Quick Links

I’ve just been perusing through a couple of “How to sell your house” guides, and I think I’ve just lost the will to live. Two words: Total junk.

The entire ‘Top 10’ results in Google is populated by some pretty extraordinarily flimsy articles! Shockingly, many of them are contributed by extremely popular property websites that really should know and do better. Alas, they all pretty much shared the same primitive drivel: ‘eliminating clutter’ and ‘applying a fresh lick of paint’ is the magic formula. I mean, seriously? Who doesn’t know ‘clean and tidy’ sells? What about all the other steps that is required to sell a home efficiently?

While those are key steps, they’re not exactly useful tips that most people with a shred of common sense didn’t already know! If selling a home boiled down to throwing and cramming everything into cupboards, and painting the entire house in a ‘neutral’ colour then why would anyone even need help?

Long story short, I was so disappointingly baffled by the piss-poor quality of articles, I’ve been reluctantly forced to put much needed meat onto the bones. I’m going to shuffle from the top all the way to the bottom, so feel free to jump in where relevant…

Page contents

How much is your property worth?

First things first.

Before even contemplating a sale, we need to know how much cash we can squeeze out of your property.

Many people make a fatal mistake at this very first step, and that is by approaching the closest estate agent to their doorstep, and solely relying and trusting their assessment. STOP right there!

Alas, all estate agents aren’t made equal. More specifically, it’s not uncommon for agents to completely miss the mark when it comes to valuating properties for their own agenda, and that can be costly to the vendor.

Getting multiple valuations from different sources is sensible – that will provide for a much more accurate and realistic valuation. Too many properties get left on the shelf gathering dust because of overvaluations. Equally as devastating, many fly off the shelf because they’ve been sickeningly undervalued. Finding out you’ve sold too low is a kick in the nuts, for sure. When it comes to property – our most valuable asset – selling low by even a puny 1% can equate to thousands of pounds!

Here are a few methods of getting a valuation:

- Look on Rightmove and Zoopla for both current and sold prices data

- Get valuations from the most reputable local agents, not just one!

- Use free online services which provide information on how historical ‘house sale’ statistics- specially how much recent properties in your area actually sold for!

Use as many methods as possible to form a clear picture of how much your property is actually worth!

Complete guide on how to value your home

How much will it cost to sell my house?

Below is a list of the typical and estimated costs of selling a home.

Note, most of the services listed are circumstantial, so they may not all apply to you.

| Service | Cost (approx) | |

|---|---|---|

| Remortgaging | £1,500 – £3,000 | Competitive Mortgage Quotes |

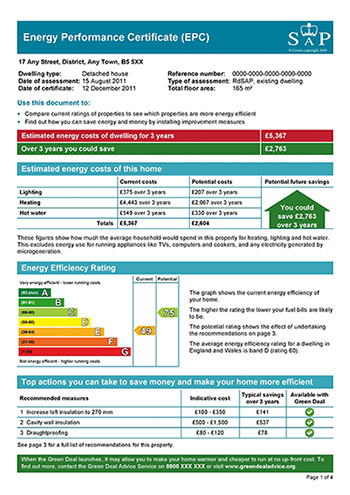

| Energy Performance Certificate (EPC) | £60 – £120 | Order Online for £69 |

| Estate agent fee | Online Estate Agent: £600 fixed-fee High-street Estate Agent: 1 – 3 % of selling price | List of Online Estate Agents |

| Conveyancing fees | £500 – £1,500 Could be more if you’re buying a property also. | Get Competitive Quotes |

| Removal costs | £300 for a 1-2-bedroom house £500 for a 3-bedroom house £700 for a 4-bedroom house £900 for a 5-bedroom house Costs are based on moving 10 miles away in 2018. | Get Competitive Quotes |

For more details, you can jump over to my in-depth blog post on the costs of selling a house (and how to keep them down).

When is the best time to sell?

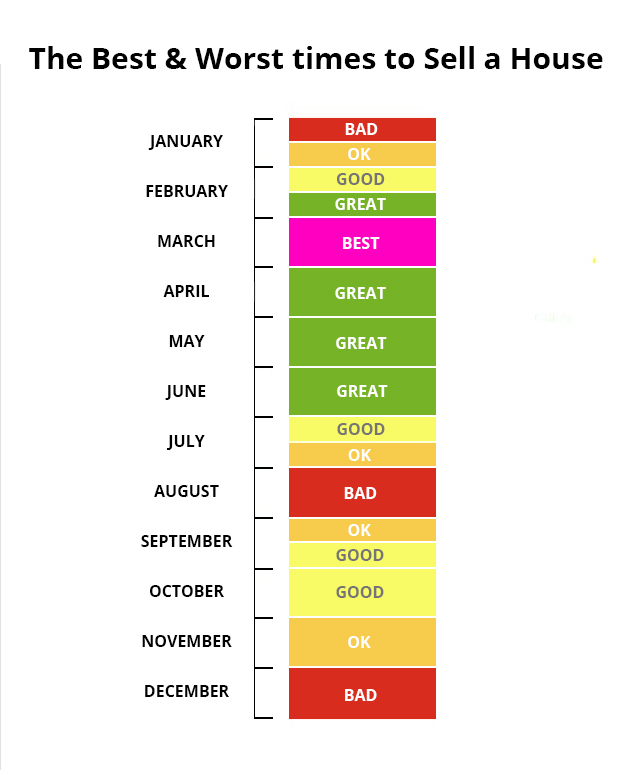

I fully appreciate that not everyone has the luxury of time, but if you do, it might be worth noting that spring (March, April and May) is traditionally the most active period in the property market (there are more buyers around), and that’s why it’s considered the best time to sell a property.

Below is a visual that nicely shows typical market activity throughout the year. The data is based on historical trends and Rightmove data gathered by The Advisory.

December and early January is traditionally the ass-end of the property market for obvious reasons. Probably best avoided if possible.

If you’re forced to sell during out of peak periods due to circumstances, I wouldn’t worry about it. At the end of the day, you need to sell when you need to sell, so rest assured that there are buyers’ all year round, every day of the year, and all it takes is one to make a sale.

The most important factor when selling – no matter when – is to maximise exposure in order to attract as many eyeballs onto your property advert as possible.

Ultimately, there’s no guarantees, but it’s always worth stacking the odds in your favour if you can.

Estate Agents

Do I even need an Agent to sell my home?

Common question, and I totally get it.

Putting their insanely high and gut-wrenching fees aside, estate agents have scorned society with their greasy personality and snake-oil sales tactics, so it’s not surprising that many are looking for alternative solutions.

There, I’ve taken my stab. So in order to remain balanced, it’s important to highlight what a good estate agent will bring to the table, and why they shouldn’t be dismissed:

- Sell faster

- Sell for a better price

- Generate more enquiries

- Communicate well

- Pivot and restrategise if enquiries are low

Ok, so let me answer the question at hand: you do not need an estate agent to sell your property. You can market and sell your property anyhow you wish, even without an agent. Whether that be through social media, word of mouth, local newspapers and/or pin boards in your local corner-shop and grocery stores.

However, if you’re going to use any of those methods, you might as well commute to work on a cart and carriage, because they’re not exactly the most effective means of generating leads in this digital day in age.

In my opinion, if you want the best possible chance of selling your property effectively, you will need to work with some ‘form’ of estate agent.

Currently, the only way to get your property listed on the biggest UK property portals like Rightmove and Zoopla is via an estate agent, and good sense will definitely ensure you list on those websites if you want as many eyeballs on your property as humanly possible.

However, you don’t have to work directly with your local estate agent do to that, you can use an “online estate agent”

Online Vs High street Agent

Long gone are the days where going to our local high-street agent and being savaged by their insanely high fees is the norm, and the only means of selling our homes. It’s over! That was yesterday’s news and today’s fish ‘n chip paper! And thank God for that.

Vendors now have choice between using an online estate agent to sell their property privately and the traditional high-street agent! The most notable difference between the two (and the one that most people care about) is that online agents are a buttload cheaper.

According to HomeOwners Alliance, high-street estate agents charge a percentage fee anywhere between 0.75% and 3.5% of the agreed selling price. So if we base an example on a 2% fee for a property that sells for £100,000, the agent’s fee would be £2,000. Now compare that with the average cost of an online agent, which is £600! So that means a £1,400 saving! So the potential savings are gigantic! Perhaps that explains why so many are jumping ship from the traditional route.

I’m not going to get into the nitty gritty details in this post, but I do want to make it abundantly clear that you don’t have to use your local estate agent to sell your home anymore, and by using an online agent you could potentially save thousands! Most online agents operate nationwide, so they’ll be able to market your property for sale whether it’s Scotland, Wales or England. So it’s worth looking into Online Estate Agents and then deciding which type of agent you want to use.

Complete guide on Online Estate Agents

Tips for working with High-street Estate Agents

- Member of a redress scheme

It is a legal requirement for estate agents and letting agents, including online agents for that matter, to belong to a government approved independent redress scheme.The role of an independent redress scheme is to provide fair and reasonable resolutions to disputes with members of the public.

Ensure any agent you work with is a member of at least one of the following:

- Less might be more!

This is crucial.Don’t just work with an Estate Agent that values your property with the highest price tag. Find out what their fees are first. In the long run, they could cut into a healthy portion of the sale price, and that could end up being the most costly option.

Always do the maths before making any commitments!

Also, ensure you get confirmation of the total bill on paper! Estate agents are notorious for riddling their T&C’s with nasty hidden and extra costs.

- Agent’s Marketing Strategy

I personally wouldn’t recommend using an agent that does NOT advertise their properties on Rightmove AND Zoopla! They’re currently the two biggest property portals in the UK, and most agents generate the majority of their leads from them. If you want as many eyes on your property as humanly possible, then statistically speaking, you want your property on both of those websites!Some of the smaller agents will only advertise on one or the other, but that’s only because the fees for marketing on those websites are allegedly astronomical, so it’s not always financially viable for all agents!

Find out where and how your agent will market your property. It’s also worth enquiring about the localised marketing they do e.g. newspapers.

- How long does it take them to sell a property?

Find out how long it currently takes the agent to sell a property from the day it’s put on the market. Each estate agent should have a figure based on their internal sales data.Be warned though, I wouldn’t take their answer as gospel, but it’s still interesting to know their answer.

- Contract types

When dealing with a high-street agent you’ll have to agree to a contract that will determine the terms of service with your agent.There are different types of contracts, so just I’ll cover the most common one’s you’re likely encounter.

- Sole agency agreement – this is the most common contract used by estate agents.

This agreement means that the seller contractually grants exclusive rights to the agent to market and sell their property within a specified period (i.e. typically between 8 – 16 weeks), during which time another agent cannot be instructed without breaching terms of service. It’s often possible to negotiate the tie in period, so the option to use another agent is available sooner rather than later if you’re dissatisfied with the service.

You only pay the agent if they find you a buyer. If you find a buyer yourself during the fixed period, you won’t have to pay anything to the estate agent.

The typical fee for a sole agency agreement is 1-2% of the sale price.

- Multi-agency agreement – this is when you’re contractually permitted to use multiple estate agents to help market and sell your property at the same time.

You’ll only need to pay the commission to the agent that sells your property. However, typically the fee for a multi-agency agreement is 2.5% – 3.5% of the sale price, which is comparably more than the standard 1% – 2% for a sole agency agreement.

Using multiple estate agents is a strategy often used to generate more enquiries and achieve a higher sales price.

If you’re interested in a multi-agency strategy, I highly recommend looking into flyp’s service (they’re an affiliate partner of mine – one that I’ve been thoroughly impressed by).

flyp find, recruit and manage the best performing local agents for their clients (i.e. sellers), and then get them to all market the property simultaneously, resulting in more interest and in-turn, quicker sales. Their clients pay an average of 1 – 1.5% of the sale price, which means it’s possible to get a multi-agency agreement in place for the price of a sole-agency agreement fee.

If I wanted to sell a house through a traditional high-street agent (and benefit from all the perks versus an online agent), this is the option I would personally use, no doubt about it.

To find out more, you can read my in-depth explanation of flyp’s service, or you can skip the foreplay and enter your postcode below, to get a free appraisal from flyp, which includes an overview of how many how many local agents they can get working for you.

- Ready, willing and able purchaser – avoid this one, it’s plain nasty.

If this clause is in your contract it means you’ll be liable to pay the estate agent fee even if your circumstances change and you choose not to sell.

Bin it.

- Sole selling rights agreement – this type of agreement is very similar to ‘Sole agency’, only difference is that you still have to pay the agent if you find a buyer yourself during the fixed period.

- Sole agency agreement – this is the most common contract used by estate agents.

Please note, I only provided a general overview of the most common types of agreements. The exact terms of service can (and usually do) vary from each agent, so it’s critical that you fully read any agreement before signing.

Cash House Buyer Companies (sell quickly for cash)

I’d be woefully remiss if I didn’t throw this controversial curve-ball; the option of selling your home to a specialist “Quick House Sale” company for cash, also commonly known as ‘We buy any house’ companies.

It’s certainly not an option for everyone, but if you’re particularly desperate eager for a quick cash sale and don’t mind selling your home below the market value (approx 10% – 15% below), then you could wrap this up rather quickly by going straight to a Quick House Sale company.

Fair warning: don’t be surprised if you feel sick to the stomach after receiving your cash offer. But rest assured, you’ll have the funds in your account sharpish – because they’re super rapid (i.e. they make it very feasible to complete a cash sale within 7 days).

On a serious note, these services are becoming incredibly popular, especially among the following types of sellers:

- willing to sell at a discount in order to achieve a super quick cash sale

- after a hassle free sale

- trying to sell particularly difficult properties, whether that be due to maintenance issues, subsidence, Japanese Knotweed etc.

Here’s a guide on Quick House Sale companies if you’re interested in finding out more.

Marketing Material

Property Photography

Good photography won’t directly sell your property, but they will have a direct impact on how the amount of enquiries you receive, which means they will have an indirect impact on the efficiency of your sale. Needless to say, More Enquiries = Better chance for a sale. Learn it, love it, live it (did I get the order right? I always forget)!

I’m baffled when I go onto the likes of Rightmove and see properties with total bullshit images; whether it be due to poor angles, dark and dingy lighting and/or clueless compositions that show the corner of a room! It almost makes me question whether the owner wants to sell the property. Even worse, is when I see properties with NO images at all. I mean, WTF, who is actually going to enquire?

The thing is, Rightmove and Zoopla do NOT allow individuals to directly advertise on their website- you need to go through an estate agent! So that means an agent approved each and every one of those photoless adverts, and those riddled with inadequate photos. Unbelievable!

Whether you’re using an online or high-street agent, make sure you use professional property photography that will actually sell your house! If your agent is responsible for taking the pics, make sure they’re actually of quality. If they’re not, kick up a fuss, or abandon them, because that clearly means that they either have no idea what they are doing, or selling your house is not in their best interest! I’m not totally sure which scenario would be worse.

If you’re responsible for the pictures, and all you have to hand is the camera attached to your smartphone, then get some professional photos taken- it’s not that expensive! You can get them from £85, which includes floor plans!

Believe me, good photography is crucial to the efficiency of your sale.

So, onto floor plans. Getting professional floor plans to supplement your advert is recommended, because it gives potential buyers a good idea of how your house is laid out. If you’re using a high-street agent, it should 100% be part of the deal. While getting as many enquiries as possible is crucial, you also don’t want to waste time- floor plans are a good way to prevent that:

I’ve already written an indepth blog post on Why landlords should use professional photography when looking for tenants, but the same principles apply when selling a property…

Guide on Property Professional Photography

Property Description

In my opinion, perhaps not as crucial as the photography, but it’s up there on the scales of importance- to have a strong description/details of your property to maximise the enquiries.

Once again, it’s not important who is managing the sale, whether you’re selling privately or using an high-street agent, the important thing is that the description is done properly! So if you need to bust some chops to make it happen, then do it!

Your description should include the following:

- List of all rooms

- Size/measurements of all rooms

- Local amenities

- Public transport links

EPC (Energy Performance certificate)

Whether you use an estate agent or not, it is a legal requirement to have an Energy Performance Certificate for the property when marketing your property for sale. An estate agent should be able to provide one for you (often at an additional cost), but as a private seller you can still organise it yourself rather easily. For example, you can order an EPC online from LettingaProperty.com for £69.

The Property

Make your property presentable

Ok, ok, ok! I know in the opening of this blog post I had a mental breakdown because of all the generic and flimsy articles on “how to sell your home” being polluted with bog-standard tips that were based around ‘presentation’, all of which a chimp wouldn’t be educated or surprised by. I’m going to cover those exact tips now! In my defence, I did say they were crucial, albeit as obvious as saying that the sky is blue. However, for the purpose of making this guide ‘complete’ I gotta’ mention them…

- Keep it neutral

This is a classic; this tip is in every guide, and there’s a good reason for it… it’s important!Every step taken to prepare your home should focus on this being the end game- to make the property look as neutral as possible, so it appeals to the most amount of people. If you’re going to repaint, if you plan on staging your house… make the end result look neutral, or as neutral as possible!

This step is particularly crucial if you’ve stamped your own unique style all throughout the property. To what may come to your surprise, not everyone will appreciate vibrant red and purple walls; such distinctive and striking styling choices may make it difficult for prospective buyer’s to see beyond what’s in front of them, and that may cause a stumbling barrier.

- Declutter

Clutter is the devil!People like being able to envisage what the property would look like if they were living there, which is often difficult to do when every square inch is occupied with junk. It’s important to create as much space as possible, and usually, the best way to do that is by getting rid of all the clutter. Be warned though, clutter WILL mostly consist of the items which you consider ‘prized possessions’. So you may need a little “reality check” before coming to terms with what you need to get rid of.

For most people, decluttering will consist of a two-step process! First step is to make a few dozen trips to the local dump and dispose of the junk that’s accumulated over the years. Second step is to box, cram and hide clutter out of sight.

- Rearrange furniture to maximise space

Consider removing or rearranging any bulky furniture, because they’re good at making a room feel awfully small. People are obsessed with space; people want to swing cats around without making any contact! The bigger your property/rooms look, the more enticing the proposition becomes.Light and airy is cool!

- Fix & Clean

Patch up and repair any visual eye-sores that may scare potential buyers away e.g. holes in walls, broken doors/windows, and throw away the rotten rugs.Bear in mind, buyers are looking for the best deal possible, so they will always look for faults in your property, hoping it will help knock down the price. So if there are major problems, weigh up whether they’re worth fixing.

Needless to say, ensure the property is thoroughly cleaned; tiles sparkling, carpets dust free and cobwebs swept away!

- Fresh paint sells

It’s true, giving your walls a fresh lick of neutral paint will make your home seem lighter and bigger.If your house is contaminated with dated wallpaper and/or dark, grubby walls, this might be a particularly important step to take!

- Front door

There’s an argument for the front door being important to create a good ‘first impression’. I believe it, although I’m not sure how much of a deal-breaker it is, but it’s still worth adding to the list.If your door is painted and is in particularly bad shape, whether it be smothered in a distasteful colour, or flaking to pieces like a foot with a bad case of athlete’s foot, it could be time to finally sand it down and repaint.

Make your home welcoming from the offset.

- The sniff test; bad smells kill!

Bad smells are one of the biggest turn offs for prospective buyers, and it’s crucial to find the source of the smell and resolve the problem, as opposed to covering it up with air freshener. In most cases, air freshener and other artificial fragrances will only make the bad smells more potent. Moreover, overpowering fragrances can also often be a clear sign of obvious deception, especially when trying to hide the smell of dampness and mould!Clear the drains, wash the bins after they have been emptied, open windows, air the kitchen from old cooking smells, get rid of furniture that is embedded with cigarette smoke, and wash any grimy bed sheets.

If you or any other resident is a smoker, look for guides online on how to eliminate the smoke smell. There are plenty around.

The kitchen & bathroom(s) are key areas

Arguably the two most valuable areas of any house is the kitchen and bathroom(s), which means they can easily make or break a sale. That’s why it’s important to pay special attention in those rooms!

Both these areas are worth ‘staging’, which may include fresh flowers, a bowl of fruit, and even new furnishings. Moreover, it’s worth spending a little extra on professional cleaning services, because they’ll have the equipment and experience to do a deep clean, which always goes a long way. Most professional cleaning companies will have pretty inexpensive “end of tenancy” or “move out” cleaning packages.

If you feel like your kitchen and/or bathrooms are in dire straits, and it seems like you would be ‘polishing a turd’ if you even attempt to give it a clean… at least make it clean and tidy. Do the best you can, but realise these rooms are key!

Don’t neglect your garden

We’re a nation obsessed with BBQ’s, probably because we only have a very limited amount of days where the weather permits them! Your back garden should look like a space for entertaining.

Many sellers wrongfully neglect the garden, but it can be a real selling point, especially for the family market! The same principles apply to the garden as with any room in the house- declutter, clean, and make it look spacious! So cut back the bushes, clean the patio and furniture of dirt (or throw them away), and cut the grass. Money doesn’t need to be spent on staging as long as the garden is neat and tidy.

Selling your home

Viewings

If you’re using an agent to take your viewings, you should just leave them to get on with it. There’s nothing really for you to do. However, if you’re selling your property privately, and you’re taking on the responsibility of viewings, here are a few tips:

- Be honest

Don’t be an estate agent.Yeah, I said it :)

You should answer questions about the property honestly. And if you don’t know the answer, say that, but tell them you will find out and let them know. Trust me, burying yourself into a hole of lies and deceit is not a good idea.

- Be flexible with schedules

To maximise your chances of a quick and efficient sale, you need as many people to view your property as possible, so you need to be flexible with your time. If that means you need to put your social life on hold temporarily, then so be it! - Give them space

Give all prospective buyers the opportunity to freely walk around the house and ask any questions.On a side note, you should store away any valuable items, because you just never know… you just don’t!

- Prepare to be asked questions

Most buyers will ask a common set of questions, so you should be prepared. Here are a few of them:- How much is the council tax?

- What are the neighbours like?

- How much do your utility bills cost on average?

- What are the local schools like?

These are all questions you should already be able to answer, but if you have a goldfish-like memory, you may want to have all the answers written in biro pen on your wrist, like you’re cheating for an exam.

Conveyance Solicitor / Paperwork

You’ll need a Conveyance Solicitor to prepare and handle all the boring legal paperwork and formalities, there’s no avoiding it! Here are a few off-the-top-of-my-head tippets of advice:

- Get a good one!

Trust me on this, a good conveyance solicitor is worth their weight in gold, so it’s important to do your due diligence when choosing one!I’ve used a pretty God awful one in the past, and they were responsible for horrendous delays. That’s the main problem with using an idiot conveyance solicitor, they can slow down, and even be the reason for a total collapse!

- Fixed fee quote is crucial!

I always recommend using a conveyance solicitor which operates by a ‘fixed fee’ pricing policy, so you know exactly how much you will pay. - Prices drastically vary so shop around

From what I have noticed, prices vary drastically for exactly the same service. So it’s always worth shopping around. - Your Agent will probably recommend you a Solicitor

Most estate agents will recommend for you to use their in-house or affiliated solicitor because most of the agent’s receive commission for the referral. Needless to say, they’re not competitively priced, so don’t feel obliged to use them. - Reviews, recommendations and reputation matter!

As said, getting a good solicitor is imperative because they will be responsible for a large portion of the entire process of selling your home.Whoever you decide to use, or shortlist, make sure you do research! A simple Google should unearth a lot of information. I’ve read A LOT of bad reviews about some pretty notoriously bad solicitors, but they continue to get business because some people simply don’t bother doing research. Baffling.

Instant Conveyance Solicitor Quotes

More Details on Conveyance Solicitors

Choosing the right buyer

Yes, this is really a “thing” as choosing the right buyer, especially when you’ve received a few offers (common during a booming market).

Remember, the person who offers the highest price isn’t necessarily the best choice.

It’s important to find out important details about each party that has made an offer; find out how they plan on financing the property- cash buyers are the best. Are they in the middle of a chain? If so, has their property sold or is still on the market? The larger the property chain, the greater chance of collapse.

By picking the wrong buyer, you can end up having a long and painful sale, especially if you fall victim to a scam like ‘Gazundering’, which is when a buyer threatens to pull out just before exchange of contracts if the vendor doesn’t reduce the price! Shameless tactics, but sadly it happens!

Essentially, assess each buyer and determine who is statistically least likely to cause any issues.

Holding the deal together

Holding the deal together is often the hardest stage of the transaction when buying and selling a property. The longer it takes to reach an exchange of contracts, the greater the chance of the entire deal falling through. It’s important to keep in regular communication with your solicitor to find out what stage you’re at. Stay in contact with your Estate Agent as he/she can pass on information regarding the buyer- it’s equally as important to know the progress of your buyer as well as your own.

Moving Out / Removal Services

Often overlooked, but planning for move-out day is still an important step in the process which needs consideration, because your budget may need to allow for the cost of removal services.

Removal services can be hefty, particularly if you plan on shifting a boatload of furniture and personal possessions to your new residence. So it’s best to be prepared and get some quotes beforehand.

According to an article on comparemymove.com, in 2019 the average removal company costs for a three-bed house are roughly £1192.67. That includes professional packing services and materials (£250), as well as the dismantling and reassembling of furniture at your new home (£125).

If you want to gather some quotes, you can complete this House Removal form and you’ll be given 5 quotes with in seconds.

Oh, and don’t worry! You wouldn’t be an odd duck if you’re pondering on whether you should try to save the pennies by sourcing your own van and guilt-tripping a couple of friends into helping with the big move. Of course, your friends would rather watch paint dry, and they’ll hate you for asking. But you definitely wouldn’t be the first to call in the favour.

From my experience – and feel free to take the following with a pinch of salt – it’s something you can get away with when you’re dealing with small amounts of cargo. However, when you’re dealing with large amounts, it’s often a lot more hassle than it’s worth. The advantages of using a removal company is that they will load and unload everything for you, and they’re well equipped to transport your possessions safely. That’s frequently not the case when you rely on DIY services. Think Chuckle Brothers.

You may also want to bear in mind that moving homes is said to be one of the biggest culprits of causing stress. I don’t know if that’s statistically true, but it always seems to be said. In any case, my point is, I imagine a large portion of the stress is incurred during moving day.

I’ll leave it in your capable hands to make a sensible decision. Either way, might be worth getting some quotes before making any finalised decisions.

Disclaimer: I'm just a landlord blogger; I'm 100% not qualified to give legal or financial advice. I'm a doofus. Any information I share is my unqualified opinion, and should never be construed as professional legal or financial advice. You should definitely get advice from a qualified professional for any legal or financial matters. For more information, please read my full disclaimer.

Landlord Products / Services

Landlord Products / Services

![Selling Your House For Cash [With in 7 Days] Selling Your House For Cash [With in 7 Days]](https://www.propertyinvestmentproject.co.uk/wp-content/uploads/Sell-House-For-Cash.jpg)

![HELP! I Can’t Sell My House [3 Solutions]! HELP! I Can’t Sell My House [3 Solutions]!](https://www.propertyinvestmentproject.co.uk/wp-content/uploads/HELP-I-Cant-Sell-My-House.jpg)

![The Fastest Way To Sell Your House [4 Options Explained] The Fastest Way To Sell Your House [4 Options Explained]](https://www.propertyinvestmentproject.co.uk/wp-content/uploads/how-much-to-sell-house.jpg)

![IAmTheAgent Discount Voucher Code [Updated 2024] IAmTheAgent Discount Voucher Code [Updated 2024]](https://www.propertyinvestmentproject.co.uk/wp-content/uploads/iamtheagent-logo-1.jpg)