Holy moly!

So, is this really it? Is this how and when we finally get toppled, comrades? For those of us remaining, are we, like, walking straight into a meat grinder?

Everywhere I look.

Every. Bloody. Where. I’m inundated with an apocalyptic outlook on the BTL market…

Source: YouTube / Charles Kelly Money Tips Podcast

Source: YouTube / Charles Kelly Money Tips Podcast

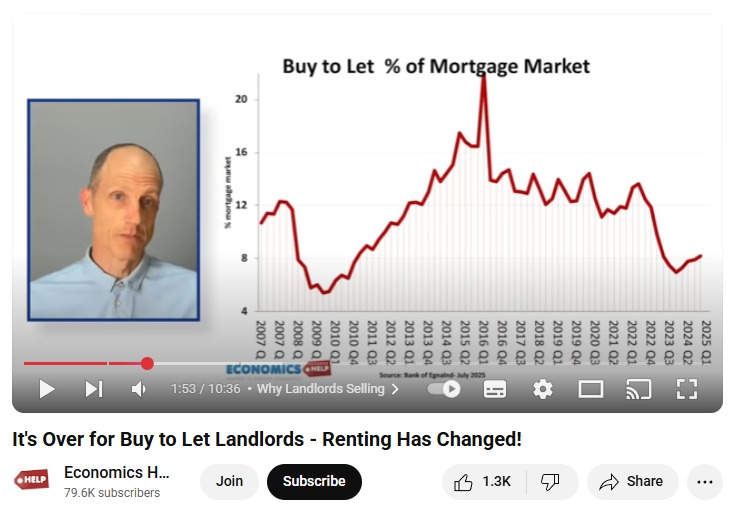

Source: YouTube / Economics Help

Source: YouTube / Economics Help

Source: The Telegraph

Source: The Telegraph

Source: X / @moving_charlie

Source: X / @moving_charlie

Source: The Negotiator

Source: The Negotiator

LA LA LA LA! MAKE IT STOP! What in the actual fuckity-fuck?

TEAM MEETING! RIGHT NOW!

We’re in dire need of balance. Or perhaps, some delusions of grandeur. Don’t worry, I’ve got your fix.

Just to be clear (once again!) – I still ain’t selling a bean.

Hell, I’ve been a busy-bee, trying to double-down on my conviction.

But if you’ve already decided it’s all too much, and it’s time to capitulate and fold-up like a deck chair – joining the alleged exodus of landlords (is it just me, or is this the longest exodus in history?) – no judgement from me. You’re the captain of your own ship.

As for this sailor? I feel like I’m exactly where I need to be. The bigger picture hasn’t changed from where I’m sitting: the BTL model remains a resilient, profitable long-term investment (when executed sensibly) and has a rightful place in every portfolio, from DIY landlords to mega corporations.

You’re either with me, or with the wailing, meandering, fannies. The line’s been drawn.

In no particular order (and this is nothing I haven’t said before!)…

Regulations & Tax Liabilities

I know, I know. We are getting absolutely deep-fry, onion-ring, battered from all directions.

I hear you loud and clear.

The pressing issue right now is obviously the Renters’ Rights Bill.

A ghastly infection that’s been looming over our heads for the past century, like a throbbing haemorrhoid, forever on the verge of bursting.

I don’t know. I kind of think landlords are going a bit OTT with the freak-out. Personally, I believe the Bill will hit vulnerable tenants harder than anyone else, and most sensible landlords will be alright. Time will tell.

There’s also been an insane amount of speculation about what vulgar garbage the Autumn Budget might unleash on landlords, from taxing unearned income to slapping self-employed landlords with National Insurance. Every week, a new crackpot idea seems to circulate.

Either way, there’s nothing I’ve heard so far has been enough to rock my conviction.

“The government is trying to demolish small landlords.”

Perhaps.

But the jokes on them, because the more they try to force me into selling up and getting a real job, the more defiant I become, and the more convinced I am that I’m exactly where I need to be. Do these psychopaths really think we became landlords because we aspired to be productive members of society – a cog in the system?

Ha, morons.

I’m ready to go down with this ship just to avoid it. Landlords are wired different.

Next!

The expert house-price doomers are a fascinating, ragtag bunch!

Every cycle.

Every single one!

At some point, the economy naturally takes a steaming dump, and like clockwork, out pop the house-price Stormtroopers, insistent that doomsday has finally arrived: the property/BTL gravy train has reached its final destination.

No, it’s for real this time!

Sadly, a lot of people get swayed by their yapping. I get it. They can be convincing.

But what’s interesting is that most of these participants are armchair commentators and self-proclaimed house-price clairvoyants with zero skin in the game. They’re just professional ramblers.

I always find their unwavering conviction mystifying, because if I could predict the future, I’d be far more successful than they are. No shade (I’m lying!), but these people are usually not particularly successful, despite being the loudest in the room and claiming extraordinary abilities. What a waste of talent.

I’ve learned to drown out the noise, because the moment you let it in, you risk being led by a bona fide donut.

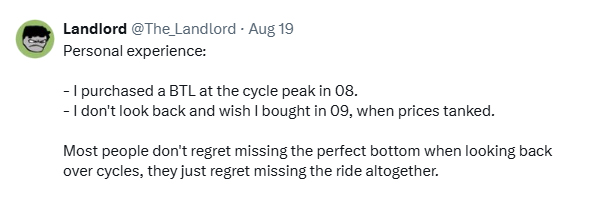

I’m not saying they’re wrong, I’m just saying they haven’t given me any compelling reason to trust them. Too many people miss out on opportunities this way, sitting on the sidelines while a cycle passes by, only to regret not pulling the trigger when they had the chance.

I believe timing is less important than personal finances. I’ve never tried to time the housing market based on “price predictions”, my decisions have always been grounded by my faith in the market and in what I can afford.

If I can comfortably afford a property using stress-tested figures, I’ll buy it (assuming I’m looking to invest). It’s worked out well for me so far. All good.

If not now, when?

I’m not quite done with these experts just yet.

No doubt, house prices have cooled, sentiment is at rock-bottom, and in some regions, prices have been stagnant for years. Leaseholds in London in particular have been cooked (but that comes as no surprise, I’ve been warning against leasehold properties for as long as I can remember).

There are people screaming from the rooftops that the property market is dead, or almost dead. Just relentlessly gloomy.

So my question is, if that’s the case: when is a better time to buy then? Never? Why aren’t they optimistic right now?

I’m not claiming this is the right or wrong time to buy, I’m just trying to understand the doomers’ mindset, because it seems like a losing one.

My gut tells me these are the same experts who’ll be blasting the “IT’S SHOWTIME, BABY: BUY, BUY, BUY!” horn once prices start soaring again.

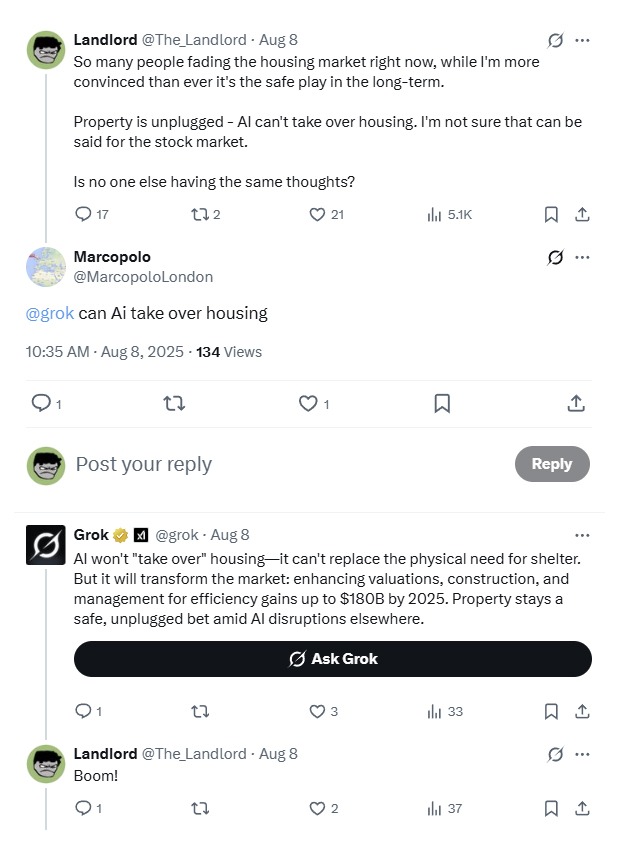

AI is coming

I don’t know if you have thought about this, but I have.

Whether we like it or not, AI is coming, and it’s going to clean-sweep a concerning amount of jobs. It seems inevitable.

I have two specific thoughts about the takeover:

- BTL has a couple of nice features: you can run this shit-show as a side hustle, it’s relatively passive, and it keeps chugging along generating inflation-adjusted yield, even if capital appreciation is [temporarily] heading in the wrong direction. So if your job eventually gets hijacked by a cyborg that does it infinitely better than you (which it will), BTL will still be there for you.

-

Could property serve as a hedge against AI-driven disruption, specifically from an investment perspective?

I could be way off here, I’m just spit-balling some thoughts I’ve pondered.

The middle class is dying, the wealth gap is increasing

The rich are getting richer, the poor are getting poorer, and more of the middle class are sliding down the ladder rather than climbing up. Why is that?

There are many explanations, most of which are above my paygrade and mental capacity to comprehend. But I’m certain a big part comes down to the average person not understanding inflation, specifically currency debasement. One symptom of this is middle-class households selling appreciating assets to the wealthy for pennies on the dollar during downturns.

This is exactly why recessions are such fertile ground for wealth transfer. After each downturn, the rich are richer, the middle class is weaker, and the gap keeps widening.

I don’t want to aid in increasing the gap.

Capital appreciation + Yield

BTL remains one of the few assets that delivers both capital appreciation (over the long term) and steady yield.

Even if property prices take a tumble, the rent keeps rolling in. It’s a beautiful thing.

Property cycles

I genuinely feel like we’re not seeing anything new in the current climate, yet everyone’s acting like the sky is falling for the first time.

“It’s different this time”

Is it?

Or, are we just witnessing the usual noise that comes at the bottom of cycles, paired with a shake-up of regulations? It was far more painful in 2009, at least for me personally.

During these scary times (I’m not denying it looks bleak out there), I have to draw a line in the sand: do I really believe property cycles are broken forever, that we’ll never see positive returns again, and that the need for shelter is ending? Or are the cycles more or less intact, and we’re merely going through a healthy, much-needed correction, like we have done in the past?

My money is on the same old, same old.

In 10–15 years, I’m sure we’ll see another generation of folk wondering why they didn’t buy when prices were more reasonable.

Same old, same old.

Time-Value of debt & Leverage

I’ve chewed through enough fancy words and charts proclaiming that BTL is dead to last me a lifetime. The Lord knows I have. It’s been grim reading.

What makes me question the objectivity of these reports is that they never highlight what I consider to be two of BTL’s biggest investment advantages, or at least, I’ve yet to come across one that does.

1) The Time-Value of debt

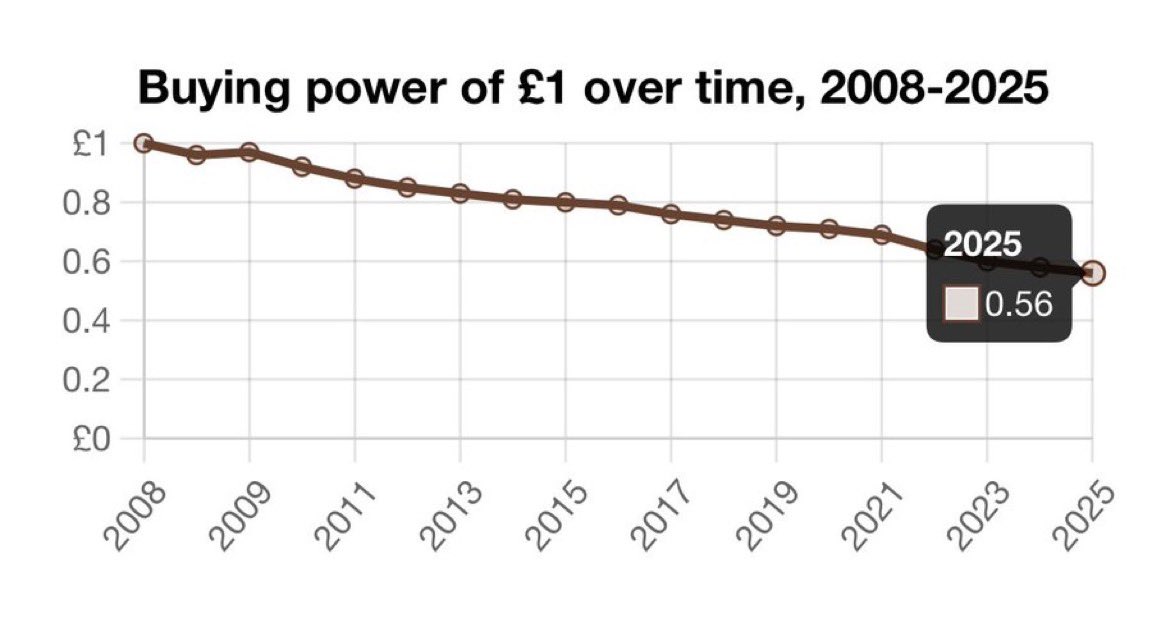

In simple terms: £5,000 today is not the same as £5,000 twenty years ago. Same nominal amount, very different purchasing power.

Now, let’s apply that to debt.

Suppose I pick-up a BTL property for £100,000 today, put down a 20% deposit, and take on £80,000 in mortgage debt.

£80,000 might feel like a lot today, but in twenty years, that debt will be worth a fraction of its current value and will feel a lot less painful. There was a time when £20,000 in mortgage debt was considered unmanageable for the average household, but today most people can only dream of having such a puny balance.

Fixed-value debt gets inflated away over time.

Like I said, I believe most people don’t truly understand inflation.

2) Leverage

Even with Section 24 making leverage trickier to balance, property remains one of the few asset classes where you can effectively use leverage, especially because mortgages are relatively cheap debt.

Put simply: you invest a deposit, borrow the rest, and control a larger asset with less of your own money. If property prices rise, the return on your initial investment is amplified, since most of the gain comes from borrowed funds.

This has always been why real estate is popular among investors, and why corporations still love it. The largest asset managers in the world, like Blackrock and Blackstone, are accumulating right now.

The fact that the house-price doomers almost never mention these very real advantages tells me everything I need to know. They’re either pushing a narrative to suit their bias, and/or they understand little beyond short-term noise, and price go uppie and downie.

Pound Vs Property Prices

Wrap your noodle around this: The £ in your pocket today is worth 50% of its value in 2008.

Isn’t that crazy?

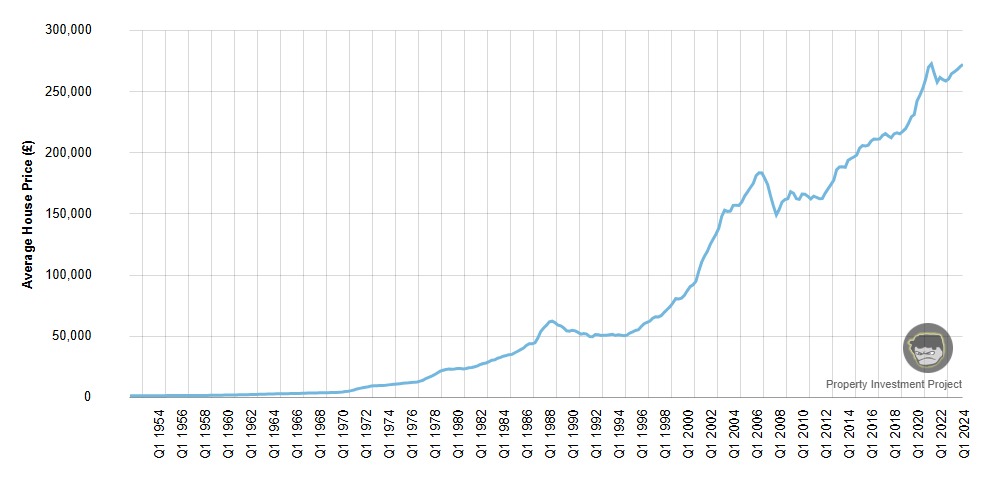

While property prices don’t always rise in real terms (i.e. adjusted for inflation), over the long run, they’ve trended upward, with natural peaks and troughs.

The graph uses Nationwide’s house price index and is not adjusted for inflation.

In contrast, there is not one fiat currency in existence that has trended upwards (that’s because every government robs their citizens blind by overspending and money-printing, ultimately debasing their own currency).

Sure, many houses haven’t outpaced inflation over the past decade, but prices have still increased overall, which is why BTL beats sitting on cash hands down.

There are still plenty of properties that have beaten inflation over the last ten years (mine included!). That’s why, as always, it’s crucial to buy the right BTL property for maximum return.

The truth is, if I sold up, I literally wouldn’t know where to put the money.

I only care about one question!

Which will serve me better over the next 10–20 years: holding £100k in a fluctuating savings account (we’ve all seen those rates tank over the past year) while the value of fiat currency erodes, or a BTL investment that has proven to deliver inflation-adjusted yield (rent) and long-term capital appreciation?

Toughie.

Couple of essential caveats

- The game is a different beast: While I’m still confident in the long-term outlook, I’m not oblivious to the fact that we’re likely to see diminishing returns in the current climate.

The market is tougher today; new regulations and tax liabilities have changed the landscape. Long gone are the days when any old pile of bullshit rubble can be profitable with a lick of paint and some laminate flooring. Those days may never return.

The barrier to entry is higher, but that’s not necessarily a bad thing. It definitely helps keeps the get rich quick crowd at bay.

Given where we are, decisions now require more consideration, balancing taxation, leverage, and property type carefully. The margin for error is smaller.

- I’m diversified: Property still accounts for the bulk of my [paper] wealth, and while it remains the cornerstone of my long-term portfolio, I’m diversified.

Property has never been the fastest horse in the race (especially short-term), but I still think it remains one of the most reliable and resilient. Gold is up there.

I’m not claiming that BTL is the most profitable or the easiest type of investment. Never have done.

- I cannot predict the future: I don’t know where property prices will be next year, let alone in ten years. My conviction comes from past trends.

I still believe in property and liquidity cycles, and I still believe people need homes to live in.

I could be wrong.

- Your situation may differ: You might not be in the same financial or life position as me (and I don’t mean that in a good or bad way). My process and outlook are entirely based on my specific circumstances.

I’m not ready to call it a day. If I were close to retirement, for example, I’d likely hold different views. Similarly, if I felt the urge or need to trim some profits and take money off the table, I might act differently.

At the end of the day, everyone has to do what’s best for themselves and their loved ones. All I’m saying is that I think there’s still life left in the ol’ gal, despite the overwhelming views to the contrary.

Source: X / @moving_charlie

Source: X / @moving_charlie

Yeah, I’m not convinced. At all. I’LL SEE YOU IN HELL!

Landlord out xo

Disclaimer: I'm just a landlord blogger; I'm 100% not qualified to give legal or financial advice. I'm a doofus. Any information I share is my unqualified opinion, and should never be construed as professional legal or financial advice. You should definitely get advice from a qualified professional for any legal or financial matters. For more information, please read my full disclaimer.

Landlord Products / Services

Landlord Products / Services

Generally I agree but when a tenant leaves it’s sold. Why.. mortgages , cheap mortgages are history. Age is against me. In expensive areas yiu d get capital appreciation, and looming cgt , but inside areas of depression and jobless you do not ..ok you get returned income at higher Rate .

But with returns in south east5% and mortgage 4,5% it’s too tight . I’ll be mortgage free on sale of next one first timecun50: plus years.. yes pretty much set up with estate or £1m third of which is home .

Without buy to let I’d have been poorer and have only my own house. Nit 3 others

But it’s no what it was ,in today’s market I wouldn’t enter it

Retirement in 3 years when 8 couldn’t get a mortgage anyway