Need expert tax advice on how to manage your BTL rental bizz?

Unfortunately I can’t help you – never have been able to, never will be able to.

But never have I felt so compelled to urge fellow landlords to only use suitably qualified tax accountants and sensible solutions to manage tax dodging optimisation. Due diligence is paramount.

I’ve been prompted to ring the village bell to call for this community assembly after a good old fashioned schoolyard fist-fight broke out – over landlord tax, of all things. It’s been an absolute bloodbath so far, with calculators and monocles flying all over the place.

Ladies, gents, and non-binary friends, we have a situation on our hands.

Dan Neidle, of Tax Policy Associates, a seemingly highly reputable tax-lawyer-chap, with qualifications and experience seeping out of his gills – this is the same guy that took down former Chancellor of the Exchequer, Nadhim Zahawi, after exposing his £27m tax avoidance scandal – has given us all a brutal reminder of why it’s imperative to choose our landlord/property tax advisors and experts wisely.

In this blog post, I’ll be covering:

- DANGER: Undercover Landlord Tax Avoidance Schemes

- Where landlords should get expert tax advice from

- Where landlords shouldn’t get expert tax advice from

DANGER: Undercover Landlord Tax Avoidance Schemes

Unfortunately, the introduction of Section 24 (an amendment to the UK tax code, which has restricted landlords’ from deducting interest payments on mortgages from their taxable rental income) has created an industry of dodgy tax advisers preying on landlords with magic tax avoidance solutions – and according to Dan Neide, none of them work, creating more liability and problems than they solve.

In the space of a couple of weeks, Dan has published a couple of scathing articles to his library of investigations, against two very prominent landlord tax planning services that he claims offers said schemes:

- Property118 – “a tax avoidance scheme for buy-to-let landlords that defaults their mortgage and increases their tax bill”

- Less Tax for Landlords (LT4L) – “the £50m landlord tax avoidance scheme that HMRC say doesn’t work, and can trigger a mortgage default”

Whilst both companies claim to offer landlords with solutions to lessen the blow of Section 24, it’s worth noting that they use different structures to achieve the outcome. And believe you me, neither of these tax services are available for bargain basement prices – we’re talking tens of thousands of pounds in fees.

- Property118 uses a structure what they refer to as “Substantial Incorporation Structure”

- LT4L uses a “Hybrid Business Model” structure

(I’m not going to get into the details of how the structures work, Dan already did that nicely in his reports. Besides, it’s irrelevant for the purpose of this blog post.)

Apparently tax experts have shown concerns with these kinds of structures for years, alleging that they don’t work and are no more than tax avoidance schemes. But that clearly didn’t deter either company from flogging the structures and cashing in.

If it’s true that neither works, and they are truly undercover tax avoidance schemes, then any landlord that has paid a small fortune to rearrange their rental businesses in accordance to these structures have essentially pissed their money down the drain and will need to spend even more to untangle the mess.

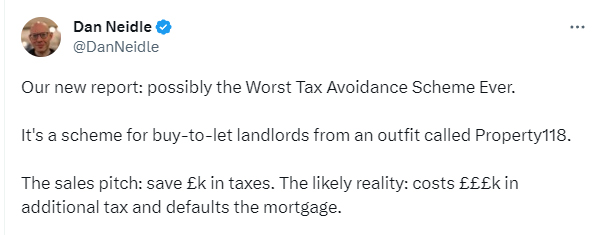

Dan has called Property118.com and their legal partner Cotswold Barristers landlord tax planning service to be, I quote,

“possibly the worst tax avoidance scheme ever”

Source: original Tweet

FUUUUURCK ME! Savage!

And he has accused Less Tax for Landlords’ structure to be not being much better. In fact, he believes it’s worse.

“A different scheme, but with some commonalities; in many senses an even worse scheme than Property118’s.”

Dan shares his thoughts in detail in his reports, both of which are technical and surgical deconstructions of each respective landlord tax planning solution being touted, explaining why he believes the “tax avoidance schemes” fail spectacularly, resulting in clients paying much more tax than is saved and also likely defaulting the mortgage.

Property118’s position

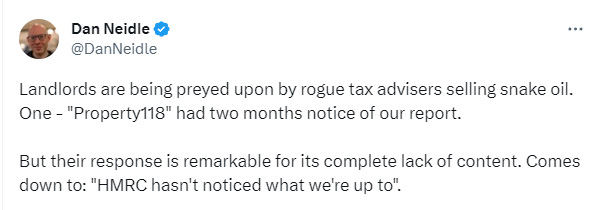

At the time of writing this blog post, Property118 and their partner Cotswold Barristers have issued a response refuting the allegations, claiming “None of the detriments forecast in Dan Neidle’s article has ever come to pass across this significant body of casework.”, but Dan appeared less than inspired by their defence.

Source: original Tweet

Relentless. That’s what we like to see.

A lot of interesting details were exposed in Dan’s assault, but the following specifically caught my eye, mostly because I found them both ridiculous and hilarious:

- Property118 is an unregulated adviser which works in a joint venture with a barristers chambers called Cotswold Barristers. But neither Property118 nor Cotswold Barristers appear to have any members or employees with tax qualifications.

- The head honcho of Cotswold Barristers was previously suspended for a month by the Bar Standards Board for acting negligently and “failing to act with reasonable competence”

- Property118 and Cotswold Barristers often charge fees of over £40,000 to relatively small landlords earning less than £100k/year.

Uhm, EXCUSE ME, WHAT? Say it ain’t so!

£40,000 for a tax service provided by an outfit without tax qualifications. It just seems so silly. And a weird purchase for anyone to make, in my opinion.

I have to ask! If someone is going to unload such an obscene amount on a specialist service, why wouldn’t they ensure they’re benefiting from expert advice from a dork of the highest order, with distinguished qualifications longer than my twig and berries, within the specific field? In this case, tax qualifications.

That’s not a swipe at Property118/Cotswold Barristers, but rather the consumer, and it’s actually just a general view on consumerism.

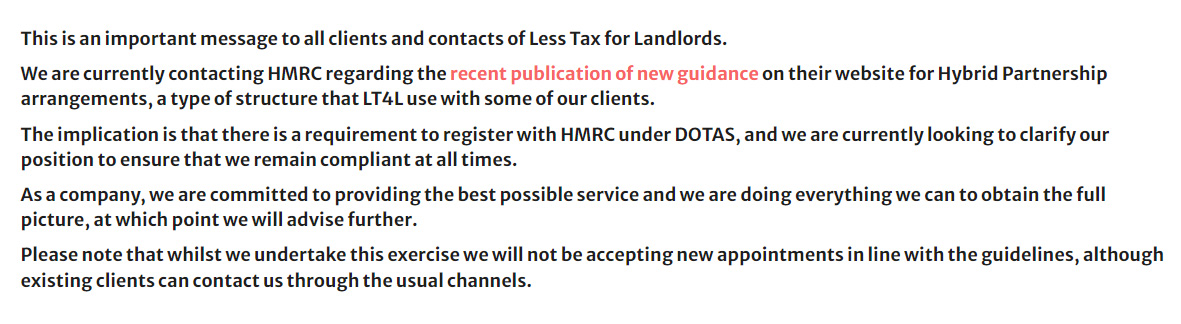

Less Tax for Landlords’ (LT4L) position

Meanwhile, HMRC have caught wind of Dan’s investigation on LT4L, and they were quick to publish this article in their “Tax avoidance” archive, stating that in their view, the hybrid business model “does not work”

Basically, confirming Dan’s assessment.

Once news broke, Less Tax for Landlords’ were quick to deface their homepage with a disclaimer, notifying us that they’re waiting for confirmation from HMRC as they investigate further.

Well, that’s certainly not inspiring.

Surely they should have done that before selling it?

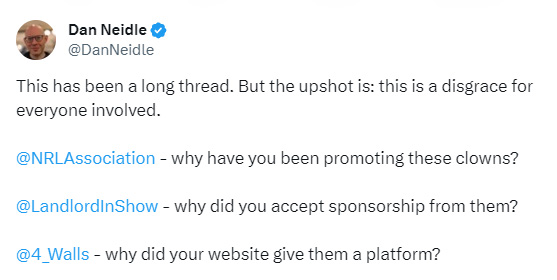

What’s most concerning about LT4L’s situation is the fact that they have (or at least, had) sponsorship deals with very reputable landlord service providers and therefore have been heavily promoted, including from the likes of NRLA landlord association, National Landlord Investment Show and Property Tribes, so that means the contagion is likely widespread.

Dan seems particularly irritated that these big outlets entered into sponsorship deals without doing their due diligence, so now he’s literally asking [on Twitter], “why have you been promoting these clowns?”, LOL

Source: original Tweet

Fair question.

Unfortunately, I think the answer is a lot less complicated than the tax avoidance schemes being pitched.

Money talks!

Update (13th November 2023): Dan Neidle has featured on accountingweb.co.uk’s podcast, where he goes into detail and breaks down his concerns with Property118’s and LT4L’s tax avoidance schemes in a way that’s very easy to understand.

I’ve embedded the podcast below – it’s an interesting listen for anyone that’s following the story. Timestamp: 3:50min – 24min.

Bottom line: avoid ALL weird-arse Landlord Tax solutions to be safe

Alas, there isn’t a shortage of companies selling mind-bending tax avoidance solutions (Property118 and LT4L seem to be the most prominent though), but Dan seems confident that none of the structures work, simply because there are three choices, and only three choices when it comes to dealing with Section 24:

- Incorporate – Instruct a proper tax adviser, incorporate a company, and move the business to that company. The mortgage interest will then be fully deductible against the company’s corporation tax.

- Don’t incorporate – Continue as you are, bearing the cost of the section 24 non-deductible interest.

- Sell-up – If section 24 makes your rental business uneconomical, then selling up might be a sensible option.

Anything else being offered is snake oil, especially if it includes complex structures with Trusts, LLPs, or offshore arrangements. I know, I know, we all want to believe in the magic pill, really badly – one that will vanish our tax liabilities into fairy dust. Who knows, maybe Jack’s magic bean supplier also flogs magic tax evaporating pills.

Needless to say, I’m not qualified to make any judgments. I’m just the shameless industry gossip columnist, knocking back the vino, and dishing out the sauce.

We certainly can speculate though, with the information we have available.

Ultimately, in one corner, there’s a debate between Dan Neidle and Property118, but with only one of them being a reputable tax lawyer and having actual tax qualifications.

I mean, well, okay!

In the other corner, HMRC have already stated the Hybrid Business Model that LT4L uses does not work in their view.

Well, isn’t that kinda’ game over?

No matter which way you slice it, the situation doesn’t look great for any company selling these jazzy tax reduction solutions to landlords, least of all the two featured companies, and not just because one of the most reputable and qualified tax lawyers in the country has a problem with them. It’s because his exceptionally qualified friends do, too.

Source: original Tweet

you’ve got me, the mortgage lenders themselves, the author of the leading textbook on stamp duty, the author of the leading textbooks on capital gains tax and income tax, and a former President of the Chartered Institute of Taxation (who, when a senior HMRC official, oversaw the introduction of DOTAS). Plus a dozen other specialists, ranging from KCs to retired HMRC inspectors. And all the professionals commenting on Twitter and LinkedIn, where opinion is virtually unanimous.

Source: Extracted from his blog post

Yeah, I think I’m siding with Dan and his posy on this one. I’m going to personally avoid all these doolally restructuring options at all costs (not that I would have used one anyways, I’d probably need to sell both my kidneys just for the entry level package), and I can only recommend that you do the same.

Simply,

Tax Policy Associates advice for anyone that has opted into a tax avoidance scheme!

The following is Dan’s advice for anyone that has used Property118’s tax avoidance scheme, but presumably he’d suggest the same for anyone that has used Less Tax for Landlords’ or any other scheme.

We would strongly suggest you seek advice from an independent tax professional, in particular a tax lawyer or an accountant who is a member of a regulated tax body (e.g. ACCA, ATT, CIOT, ICAEW, ICAS or STEP). Given the potential for a mortgage default, we would also suggest you urgently seek advice from a solicitor experienced with trusts and mortgages/real estate finance (e.g. a member of STEP).

We would advise against approaching Property118 given the obvious potential for a conflict of interest.

That actually sounds pretty, errrm, terrifying. But arguably, perhaps not as terrifying as stewing in the mess for longer than necessary.

Of course, I don’t know if any of that is necessary – presumably Property118 believes it is not.

Either way, none of this is comforting or reassuring to hear.

I’m going to sit back and watch how the situation unfolds.

In the meantime, I’d be interested to hear your thoughts on this whole ordeal. Are you in the market to pick up a £40,000 tax avoidance scheme?

Where should landlords get expert tax advice from?

In the midst of all the drama, it did get me wondering (and now I’m finally getting to the actual point of my blog post – which will take one mere sentence to address), who should landlords feel confident in turning to for professional tax advice? This seems like a minefield.

That’s now the obvious question, right?

So who did I turn to? No other than Dan Neidle (via a Tweet), of course.

Dan Neidle’s recommendation is to get tax advice from CIOT and/or ATT qualified accountants or lawyers, and the safest approach is to only instruct an ICAEW-regulated accounting firm.

So basically, anyone reputable with an actual tax qualification?

Right, got it.

Sounds so obvious when you say it out loud.

If anything, these brawls’ have reinforced my belief in due diligence and always choosing the right people for the job, whoever that may be.

A few general thoughts on tax liability and acquiring expert advice…

- I’ve always been under the belief that when anyone is trying to endorse a tax avoidance (or reduction) strategy that isn’t text-book, or one that seems overly complicated and/or requires acrobatic hoop-jumping, I’m naturally inclined to believe that I’m potentially being led into murky waters and there’s a good chance I’d be skirting the lines if I follow through. Thanks, but no thanks.

- In situations like this, I’m reminded of the age old proverb; a true expert should be able to clearly explain their craft to a layman so they can also understand.

Point being, if someone can’t explain their service to me so it makes sense, I’m out. “Trust me, I’m an expert” won’t cut it.

- BTL/renting out property is a simple business model, so it’s very hard for me to conceive that it requires more than keeping taxes simple!

Where landlords shouldn’t get expert tax advice from (how to identify cowboys)!

In a timely follow-up post, Dan published his tips on how to identify cowboys.

To summarise the highlights and my personal favourite warning signs:

- Any tax advice should come from someone at a respected regulated firm, and/or with a tax qualification. You need to be speaking to the actual tax adviser, and not unqualified people giving tax advice.

- Anyone claiming to be “HMRC approved”. HMRC doesn’t approve any tax planning.

- Anyone shilling acrobatic tax planning solutions, providing reassurances like, “MRC has never challenged any of our structures”.

- Anyone pitching “our unique systems”, “our proprietary strategy”, etc. When it comes to tax, sensible people do what everyone else is doing.

- “We’ve glowing testimonials from dozens of clients” – this is how a salesman talks.

- No discussion of risks and downsides.

- Pressure to go ahead/sign a contract.

- “Your normal advisers won’t be familiar with these obscure rules”. A common tactic to pull clients away from trusted existing advisers.

- No mention of ATED – a special tax that will apply if a corporate or LLP (with a corporate partner) holds residential property.

Once again, all sounds legit. I dig it.

To conclude (and final disclaimers)…

Before I sign off to start preparing my sparkly new – all bells and whistles – tax planning service (be sure to look out for my sales email – coming to your inbox soon, for only £39,899! That’s what you call undercutting the competition – entrepreneurship 101), I do want to clarify that I have no ill will against Property118.com or LT4L, nor do I have an axe to grind against either – I’m not sharing Dan’s investigations out of malice or with an agenda.

However, I am sharing them because of my unwavering allegiance to our community. If I feel like important information has come to light and is worth sharing, you can bet your bottom dollar on me squealing like a pig, and allowing you to decide what you want to do with the information.

Other than a few Tweets post-publication of the investigation, I have no prior or current relationship with Dan Neidle or Tax Policy Associates. I only became aware of him and his company’s work after I saw their investigation on Property118’s tax planning service circulating on Twitter/X. Admittedly, I am now a fan.

To reiterate, I’m not qualified to determine whether Property118’s or LT4Ls’ tax planning services are as bent as nine bob note or not – I genuinely hope they’re legit for their own sake and for the sake of their clients – but what I do know is that a seemingly very qualified and reputable tax lawyer – and his qualified posy – appear to have grave concerns with them (and every other type of landlord tax avoidance scheme that exists), so we’d be foolish to ignore them.

Be careful out there!

Landlord out xo

Disclaimer: I'm just a landlord blogger; I'm 100% not qualified to give legal or financial advice. I'm a doofus. Any information I share is my unqualified opinion, and should never be construed as professional legal or financial advice. You should definitely get advice from a qualified professional for any legal or financial matters. For more information, please read my full disclaimer.

Landlord Products / Services

Landlord Products / Services

That was enlightening, not read Dan's blog yet, tax planning is sensible but when it's a product like this is... then it is normal for the seller to make more than the buyer and for all the contingent liability to lie with the buyer too - are the sellers going to be there when the man with a wig starts making decisions? I doubt it.