I can’t believe I’m finally getting to pull the trigger on this bad boy.

I’ve had this stubborn booger clinging onto my nasal cavity for the better part of a decade, itching to be yanked free. I’ve been patiently waiting for the the powers that be to quit moving the bloody goalposts, and for me to finally summon the will to cover such a brain-numbingly mundane topic: Making Tax Digital (MTD). The stars have aligned.

FYI, I’m definitely taking one for the team today!

Making Tax Digital (MTD) is part of HMRC’s plan to drag us – kicking and screaming – into the digital age. For many landlords, it means the current way of filing self-assessment tax returns is headed straight for the incinerator. Instead, you’ll need to use MTD-compliant software to submit your financials.

MTD was originally scheduled to roll out in 2019, but after multiple delays, it looks like it’s finally happening on 6th April 2026, and with a few notable changes to the previous handbook. Nope, your withering eyes aren’t deceiving you – that’s a nearly seven-year delay. Off-the-charts absurdity.

Even though we’ve still got a bit of runway to prep, you’ll probably want to get ahead of the curve with this one (and hopefully I’ll do a half-decent job of explaining why).

You’re going to fucking hate this, it’s going to be great. And as always, I’ll do my utmost to put lipstick on this pig so you don’t feel suicidal by the end of it. Let’s go, buddy…

You can read the official Gov guide on Making Tax Digital – it’s the mothership, and where you’ll find the most accurate, up-to-date info. This blog post? More of a casual pub chat, tequila-necking showdown, in comparison.

So… What exactly is Making Tax Digital (MTD) for Landlords (in simple terms)?

Welcome to the future.

The government are making us migrate over to a fully digital system for filing our self-assessment returns, hence “Making Tax Digital”

The current method of submitting our self-assessment tax returns are being phased out. Instead, qualifying landlords will need to send quarterly updates and a final year-end statement to HMRC using MTD-compliant software.

Yes, more faffing around and more expenses.

What-the-actual-fuck, bro!! They told me this landlord gig was easy, passive money. This horseshit has been nothing but a series of calamities!

My brother in Christ, they told me the same thing, and I look like I’ve been working in a coal mine for the past 20 years.

According to HMRC, the objective of this mission is to make submitting tax returns more efficient and help everyone “get tax right”

Uh huh! What it sounds like to me, is they’re hoping it cuts down on errors and pulls in more tax dosh *dies of shock*

Who does Making Tax Digital (MTD) actually apply to?

There’s no sugar coating it, a whole bunch of landlords are going to get caught in the crosshairs of this thing.

As per the Gov’s MTD Guide:

You’ll need to use Making Tax Digital for Income Tax if all of the following apply:

- you’re a sole trader or a landlord registered for Self Assessment

- you get income from self-employment or property, or both

- your qualifying income is more than £20,000

When you need to start using Making Tax Digital for Income Tax depends on your qualifying income within a tax year. If your qualifying income is over:

- £50,000 for the 2024 to 2025 tax year, you will need to use it from 6 April 2026

- £30,000 for the 2025 to 2026 tax year, you will need to use it from 6 April 2027

- £20,000 for the 2026 to 2027 tax year

To clarify a few points:

- MTD only applies to landlords and/or sole traders who file a Self Assessment tax return. If you’re an incorporated landlord (i.e. you run your property business through a limited company), MTD does not apply, unless you also earn additional income as a sole trader.

- The qualifying income is based on gross revenue.

- Your qualifying income is the combined total of any income from a UK or foreign property business (e.g. BTL) and any other income you earn as a sole trader. For example, if you earn £15,000 from a BTL and £20,000 from a self-employed goat manure business, your total income for MTD purposes would be £35,000.

- HMRC will use your most recent tax return to determine whether you meet the income thresholds.

What Landlords Need to do to Comply with Making Tax Digital (MTD)

Key Changes for landlords Filing Tax Returns under MTD

- MTD Software: In one way or another, you’ll need MTD-compatible software to report your financial transactions to HMRC.

- You will need to make 2 types of submissions:

- Quarterly updates – Instead of submitting one annual tax return, you’ll need to file quarterly updates of your income and expenses using MTD-compliant accounting software. These are essentially snapshots of your earnings throughout the year.

This is the biggest change, as it’s completely new, and a shift from the old once-a-year routine.

- Ends of year tax return – At the end of the tax year, you’ll need to submit a final declaration that replaces your traditional self-assessment return. This confirms your total income, allowable expenses, and tax owed (it’s basically calculated using the information provided in the quarterly updates already filed).

- Quarterly updates – Instead of submitting one annual tax return, you’ll need to file quarterly updates of your income and expenses using MTD-compliant accounting software. These are essentially snapshots of your earnings throughout the year.

Making Tax Digital (MTD) Software for Landlords

HMRC has published a list of MTD-compatible software that’s available now for the 2024 to 2025 tax year (this will apply to the first wave of landlords with an income of £50,000+, filing from 6 April 2026). Perhaps worth noting the following disclaimer:

All software listed on this page has been through HMRC’s recognition process. HMRC does not endorse or recommend any one product or software provider.

I haven’t heard of most of the software listed. But at this stage, it seems to be mostly made up of fully fledged accounting platforms, many of which you’ll be familiar with, such as Xero, QuickBooks, IRIS, Sage. The usual suspects.

Don’t forget, any software you use for your business is a tax deductible expense!

1) Property/Landlord Management Software

I suspect all the major and reputable property and landlord management software will be MTD-ready in time for the 2026 filings, otherwise they’ll literally be dead in the water. If you’re already rocking and rolling with one, they should fully support MTD. If you’re unsure, it’s worth investigating.

I’m also expecting a stampede of shiny new solutions to pop up, keen to hitch a ride on the MTD gravy train. My advice: proceed with extreme caution, especially since I’m sure many will launch with rock-bottom “disruptor” prices. The last thing you want is to feed your financial data into a start-up that ends up receiving the death sentence because it couldn’t gain traction. I’ve already witnessed plenty of ambitious companies fall into that trap, often because they completely underestimate how saturated the market already is. There are more landlord software products than actual landlords at this point. It’s a niche market, full of very silly “tech entrepreneurs”.

Over the years I’ve tested several different products, each one claiming to be the silver-bullet, and the ultimate solution landlords have been clamouring for (whether we realise it or not).

None of them are. In my experience, a perfect solution doesn’t exist.

Yup, some are better than others, and some are better suited to specific requirements. But ultimately, they all fall-short in some way or another, mostly due to subjective reasons. There will always be a missing feature, or a tool that doesn’t quite work as expected. A reality I’ve had to come to peace with.

My weapon of choice

Shameless plug, ahoy (but for all the right reasons!)!

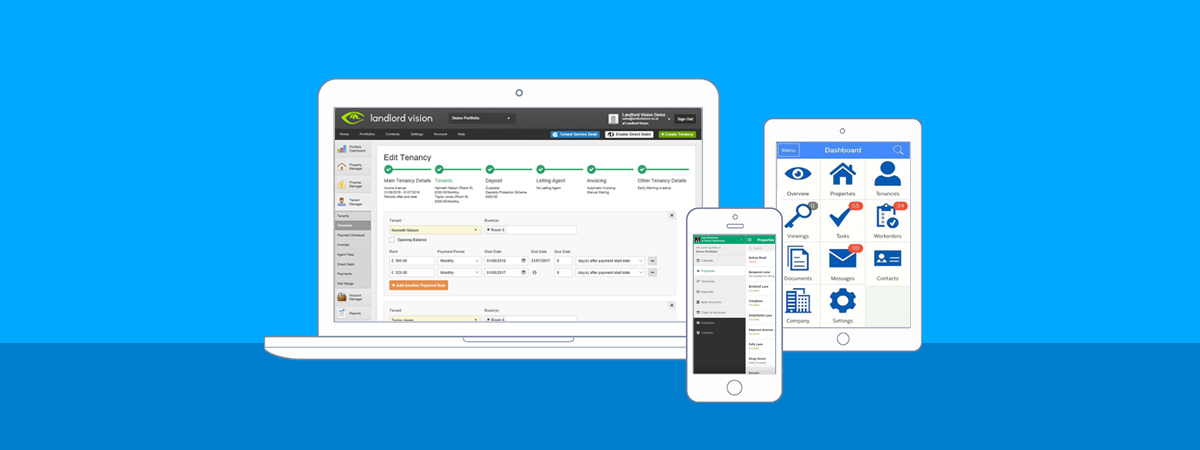

I’ve been using Landlord Vision for donkeys now (which I’ve previously mentioned a few times). They launched in 2013, and as far as I know, they’re the most popular landlord-specific management and accounting software out there (someone please correct me if I’ve just totally pulled that out of my jockstrap!) – I don’t see them going anywhere anytime soon. They have confirmed that they will be MTD ready.

They’re one of the better bits of kit among the gazillion options out there, in my opinion, and for what it’s worth, they’re only one I’m currently willing to have an affiliate partnership with. I’ve hard-passed on 99% of offers from other companies, willing to cut me off a slice of their marketing budget. Make of that what you will.

But don’t get it twisted, I’m not saying there aren’t better alternatives out in the wild. There quite possibly are. But who has time or will to test them all? What I am saying is that, out of all the ones I’ve taken for a joyride (which is a small handful), Landlord Vision has been the best fit for me. It’s easy to use, ticks the right boxes, and does what I need it to do.

And, honestly? I just don’t have any solid reason to vouch for anything else.

Here you go, stick this down your gullet.

| Software | Notes / Description | Price from | |

|---|---|---|---|

Software | Notes / IncludesCloud-based solution, great for the Everyday & Portfolio Landlords with 1- 500+ tenancies!Landlord Vision is an online cloud-based property management software tool. You can access it from any web connected device. The software produces reports that show cash flow, rental income, expense, taxation and equity reports. Key features

| Price fromDiscount available£19.97Ex VATPer month 14 days Free Trial. No payment details required to sign up. | Visit Website 25% off for 6 months on monthly plans – Use code: PIPPromo25 10% off the first year on annual plans – Use code: PIPPromo10 |

Please note, I try my best to keep the information of each service up-to-date, but you should read the T&C's from their website for the most up-to-date and accurate information.

In the spirit of fairness and balance, Arthur and Hammock are a couple other options that look quite promising, and are either already MTD-compliant, or claim they will be. I know Arthur is bloody huge (that’s what she said!) for property management, but I don’t really know much about Hammock.

Of course, I strongly encourage you to do your own due diligence and explore other options.

2) MDT Compliant Accounting Software

As mentioned, all the well known, fully-fledged accounting platforms – like Xero, QuickBooks, IRIS, and Sage – already seem to be MTD compliant, and listed on HMRC’s official list of software that’s “been through HMRC’s recognition process”

So if you’re already using one of these puppies to manage your accounts, you’re probably good to go – no need to panic or switch things up.

That said, if you’re not using one already, I personally wouldn’t recommend signing up to one if your income is generated solely by rental income, because these platforms are designed for general accounting, not landlording specifically. So you may as well opt for a purpose-built software that’s designed for your property business, benefiting from tools and features, like rent schedules, tenant tracking, compliance tracking, and expense categorisation tailored for a property business. Basically, stuff that doesn’t usually exist in your generic accounting package.

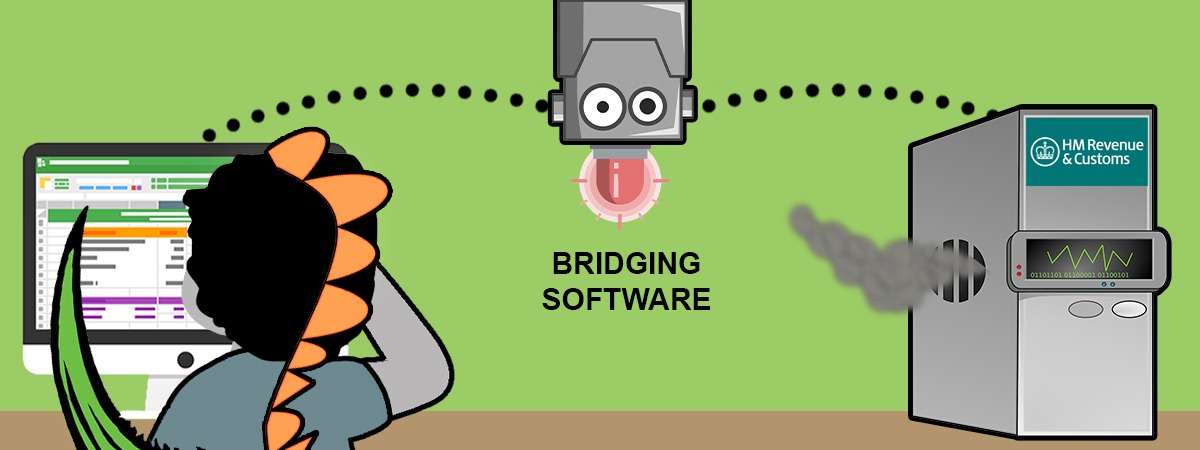

3) Bridging Solutions for Non-MDT Compliant Software & Spreadsheets

If you’re currently using property management or accounting software that isn’t MTD-compliant – and doesn’t seem likely to be any time soon – or if you’re blissfully happy with being a spreadsheet-wielding digital dinosaur for now, then good news – you might still be in luck.

You can use something called “bridging software” to send your data across to HMRC.

Bridging software is essentially a third-party intermediary tool – it connects to your non-compliant system and submits your data to HMRC in an MTD-compliant format. It creates the required “digital link” without forcing you to switch away from your current setup.

HMRC does mention bridging in its guidance, though it doesn’t go into much detail.

I don’t have any personal recommendations, but if you Google something like “Making Tax Digital Bridging Software for [your current solution]”, you might discover some potential options.

If you’re only managing one or two properties and want to keep costs to a bare minimum, using bridging software alongside a spreadsheet could be the way to go.

In my view, I do think there’s a strong case for bridging if you’re comfortable working with spreadsheets and aren’t managing a lot of properties and transactions. Otherwise, the best approach is to use a solid, all-in-one accounting solution that handles MTD directly, without the need for bridging.

I can’t really make a case for using a property management software that requires bridging, because it just seems wasteful and pointless, and I imagine the setup can be quite clunky, introducing additional pain points and increasing the risk of errors. Just speculating.

4) Accountant

If you’ve already got an accountant running the show, they should already have a game plan in place for MTD compliance. Chances are, they’re using one of the big-name accounting software that’ll handle all the heavy lifting.

But it’s worth double-checking with them to make sure they’ve got their ducks in a row, and ready to plough through this shit like warm butter. They will likely have to introduce a new process to help file the quarterly reports.

Side note: if your accountant responds with a blank stare when you mention Making Tax Digital, it might be time to ditch the clown-show and pivot.

How Landlords can Prepare & Plan for Making Tax Digital (MTD)

- Start digitalising your accounts ASAP – if you’re under the £20K threshold, but close to it, it’s worth planning ahead. Once you cross that line, you’re in MTD territory.

I appreciate that the £20k crew have until 2028, but the sooner you get your accounts onto a digital system (i.e. sign up to some software and start using it properly), the smoother the transition will be when the deadline finally rolls around. We all know how time works – one minute it’s New Year’s, and next thing you know, you’re plastered on Christmas eve, straddling a bog.

Honestly, I wouldn’t be shocked if HMRC eventually scraps the thresholds altogether and drags everyone into this hellhole, regardless of income.

- Talk to your accountant – Ask if they’re already MTD-ready and which system they plan to use. In particular, find out how you’ll be expected to send them your quarterly reports.

- Bank Account – If you haven’t already, for the love of God, open a separate bank account just for your rental business. It’ll make your life 10x easier in general, but especially when syncing your account with software, otherwise you’ll have to filter out all your personal transactions.

Oh, believe me, I know. I so bloody know.

Landlord out xo

Disclaimer: I'm just a landlord blogger; I'm 100% not qualified to give legal or financial advice. I'm a doofus. Any information I share is my unqualified opinion, and should never be construed as professional legal or financial advice. You should definitely get advice from a qualified professional for any legal or financial matters. For more information, please read my full disclaimer.

Landlord Products / Services

Landlord Products / Services

Does the Landlord Vision software make it easy to snap receipts and create digital records? I know the others can do that.

I’m not particularly bothered about seeing financial snapshots. I know where I am month to month but record keeping is my achilles heel. I keep the papers together, just not in a very useful order. I’m always promising myself I’ll sort it or buy another folder soon to organise it all.

Taking pics at the point of purchase is, for me, game changing. Because I am an ass.