If you’ve landed on this page after searching for solutions on how to sell a leasehold property in this current climate, you likely already know the situation: it’s a bloodbath! And I don’t say that lightly, or without sympathy.

While tough sells were once reserved for properties with short leases, today the entire leasehold market seems to be taking a brutal hit. London appears to be ground zero, but the issue is increasingly being felt nationwide. Prices have reportedly collapsed by as much as 35%, yet even at those levels, many flats can’t tempt a single bite. No viewings. No offers. Nothing. Just tumbleweeds!

The horror stories are everywhere.

There are a few reasons behind this, but one villain stands head and shoulders above the rest: eye-watering service charges. They’ve rocketed over the past few years thanks to inflation, and buyers are spooked – the maths simply isn’t stacking up. To make matters worse, we’ve got Labour appearing to quietly backtrack on their manifesto pledge to abolish leasehold altogether – breaking what little confidence the market had left.

Don’t get me wrong – leaseholds are still selling. But it’s a seriously unforgiving market, with many properties gathering dust for months on end, attracting little to no interest, triggering a race to the bottom as prices are repeatedly slashed (something that, in itself, puts buyers off).

So what’s the solution?

Why Buyers Are Ignoring Your Leasehold Property

Forget all the market conditions and variables for a moment.

The reality is usually very simple: there absolutely is a buyer for every property out there (I genuinely believe that), but if yours isn’t selling, the most likely reason is that it’s overpriced. That’s the number one reason properties don’t sell, and I get it – it’s a bitter pill to swallow.

What often happens – with the best intentions from sellers (and sometimes their agents) – is overvaluing, because properties get valued based on:

- What the seller paid

- What the seller need

- What the seller spent on renovations

- What Zoopla says

- What the neighbour asked for theirs

And, not what someone is actually willing to pay.

That’s why so many homes sit on the market for months, only to be marked down… and down… and down. To add insult to injury, in a slow market, there’s added downward pressure as prices continue to drift lower.

And, statistically, we know this: had a realistic asking price been set from the outset – even if it bruised expectations – the property would have been far more likely to sell, and often for more than the price it eventually limps down to.

So what’s my point? Sometimes, setting an asking price lower than you want today is exactly what will earn you the most money in the end.

But hold that thought, because it’s the perfect segue into the only guaranteed way to sell your leasehold today.

The Hail Mary Option: Sell to a Cash Buyer Company

Call this the last resort, or even a quick and painful end to your misery, if you like. And I appreciate, this option absolutely won’t be for everyone, but hear me out.

If you’re desperate to sell your property ASAP and are willing to let it go for roughly 20% below market value, selling to a Cash Buyer Company (a.k.a. “We Buy Any House” company) can be an extremely effective solution. They’ll take your leasehold – or any type of property, for that matter – off your hands for cash, and often complete the purchase in as little as 7 days.

The Benefits of Using a Property Cash Buyer for Your Leasehold

- Cash offer with in 48 hours (no obligations)

- Complete sale in as little as 7 days

- No fees to pay, they cover all costs (including legal)

- Any property, any condition considered

Yes, cash buyer companies will low-ball you – you will be selling for 15–25% less than market value, but you are guaranteed a sale. That’s the trade-off for a super-fast cash sale – and, of course, how cash buyer companies make their bread.

But here’s the kicker: in many cases, using a cash buyer company can be surprisingly competitive compared to listing on the open market in a declining market (where you might wait months for a sale that never comes). Sometimes, taking a hit today is the smartest move for your pocket tomorrow. You might not get every penny (though sometimes you do!), but you can secure a competitive price with far less hassle.

Selling for Less to Make More

Let’s say your leasehold is valued at £200,000 in January 2025, and a cash buyer offers £170,000. Your natural instinct? Laugh, reject it, and try your luck on the open market for the full asking price, or at least something close to it.

But what if the interest never comes… and the market continues to slide?

By summer, you may have reduced the price to £180,000 just to generate viewings. And if you then circle back to the cash buyer, their offer might no longer be £175,000 – it could be £160,000.

It’s not a scare tactic. It’s a very real and common scenario.

Sometimes, the “low” offer at the start turns out to be the strongest one you’ll see (especially in tough market conditions). Just something to think about.

Here’s my full guide on Property Cash Buyer Companies – it goes into much more detail.

Recommended Cash Buyer Companies – Free No Obligation Cash Offers

The cash-buying industry is unregulated, so it’s essential to work with a reputable company. Only deal with one that’s a member of the National Association of Property Buyers (NAPB) and registered with The Property Ombudsman (TPOS) – like the ones listed below.

| Service | Rating | Features | Offers (up to) | |

|---|---|---|---|---|

Home House Buyers | Rating Reviews.co.uk | Features

| Offers (up to) 80-85%of Market Value | Get cash offer |

House Buy Fast | Rating feefo Reviews | Features

| Offers (up to) 85%of Market Value | Get cash offer |

Property Solvers | Rating TrustPilot Reviews | Features

| Offers (up to) 75%of Market Value | Get cash offer |

Full disclosure: the companies listed are affiliate partners, but they have been through a vetting process, which I explain in more detail in my full guide on Property Cash Buyer Companies.

Please note, I try my best to keep the information of each service up-to-date, but you should read the T&C's from their website for the most up-to-date and accurate information.

Property Cash Buyer Companies Have Become Insanely Popular – with Everyone!

Despite the inevitable gut-punch of selling to a cash buyer, these companies have skyrocketed in popularity among all types of sellers – from those in genuine distress to everyday homeowners simply drawn in by the promise of a fast, hassle-free, cash sale. Some of these companies have racked up thousands of genuine reviews from real sellers.

Case in point, here’s a post I came across on my Twitter/X timeline, by @landlord_secret:

Yes, these companies are particularly popular with distressed sellers who just want to wipe their hands of a property – think leaseholds, probate properties, homes in disrepair, or sellers facing repossession. So there’s a strong argument that some of these firms prey on vulnerable situations.

That said, I’ve spoken to a few personally (including the one’s I’ve listed), and many come across as genuinely empathetic and completely professional. Whether they’re just good actors or not, I’ll probably never know. Either way, at the end of the day, they provide a real service – and they take on serious risk by buying these properties for cash, with no guarantee they’ll be able to sell them for a profit.

Cash Buyer Company Vs Vs High-street Estate Agents

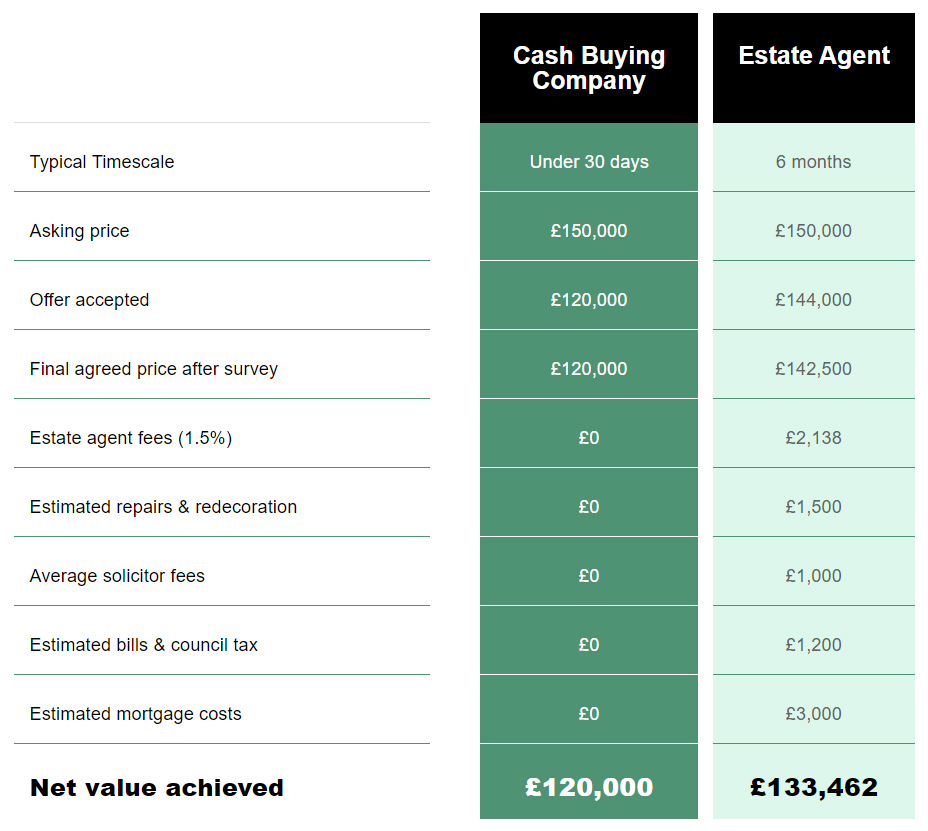

Bear in mind, this is just for illustration purposes: below is a costing table I found on a “We Buy Any House” website, showing what you can realistically expect in terms of costs and net value compared to using an estate agent. Take it with a pinch of salt – I’m just the messenger.

Is it accurate? Well, it shows the benefits of a cash-buying service, but only for one example.

The bigger picture? Selling the traditional way can drag on for months, which is especially true for leaseholds right now, and all that waiting has a real cost that most people never think about. That’s what the table really tells you: time is money – and the longer you wait, the more it costs you.

Not Sold on a Cash Buyer Company? Your Only Other Option…

As said, I know very well that a cash buyer company isn’t for everyone. In fact, it’s not for most. I totally get it. I’m not here to sell you it, but rather, make you aware of your options.

That leaves your only other choice: continue trying to sell on the open market. And if you do, I’d genuinely take heed of what I mentioned earlier – the primary reason properties don’t sell is almost always overpricing, for whatever reason.

I can’t say if that applies to your situation specifically, but it’s by far the most common culprit. Maybe it’s something worth considering.

Happy selling, and best of luck. I’m with you!

Landlord out xo

Disclaimer: I'm just a landlord blogger; I'm 100% not qualified to give legal or financial advice. I'm a doofus. Any information I share is my unqualified opinion, and should never be construed as professional legal or financial advice. You should definitely get advice from a qualified professional for any legal or financial matters. For more information, please read my full disclaimer.

Landlord Products / Services

Landlord Products / Services