I’ve recently received a few emails from curious beavers asking me what my property investment strategy is, and what the best way to invest in property is.

I’m always reluctant to sell the ‘best’ method because it’s largely a subjective question and the answer is typically based on an individual’s situation, including objective and appetite for risk. So I don’t.

However, I’m more than happy to share my personal strategy, which allows me to sleep comfortably at night, knowing believing it’s a recipe that stands up well against economic volatility (those are the times many investors, especially high-risk ones, get totally ravaged).

But just to be clear, I’m not recommending my strategy to anyone. My strategy works for me (it’s all about me), it involves a method that I feel secure with.

I believe in my strategy; it’s simple and easy; most idiots can manage it.

I’m not a “power-buyer” by any stretch of the imagination. By that I mean that I don’t go bonkers and buy several properties per year. Firstly, I couldn’t afford that level of activity, and secondly, that’s just too high-hisk for me. I’m a pussy.

My portfolio is slim, but I believe it to be sound and profitable for my future. All I’m trying to do is secure my future and attract shallow women and buy a Ferrari along the way. That’s my objective. What’s yours?

I base my investments on “what if shit happens” scenarios, so I mostly always take the low-risk route. The rewards may not always be as fruitful as alternative investment strategies that come with greater risk, but I know I’ll get my fruit in some shape or form eventually, while avoiding a lot of stress, and that’s perfectly fine with me.

I don’t use any magical formulas (I don’t believe there are, despite popular belief). Property isn’t like buying stock; property is far simpler, in my opinion. You just need to buy property where the figures stack up i.e. rental income covers the repayment mortgage (‘repayment’ being the operative word).

So what’s my strategy?

- Invest knowing it’s a long-term play (8 – 10 year minimum investment). Investing in property long-term has historically resulted in significant gains.

- Buy 1 property every 1 to 2 years (this is subject to change depending on personal and economic circumstances).

- Freehold houses only (I’m not a fan of leasehold for reasons explained in the linked post)

- Houses with 1-2 bedrooms. I think 2 bedrooms is the sweet spot and make for the best type of property for BTL.

- Put down a 30-40% deposit on each property. Yes, that much! Price of property is irrelevant to my strategy, the key is to put down a decent deposit so I don’t get hurt by economic fluctuations that are out of my control (more on this further down the post).

- Buy property with a rental yield of at least 6%.

- Ensure there is a healthy demand for rental property in the local area.

- Find a sensible BTL mortgage product, which permits overpayments without penalties.

- Use the rental income to pay off the debt (not just the interest on the debt) during the loan period. I don’t buy-to-sell, I buy-to-own.

- Make lump-sum overpayments to further reduce debt (I generally overpay the mortgages with the highest interest rates first). Property has proven to be a better store of value than fiat currency, so I’d rather put more money in property, rather than leave large sums in a savings account, only to get eaten alive by inflation.

- I’m a self-managing landlord, so I buy properties with in a certain distance, which is convenient to travel to if required.

- Avoid shortcuts, often shilled by the so-called property gurus (i.e. Rent-to-rent strategy).

Why is choosing a repayment mortgage so important to my strategy?

Most buy-to-let investors opt for interest-only mortgages because it means they’re able to keep their mortgage payments as low as possible (without reducing debt) and apparently better manage their cash-flow, but that also means they’re completely relying on property prices increasing.

Interest-only mortgages are more suitable for short-term investors in my opinion, but unbelievably impractical for an investor that wants to eventually own the property debt free.

By having repayment mortgages I’m able to chip away at my outstanding balance every month, consequently building my equity and lowering interest payments. I make sure my rental income covers my mortgage so I don’t have to pay out of my own pocket. Eventually I will be debt free, I will own the property outright and all I invested was the initial 30-40% deposit.

Remortgaging is also extremely important. I save a lot of money by evaluating my mortgage plan every few years. If there is a better deal on the market, I will switch policies.

Why is putting down a large deposit important to my strategy?

Many investors cap their deposits at 15% (although, it’s getting increasingly more difficult to find lenders that will accept such a puny deposit). From my experience, it’s tough to make the figures stack with low deposits. The odds are you won’t be able to find a property that will generate enough rental income to cover a repayment mortgage on a monthly basis with a 15% deposit, so each month you’ll need to dig into your own pocket. Yes, that can be a good investment – it’s certainly better than pissing your money up the wall – but many people end up over-leveraging themselves this way (i.e. taking on more than they can realistically afford).

I’d rather save up 30% and make the figures stack.

What makes my method relatively low-risk?

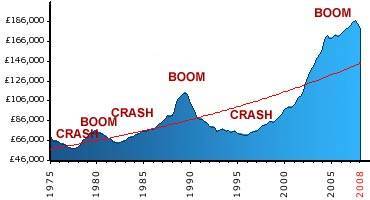

Long term property investments with large deposits and repayment mortgages are less prone to blips in the market (e.g. crashes, inflation, recession, interest rate hikes etc). Short-term investors who own one property for 1 year on an interest-only mortgage can easily fall into negative equity if the market takes a turn for the worst. In that situation, you’re stuck with an investment that isn’t liquid for the time being (unless you’re willing to sell at a loss).

Of course, housing slowdowns and crashes aren’t unusual – they come and go like the wind passed through your anal-passage. After a property slowdown, history shows that house prices exceed beyond their previous peak when the next boom kicks in (which can take several years).

A property crash won’t affect my plan because I’m in it for the long term, so I can ride out the crashes. After 20 years of investing my rental income into various properties, the market can take a 70% hit and at worst I would breakeven. The odds of a 70% hit are extremely unlikely, but if “shit happens” I’ll be ok.

How did I calculate that 70% cushion?

I put down 30% on each property, and the rest of the mortgage is paid by rental income, so I only stand to lose that initial 30%. After 20years, my mortgage debt would have been cleared, so I can take up to a 70% beating.

It’s extremely low risk, but as mentioned, the rewards probably aren’t as fruitful as the more savvy power investors out there. But shit, I value my sleep and my hair.

Why many new and ambitious landlords fail!

While there are many simple and complex reasons for why, it usually always boils down to stupidity “impatience”

People bloody love the idea of getting rich quicker than quick (and so-called “property experts” and “wealth mentors” love taking advantage by selling the cool-aid).

Believe you me (or don’t), but trying to get rich quickly will significantly increase your chances of failure, despite what any snake-oil property expert preaches. The reality is, they make more money flogging ‘get rich’ courses than with property. That should be enough of a warning. Bottom line: if they’re so successful with property, they wouldn’t be shilling courses!

Property investment is not meant to be easy, which is why alarm bells should ring when it’s sold as being easy.

Here are the two most common property investment strategies I see being touted (which often lead to devastation):

- Invest in property with little or no deposit

- Rent-to-rent model

These strategies go completely against my strategy. They’re worlds apart.

Needless to say, “…if it sounds too good to be true…”

Unfortunately, common sense gets tossed out the window when you’re dealing with someone hooked on the get-rich-today crack-pipe.

The reality is, these strategies result in investors being over-leveraged, because they’re based on absolutely… NOTHING! No foundation whatsoever. That’s precisely why it’s so incredibly easy to get wiped-out by a slight breeze. You’re better off putting your life savings on the roulette table, because at least the pain of losing is over quickly, as opposed to enduring a long, drawn out affair.

Literally, think about what is being sold to you: the idea of building an empire with zero/minimal capital!! Objectively, does that make any rational sense? It shouldn’t do. The problem is, there are “experts” out there, especially on YouTube/TikTok, doing their best to rationalise the lunacy, and they’re succeeding.

Anyways, I won’t bite into the nauseating details today, but if you’re interested, here’s my blog post on why rent-to-rent is absolute garbage.

So, my question to you is, what kind of property investor do you want to be?

Disclaimer: I'm just a landlord blogger; I'm 100% not qualified to give legal or financial advice. I'm a doofus. Any information I share is my unqualified opinion, and should never be construed as professional legal or financial advice. You should definitely get advice from a qualified professional for any legal or financial matters. For more information, please read my full disclaimer.

Landlord Products / Services

Landlord Products / Services

I was just interested in the opinions regarding international property. I have been doing a lot of research have become very interested in the location & development of Latin America especially Panama. I found a multi listing page, www.real-estate.com.pa in particular, found a one year old apartment, close to all ameities including a John Hopkins Hospital & the ocean which is fully furnished at around £155k & rented for £900 per month. The property has no tax for 19 years & the only direct expense is insurance & building maintenance which includes a gym & pool which is around £50 per month. With the canal expansion & they use US$. I have never bought outside of the country, but to me this country seems to have a lot on the plus side, does anyone have any experience?