Here we go again, ma’ Lords!

I was recently reacquainted with a very familiar crippling rage, and so help me God, I have no bloody intentions of taking a break from relapsing until everyone gets this memo, or the evil minds’ behind this ploy are slayed into oblivion.

Yup, I’m referring to the infamous and shameless BTL building insurance renewal scam, a ghastly situation that only seems to be getting worse as the money-grabbing corporate scum-bags are upping the ante! It’s an abhorrent predicament we all face, whether we want to realise it or not, and it’s an itchy scalp I’ve been publicly scratching for years.

This melodramatic tantrum is off the back of a recent experience, which was a stark reminder of why we should NEVER blindly accept insurance renewal quotes from our current provider, despite how tempting the offer on the table may seem, because the odds are firmly stacked against us of receiving an offer that remotely resembles reasonable!

Like clockwork, I received two annual “BTL building insurance renewal reminders” in my inbox last week. I curiously dived in, wondering how much of a schmuck my policy provider thought I was this year. The barometer being the amount they’ve increased my premium by for absolutely no reason whatsoever [other than diabolical gluttony].

*checks renewal quotes*

Yup, clearly they think I’m monstrously more of a schmuck than I was 12 months ago. Fuck you very much, too!

I’m confident I’d suffer from a hefty stroke if an insurance provider, whether it be a broker or the underwriters’ themselves, made the reasonable decision of rewarding loyal customers with a renewal quote cheaper than the previous year (or, at the very least, in line with inflation). Imagine that!

The situation is so depressing that I think most of us automatically expect an increase of some degree, and any other scenario would lead to unfamiliarity and discomfort.

I just received your renewal quote and it’s cheaper than the previous year’s. What kind of SICK & TWISTED mind game are you playing, sorcerer?

Is this policy even worth the paper it’s written on? Send me a real fucking quote, or I’ll take my business elsewhere!

They’ve got us right where they want us.

Obviously this isn’t a problem exclusive to landlord insurance, but rather most renewal based services (e.g. broadband, car insurance, utility services etc).

The sad reality is that most people STILL blindly, without question, accept exorbitant renewal quotes because of convenience. Ultimately, our negligence has created a market for insurers to legally shake us down, like we’re drug mules, with cocaine bullets rammed up our asses.

It’s gotta’ stop! We all need to fight this fight!

Alas, I’m an advocate of standing up against pure evil until it’s been drained of all life, so I won’t stop until THEY do!

I’ll never stop, then.

Don’t get me wrong, I’m guilty of surrendering on occasion – I allow them to tip my head back and force the swallow – but only when the increase is so minimal that it will cost more in time and effort to find an alternative. Regrettably, that certainly wasn’t the case this time…

The BTL building insurance scam in numbers

| # | Policy details | 2020 Cost | 2021 Renewal Quote | Increase |

|---|---|---|---|---|

| Property 1 | Policy details

| 2020 Cost £136.44 | 2021 Renewal Quote £179.11 | Increase (in 1 year) 31% |

| Property 2 | Policy details

| 2020 Cost £136.44 | 2021 Renewal Quote £199.70 | Increase (in 1 year) 46% |

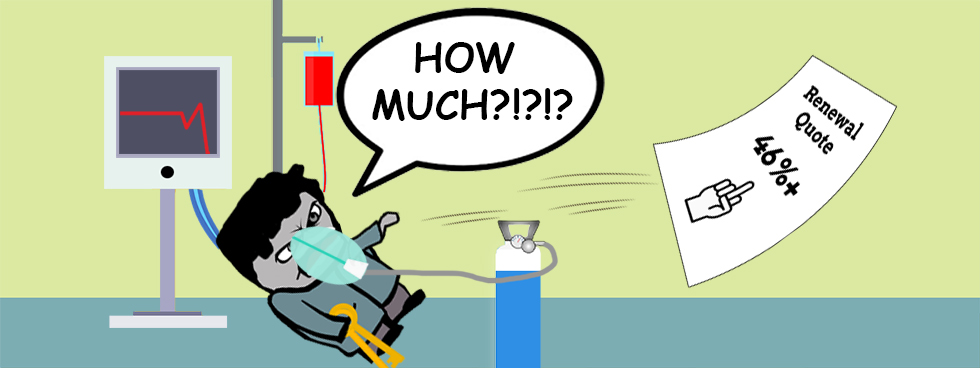

*gasps for air* I can’t shitting breath!!

It’s worse than I ever imagined it could be.

How the hell can these fools justify an annual increase of 31%, let alone an unfathomable 46%, when I didn’t even make any claims?

Also, it’s worth noting that the properties are located in the same neighbourhood and share very similar characteristics, which is why in 2020 the policies cost exactly the same. But this year, the same provider made the strategic decision to increase one of them by a further 15% *blank stare*

How is this a thing? Did the crime rate across the road increase by 15%?

Obviously there’s no logical explanation for the quotes I received, and that’s precisely why I have no hesitation in calling this entire pantomime a shameless scam on anabolic horse steroids!

I mean, come on, 46% increase!! Are they off their rocker? [rhetorical question]

I know that, with all their might, they want me to be too lazy to fetch better deals! They want us all too be so disgustingly and obnoxiously bone-idle, that we continue to blindly accept whatever number they toss under our noses.

Yup, that’s not going to happen, not on my watch! No siree Bob.

While there was less than zero percent chance I was going to reach into my pocket and renew my policy with these shysters – they were dead to me – I was still compelled to contact them and partake in the haggling ritual, to determine how much they would lower the quote by, which in reality, is what the thieving bastards should have quoted me in the first place.

Every time I get a renewal quote (which has historically always been more than the previous year), regardless of whether it’s reasonable or not, I always contact the supplier to determine if it’s the best they can offer.

99% of the time they chisel off a significant amount.

Something to bear in mind is that the biggest cost for most insurance companies is customer acquisition, so it’s more beneficial for them to reduce their rate in order to keep your custom, rather than replacing your custom.

In short, my provider said they couldn’t reduce the cost of policy #1, but were willing to reduce policy #2 to match the cost of policy #1.

Thanks, buddy, but policy #1 & #2 should have always been the same, and the only reason the rate has been revised is because your algorithm was hoping it was dealing with a total gormless twit.

Either way, that’s still an outrageous 30% increase per property, and of course that had to be questioned.

I half expended to hear “trust me, bro, it’s a solid deal”. I ‘spose my expectations weren’t entirely far off, I quote:

… prices have increased by 30% across the industry

Dear lord, my biggest fear right now is that she doesn’t look as stupid as the load of old cobblers she’s trying to feed me.

Apparently BTL insurance policies became precious metals overnight.

Funny enough, but not surprisingly, the rebuttals to justify price hikes are almost always the same, either it’s brushed off as “inflation” or “on an industry level”

It’s never about profit.

Why many landlords end up paying over the odds for insurance (and other junk)

- From a purely visual perspective, we’re talking about relatively small numbers; an increase from £136.44 to £179.11 may not seem that jarring on paper (’cause all landlords are filthy rich. What’s a few quid between property Barons?).

However, when comparing the difference by a percentage, the brutal ravaging is unmistakable.

- The obvious (and as discussed), it’s easier for us to lay dead and accept renewals.

- The failure of cross-referencing the renewal quote with the previous years’ cost.

How much I ended up paying

Spoiler alert: I only needed one quote from a different supplier to confirm my suspicions, that the only thing that has increased across the board by 30% is my contempt for these ass-clowns, which I really didn’t think was humanly possible.

It absolutely is.

| # | Policy details | 2020 Cost | 2021 Renewal Cost | Increase |

|---|---|---|---|---|

| Property 1 | Policy details

| 2020 Cost 136.44 | 2021 Renewal Cost £139 | 1.8% |

| Property 2 | Policy details

| 2020 Cost 136.44 | 2021 Renewal Cost £139 | 1.8% |

Better!

Actually, that’s cheaper than last year if the current 2’ish percent rate of inflation is taken into consideration.

I used QuoteSearcher to connect me with an insurance broker to provide quotes. I’ve successfully used and partnered with them for several years now, which is why I don’t hesitate in recommending them.

However, I don’t particularly care how or where you gather your quote(s) from as long as you’re connected with a reputable underwriter (do the usual due diligence) to ensure you’re being charged fairly, and that’s really what my recurring meltdown is all about.

Will you always get a better quote? Nope.

But it’s always worth finding out if you can.

Is the hassle worth it?

Yes.

It most definitely is, from both a financial and ethical standpoint.

First and foremost, it wasn’t much hassle at all, if any, really. At least, it didn’t feel like it was to me. To be honest, I think we all love to create reasons to justify negligence, and in this case, the task is often over exaggerated and wrongfully promoted to ‘a complete pain in the gonads‘.

I managed to pivot and rearrange my position in 25’ish mins, which included the following steps:

- 6 mins – contacted former insurance broker to query their comical renewal rates

- 4 mins – complete quotation form to retrieve quotes from a broker

- 18 mins – after completing the form, with in 5 mins, I was contacted by an insurance advisor from Academy Insurance (I have no affiliation with these folk), to discuss and arrange the new policies.

I ended up saving approx. £80 on insurance in 25 mins. That equates to an hourly rate of £192.

Totally worth it!

Moral of the story: don’t be the schmuck THEY want you to be. Be the schmuck I want you to be.

I’m eager to hear your stories and experiences with insurance, and any tips you may have! Go for it!

Landlord out xoxo

Disclaimer: I'm just a landlord blogger; I'm 100% not qualified to give legal or financial advice. I'm a doofus. Any information I share is my unqualified opinion, and should never be construed as professional legal or financial advice. You should definitely get advice from a qualified professional for any legal or financial matters. For more information, please read my full disclaimer.

Landlord Products / Services

Landlord Products / Services

You were lucky to achieve that in 25 minutes. I recently renewed my car insurance (I know not BTL property insurance, but the same "scammers" involved) After spending a total of 2 hours on the phone and a promise that I would save money, I ended up with a similar renewal quote. To add icing to the cake, a few days after renewal, got a nice email from the scamsters that they were threatening to cancel the policy as "I'd misquoted my No Claims Bonus". Of course, I had done no such thing, but they had to listen back to the recording of the telephone call - why not do that before making the false allegation? In the end I was vindicated, the error was on their part and they'd absorb "the extra £50 premium and admin charges" that their error incurred. Lesson learnt, don't do telephone quotes if it can be done online, where you control the data input.

As for the BTL insurance, we had an escape of water claim, so had to accept an increase in premiums earlier in the year.