicated is it to go after the guarantor if they do default?

I’m confused please help!

Thank you

Disclaimer: I’ve slightly modified the details to protect the Bulldog’s identity.

I genuinely hope the amount of people that are confused by the same issue, or a relatively similar one, are as rare as Northern hairy-nosed wombats (one of the rarest land mammals in the world according to Wikipedia. Who knew?). But the sad reality is, it’s probably more common than we’d like to believe, and that’s why I’m doing my part to step on this fire!

Seasoned landlords will probably read the dilemma and produce a condescending chuckle. I may have initially reacted that way, because…

The obvious answer is: do NOT touch them with a 10ft pole. You’d have to be insane to contemplate those terms, let alone agree to them.

On the surface the answer may seem blatantly obvious. But when you put the situation into context (which I did after further correspondence), it’s actually understandable why the poor schmuck was so confused.

She’s a new and inexperienced landlord, so she opted to get help from the professionals, a letting agent. Ironically, it was her grease-ball agent that was trying to convince her that the tenants were suitable and safe as houses (sorry, I just couldn’t go through with it).

When you’re rightfully looking for guidance from the experts, and they defy all logic with their bullshit advice, you naturally do question (or completely ignore) your own better judgement, despite how irrational the advice may seem. We put our trusts in the experts, and why wouldn’t we?

Needless to say, I quickly intervened and rammed her off the fiery road to hell by giving her my humble recommendation: to reject those tenants quicker than your mother can unbutton her overalls.

ALWAYS Find “suitable” tenants, never settle for slop

If you’re in a similar dilemma, my advice and points of consideration are the following (I briefly gave her the same advice):

- Always get qualified tenants

There is NO substitute for a qualified tenant.As tempting as it can be to frantically scrap together a compelling list of arguments to accept an unconvincing prospective tenant, you should realise that what you’re fundamentally doing is trying to polish a turd. If your tenant(s) doesn’t have an income that can sustain the rent payments (whether it by salary and/or housing benefits), or falls short in some other glaringly obvious (or even subtle) ways, they undoubtedly shouldn’t make the shortlist, let alone progress for further interrogation. Don’t force yourself or allow yourself to get forced by an agent into seeing something that isn’t there. Save that for women and alcohol.

That means you should not only eliminate qualified guarantors from being a substitute for qualified tenants, but also Rent Guarantee Insurance (RGI), tenants that are prepared to pay big deposits, have good references and credit rating.

A good tenant will have or qualify for ALL of the above (apart from the big deposit, it’s not necessary) and have an income that can comfortably cover the rent. Don’t settle; don’t get allured by a sparkling turd. Say it out loud, “I am not a magpie.”

- Guarantors are NOT reliable

This is the thing about Guarantors – most of them are woeful idiots. I’m sorry, but it’s soooo bloody true.From my experience, most guarantors fall into one of the two following categories:

- They only agreed to endorse their son because they wholeheartedly believe that sweet little Tommy will NEVER default on rent. He’s far too responsible. He’s a good boy.

They have ZERO intention of actually fulfilling their legal obligation if it comes down to it, because as far as they’re concerned it’s not even a possibility. They’re blinded by that fickle thing called love.

What Doris doesn’t realise is that Tommy is robbing her purse dry every time she’s clearing out her bowels.

- As I’ve discussed before, there genuinely is no incentive or reward for anyone to be a guarantor– those that sign on the dotted line largely have NO idea what they’re signing up for.

Most Guarantors are so engrossed by the actual ‘act’ of helping someone acquire a home (whether it be out of love or hate), that they don’t even pay attention to the legal ramifications of being a guarantor. They don’t even take the time to understand, they just think, “Oh, I only have to sign a piece of paper to help Tommy move into his new house. Wonderful”

Sure, it’s cute and totally selfless, but equally as mind-numbingly stupid.

I’m not saying guarantors are bad/stupid people, but I am saying many are oblivious to what they actually are.

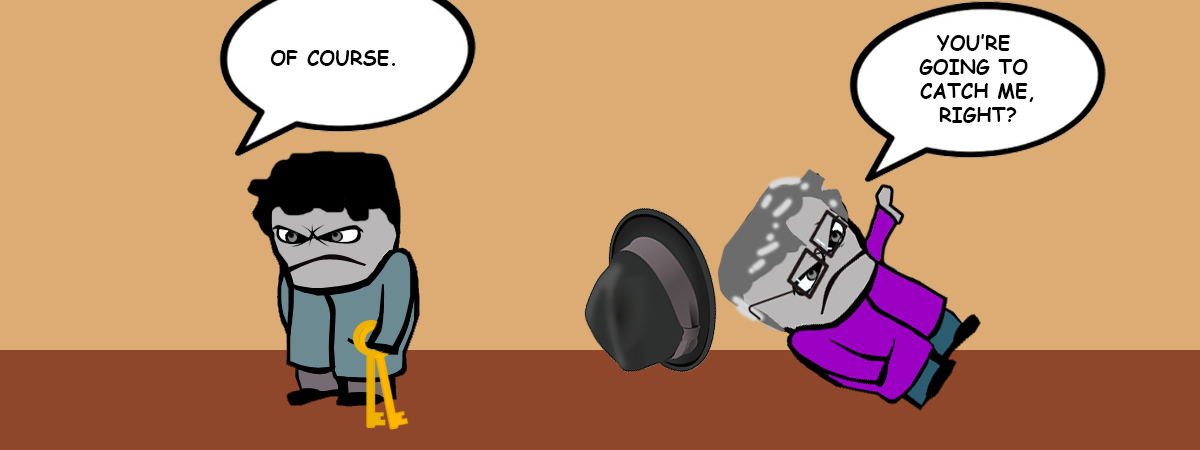

In either case, the result is often a shameless family feud, which the landlord inevitably gets caught in the middle of. The guarantor often becomes reluctant to pay, because “it’s not fair I have to pay for Tommy’s rent”

What’s remarkable is that these uppity shit-for-brains genuinely believe it’s unfair that landlords make them accountable for the legal responsibility they signed up for. So now the landlord has to decide, take the tenant or guarantor to court for the arrears? It’s the same freaking process either way.

I’m not saying you shouldn’t bother with a guarantor; I’m not saying they’re absolutely useless. You should 100% have a guarantor in place for every tenancy. I’m just saying they shouldn’t be relied upon as a guaranteed safety net- they should account for one of several nets.

- They only agreed to endorse their son because they wholeheartedly believe that sweet little Tommy will NEVER default on rent. He’s far too responsible. He’s a good boy.

- Gut instinct

If something doesn’t seem right about a tenancy situation, pay attention to what your rumbling gut is bellowing- it often makes more sense than any other referencing technique.I rank ‘gut instincts’ as one of the best referencing methods available, and ironically, it’s the one tool most letting agents are, by design, unequipped with (or just plain ignore).

Most agents will NEVER want the best for your property, because they only see the numbers, which means they rarely consider whether the prospective tenant is ‘practically’ suitable. An agent will tend to vet your tenant on paper, while a good landlord (and exceptionally good agents, which are far and few between) is more likely to vet the tenant on paper and in pragmatic terms (i.e. by judging the tenant’s characteristics and mannerisms).

That’s why I always take the viewings myself and only use online letting agents to generate the enquiries. Gut instinct is a killer weapon, one which I dare not go into the wild without!

- Reject pressure

I’ve been pressured into buying shit before. We all have, whether we realise it or not.Actually, let me give you a recent example of how weak and pathetic I am.

Last week I took my car in for a service at a franchised car dealership. Firstly, we all know how bloody extortionate they are compared to Uncle Bob’s MOT Service, and secondly, how they try to up-sell every piece of junk on the menu. But of course, we all want the ‘service history’ from a franchised dealership to curb depreciation, so we begrudgingly pay through the nose, right?

The ‘Service Executive’ contacted me mid-service to notify me of 2 barely-visible stone chips on the bonnet (which I was aware of), and then offered me a heinously shitty £12 ‘magic pen’ to remedy the grazes. I was reluctant, but somehow the sweet-talking hussy managed to wrap me around her stupid little finger and earn her commission. I know, I’m such a wally! In my defence, I was talking to her while ordering lunch, so I was distracted.

The hysterical thing is (I’m laughing at myself here), I thought they were going to apply the magic pen for me. But I was quickly woken up from my fairy tale when they returned my car (it was a ‘pick-up, drop off’ service) with an unopened “Scratch Magic Pen” on the passenger’s seat. Urgh, they got me good! *slaps forehead*

Letting agents are NOTORIOUS for selling junk, typically in the form of lousy, unsuitable tenants, particularly because agents work on commission, so they just want to close deals and move onto the next.

It can be difficult to fight off the pressure of an agent, especially if you go by life avoiding confrontation, but resistance will serve you best here. Do NOT be afraid to reject ill-fitting tenants. You are NOT obligated to take every tenant thrown in front of your face.

- Dump bullshit letting agents

This is more of a thought-provoking point.I don’t use high-street agents, but if I did, and my agent blatantly tried to flog me a dead-horse, then I’d be reluctant to continue working with them. I’d begrudge paying for their services even if they did eventually pull-through, because clearly finding me a suitable tenant was not part of their game plan.

While I didn’t advise the lady who emailed me to dump the chumps, I personally would have in her situation, because they evidently cared more about their commission than giving her a good service. I mean, come on, they tried to persuade her to accept tenants that failed the credit check and didn’t earn enough between them. That’s fucking shameful. Those agents should be sliced into digestible pieces and fed to the piggies.

I remember years ago, when an agent tried to lumber me with a supremely hopeless tenant, in the form of a DSS single-parent that didn’t have the backing of a guarantor. The tenant was miraculously unqualified in every sense. The agent then got shitty with me because I wouldn’t accept the tenant. Un-bloody-liveable. How about you fucking stick her in your house then, mate?

Needless to say, I cut my ties with the agent immediately. No one should be afraid of walking away when they’re not getting value for their money.

I know I’ve been giving letting agents a terribly hard time in this blog post, but I do want to clarify that I am generalising. There are a lot of good agents out there (they’ll all be reading this blog post, so hi to you), and they’ll be as equally mortified and disappointed by those that continue to drag their profession through donkey piss.

- Always keep your mind at ease

As I’ve started to value my mental health and well-being more and more, I almost ALWAYS avoid situations that instinctively concern me. That means I rarely make decisions which will actively make me worry unnecessarily. The stress isn’t worth it.There’s nothing worse than accepting a tenant you’re unsure of, because you’ll always be on edge worrying. Don’t put yourself through that when you really don’t have to.

Ask yourself, what will make you happier, a ‘suitable tenant’ or an ‘unqualified tenant’? It’s a no-brainer, right? Yet we often make it so difficult for ourselves. STOP! Make yourself happy.

If you have any reason to doubt the suitability of your prospective tenant, don’t let it go unnoticed, even if that means waiting longer to salvage mouth-watering tenants. Don’t just look for “better” tenants, find “suitable” tenants.

Adhering to good practices may negatively impact your short-term gains, but in the medium-to-long run the odds will be stacked in your favour. Most landlords that end up getting screwed over by rogue tenants could have avoided the situation by mitigating their risks (and that’s what finding good tenants is all about)! From my experience, giving tenants the benefit of doubt is suicide. Your applicants should either meet the requirements or fail to- do NOT go looking for reasons to pass a failed applicant (don’t allow your agent to do that either). Ya’ dig?

So, any thoughts, further advice, or similar experiences you want to share? Remember, we’re all in the circle of trust here xo

Disclaimer: I'm just a landlord blogger; I'm 100% not qualified to give legal or financial advice. I'm a doofus. Any information I share is my unqualified opinion, and should never be construed as professional legal or financial advice. You should definitely get advice from a qualified professional for any legal or financial matters. For more information, please read my full disclaimer.

Landlord Products / Services

Landlord Products / Services

Well said. Rental guarantees not worth the paper they are written on, and in any case it boils down to fairness under consumer laws. A judge could deem in unfair.