House Price Crash (HPC) (housepricecrash.co.uk) is, surprisingly, one of the more popular UK property forums.

I wanted to quickly share my thoughts on the place because I found the community members rather interesting.

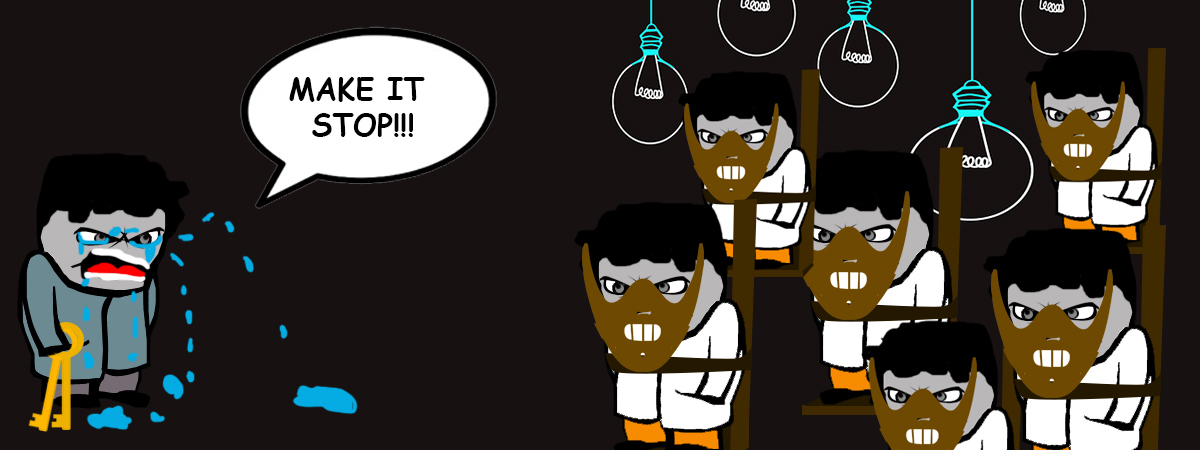

Sadly, the buzzing community largely consists of anal douche-bags that participate in gang-mentality bullying, forcing opposing opinions into tears. While it’s quite jarring and sad, I must confess, there’s something rather morbidly fascinating about watching middle-aged busy-bodies and OAPs endlessly virtually-masturbate over the prospect of house prices tumbling, and fantasise about the demise of anyone that wants to prosper in BTL. Presumably, they have nothing better to do.

Don’t get me wrong, there’s some nice and helpful people there too (I’m sure of it!), but mostly, the place seems to be a box full of lunatics.

I guess when you name a website “House Price Crash” you’re only ever going to attract a very limited and bitter mindset. Needless to say, when you throw those minds into a barrel, it can become a very dangerous environment for an outsider i.e. a Landlord.

I spent a bit of time in the forums (possibly for my sins); making casual comments (under an untraceable alias), reading the thoughts of others, mainly staying under the radar while getting a taste for the place.

It quickly became apparent that the place is just one gigantic anti-property orgy; everyone seems to be hyping one another up into a frenzy, encouraging profound anger [at the rest of the world]. It kind of felt like an obscure religious cult or an extreme right-wing activist group; say the right words and send the right message, and prepare yourself for a round of incoming virtual bum-slaps. Go against the grain, and you better duck and cover, hoping they don’t hunt you down like a rabid dog.

The thing is, I can understand why people would want property prices to tumble. But what perplexed me the most is the level of genuine anger (and perhaps frustration) people seem to carry for other [good] people that are trying to prosper through property investments.

I’m a firm believer in tact and mutual respect, but sadly those virtues seem to be absent from the nutcases and lost souls loitering in there…

This is a normal 1-on-1 conversation:

Person 1: Hey, mate, I’m a Christian.

Person 2: That’s cool. I don’t believe in Religion myself, but I’m open to all teachings…

Person 1: Good stuff. So, what you up to?

This is a normal 1-on-1 conversation in the HPC world:

Person 1: Hey, what do you think of the current property market? I think there’s going to be a crash…

Person 2: Yeah, I’ve heard a lot of people say that. But I think the market will sustain, and perhaps ripple up and down… Oh well. What you up to?

Person 1: Fuck you, you dumb piece of shit. Fuck you hard. Fucker. YOU MAKE ME SICK! DON’T TALK TO ME. EVER AGAIN!

One track mind, no room for reason.

The fact that a crash might not occur is simply beyond their realms of possibility, and the fact someone decent could be prospering through property is even more far-fetched. I don’t think there will be a crash per’se, but I wouldn’t bully anyone for thinking otherwise.

Anyways, interesting place, and this pretty much sums up my thoughts on their general mentality during my brief visits…

Disclaimer: I'm just a landlord blogger; I'm 100% not qualified to give legal or financial advice. I'm a doofus. Any information I share is my unqualified opinion, and should never be construed as professional legal or financial advice. You should definitely get advice from a qualified professional for any legal or financial matters. For more information, please read my full disclaimer.

Landlord Products / Services

Landlord Products / Services

I have been looking at the HPC site as well.

Regardless of the many children in there, it is a good source fof negative stories. I have a BLT and am relying on capital appreciation. I am new to this site, but want some advice on selling.

I want to know if some text I saw is true or not (please note that I have not edited it)....

Population:

Population density (persons per square km) in the UK is around 250 and that of Japan is 339. The population there was still growing in 1990…the year in which house prices started falling for the next 15 years—they added lots of people over their boom period and during the decline. (n.b. Japan has even less workable land because of earthquake zones and mountains.)

UK UK

Year Population

1990 57.27m

1995 57.96m

2000 58.87m

2005 60.24m

2010 61.52m

Source: United Nations.

Japan Japan

Year Population

1980 116.81m

1985 120.84m

1990 123.54m

1995 125.47m

2000 127.03m

2005 127.90m

2010 127.76m

Source: United Nations.

Hong Kong has a population density of 6,407 and Singapore 6,369 (Singapore in particular has traditionally had large numbers of foreign workers entering). They both saw a decade of price falls, although unlike Japan this was more related to the Asian financial crisis of 1997-98 (but population density did not provide a guaranteed rise in house prices as many would suggest is the case in the UK).

Interest rates:

Unemployment in Japan in 1990 was around 3% (lower than ours), while short term interest rates (higher than policy rates) were at close to current money market rates in the UK. The increased payments, in Japan, owing to higher interest rates, were of a similar magnitude in Japan, as they are in the UK now.

Japanese money market rates

1987 4.2

1988 4.5

1989 5.4

1990 7.7

1991 7.4

1992 4.5

1993 3.0

UK inter-bank lending rate

Jun-03 3.57

Sep-03 3.5

Dec-03 3.86

Mar-04 4.11

Jun-04 4.51

Sep-04 4.85

Dec-04 4.82

Mar-05 4.85

Jun-05 4.83

Sep-05 4.55

Dec-05 4.56

Mar-06 4.53

Jun-06 4.64

Sep-06 4.85

Dec-06 5.17

Mar-07 5.49

Jun-07 5.72

Sep-07 6.29

UK and US, current numbers:

Current US and UK data:

US official rates: 4.75%

UK official rates: 5.75%

US unemployment rate: 4.7%

UK unemployment rate: 5.4%

The US, in other words, has lower interest rates and lower unemployment.

This is a cross-country comparison using data that according to estate agents would have meant none of these other markets should have collapsed. This is liquidity driven and liquidity is gone. Of course each country is unique (there were other things going on in Japan’s case up to 1990, for example, but the point is that the arguments (immigration: population, lack of land for housing, low unemployment and low interest rates)) being used by housing bulls failed to help any of the other countries when bubbles came to bursting and liquidity declined.

Comments appreciated. My property is in London and I bought in 2004.