Dear Diary,

Now that I’ve struck a deal with the vendor, apparently I need to arrange a BTL mortgage [so I can enter a lifetime of debt].

Right. Got it.

So how and where do I start with that?

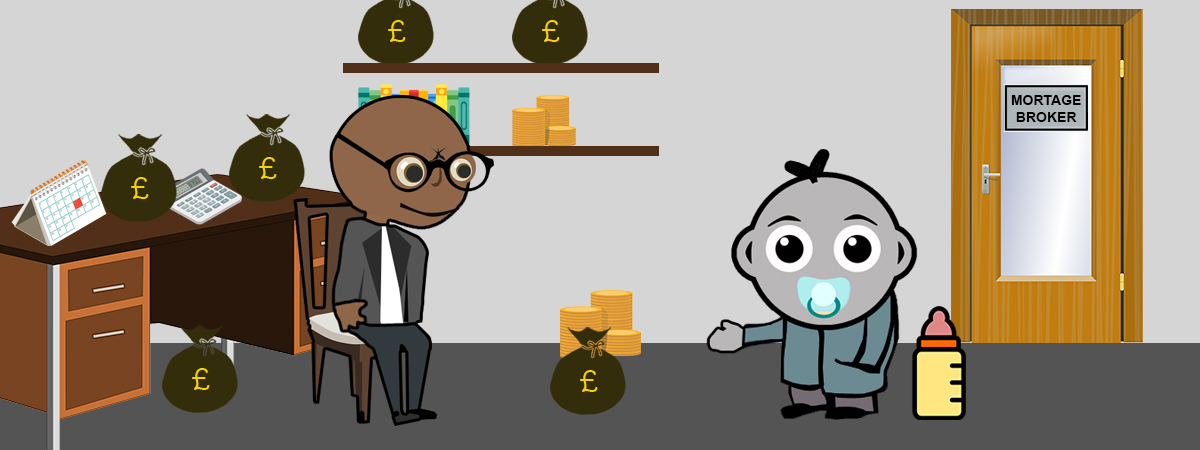

My agent must have given his in-house mortgage broker the nod, because a day after a sale price had been agreed on, I received a call from the money-man himself. He invited me to pop into the local branch to discuss whether I would be interested in discussing mortgages with him.

Sure, why not? He’ll take care of everything for me, right?

I don’t really know what I’m doing, so may the best predator take advantage.

Actually, you’re in luck, because the extent of my knowledge on mortgages is so depressing that I can give you a quick overview:

- Most borrowers take out a 25yr mortgage.

- The average BTL mortgage loan currently has an interest rate of 5.5%.

- Most mortgage brokers have limited access to mortgage products provided by specific lenders, so they don’t necessarily have access to all the products available.

In practical terms that means one mortgage broker might have access to a better product than a different broker.

- I’ll need to decide between an interest-only and repayment payment method. I already know I want repayment.

I arrived at the branch early morning, and was promptly introduced to Lee, my potential mortgage broker. First impressions: he seemed nice, like a straight-shooter. He didn’t come across as sleazy.

You know, you hear stories and just presume the worst.

I gave Lee a quick update on my current position, and he put his head down and started tapping away on his computer. Yup, there goes more of my personal information, destined to be stored in a remote database, only accessible by the Government. And maybe Google and MySpace.

He looks up at me, “we’ve got some matches”

“Is that a good thing?“, I wonder.

He run through a few options, comparing them with one another (most of the numbers went over my head), but he said the best deal he could find for me was the following:

- Northern Rock 5.47% Buy To Let Mortgage

- 2 year fixed

- 25 years term

- Repayment

I really should have thanked him for his time, told him that I have taken on board everything he has said, but since I’m a sensible person, I’m going to go away and look at other options just to make sure I’m not being bent over.

But I didn’t! Instead, “yup, let’s go for that one, I trust you, bestie”

For some reason I trusted Lee.

You know when you just meet someone and you like the cut of their jib?

In my defense, I did briefly look at a few options online before meeting Lee, so I knew the deal I was being offered was about right. It certainly wasn’t terrible. I was happy to proceed on that basis (and progress with things as quickly as possible. I’m not one for fuss).

The question is, when does one stop looking for a better deal?

Probably not after meeting the first mortgage broker.

Lee is printing out my mortgage application as we speak.

Disclaimer: I'm just a landlord blogger; I'm 100% not qualified to give legal or financial advice. I'm a doofus. Any information I share is my unqualified opinion, and should never be construed as professional legal or financial advice. You should definitely get advice from a qualified professional for any legal or financial matters. For more information, please read my full disclaimer.

Landlord Products / Services

Landlord Products / Services