Question: when did remortgaging a BTL mortgage become such a royal pain in the ass?

Perhaps that’s a question for another day, because right now I’m still jumping through hoops and dancing to whatever tune my to-be mortgage underwriters are playing. I’m doing whatever it takes to push a mortgage deal through.

As with most mortgages, there’s bullshit obligatory paperwork and bureaucracy, which can be emotionally draining, and of course worrying because there’s large sums of money on the line. I’m eager to wrap this up… like, YESTERDAY!

But unfortunately, someone is making me work for it. Hard.

Somehow, albeit lifelessly, I’ve managed to keep my head in the game. But it’s taken its toll, I have partially surrendered; at this point I’m just blindly printing off reels of bank statements they (the lender) keep requesting, hoping they eventually find what they’re looking for. I’m also aimlessly signing every dotted line my mortgage broker throws under my nose. I wouldn’t be surprised if he owns my properties and the rights to my penis.

As part of the remortgaging process, I’ve received a couple of documents from my lender’s to-be (Natwest) legal representatives; the ‘Mortgage Deed’ and ‘Questionnaire Authority Form’, both pretty standard and innocent. But sandwiched in-between the familiars’, was a document which left me scratching my melon like I was drenched in lice…

Occupier’s Consent & Postponement Deed

Occupier’s Consent & Postponement Deed

Errr… WTF is this shit?

Has anyone else received one before, which from the outset comes across as one hell of a scary piece of sheet (see what I did there? I know, “lol”)? Is this a new remortgaging standard?

It’s the first time I’ve received one, and I don’t like it. I don’t like it one iota.

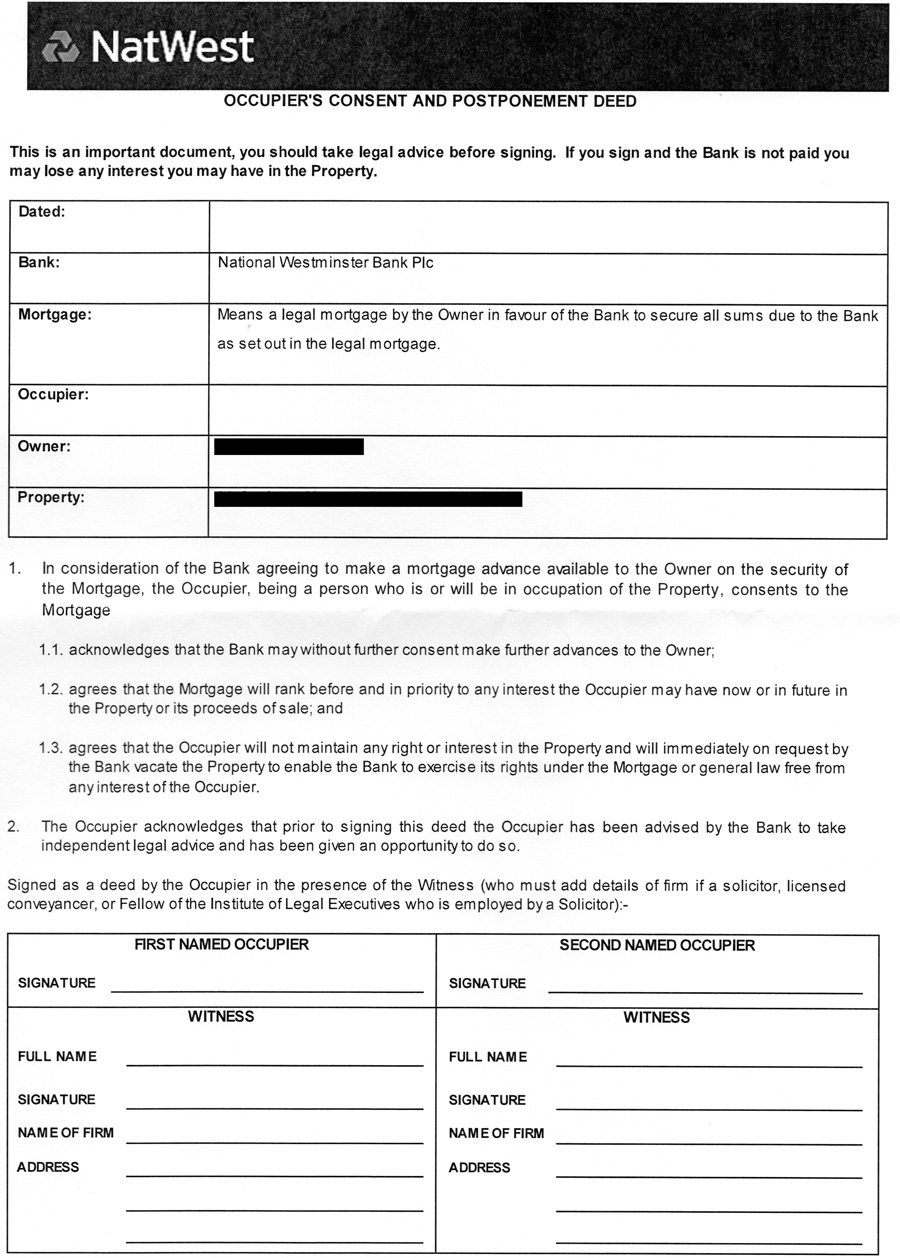

In consideration of the Bank agreeing to make a mortgage advance available to the Owner on the security of the Mortgage, the occupier, being a person who is or will be in occupation of the Property, consents to the Mortgage

What’s alarming is that they appear to be asking for the occupier (my tenant) to consent to the mortgage. At least, that’s how I’m perceiving it. You too, right? Ok, cool.

Well, actually, not cool, but it’s good we’re on the same wavelength. I probably need to book in a few extra sessions with my therapist, because this document is wreaking havoc with my anxiety.

So here are my initial thoughts:

- Never seen or heard of this document before. WTF is it? Is it specific to Natwest BTL remortgaging or remortgaging in general?

- What does my mortgage have to do with my tenant? I’d rather burn my eyes out with my very own potent mixture of semen before getting my tenant involved with my finances. (sorry, I honestly don’t know where that came from)

- I don’t want to hassle my tenant with this document, especially since it seems like she will need to involve a witness!

- If I were the tenant I would NOT feel comfortable signing it, because I’d naturally assume I’d be held liable if my dip-shit landlord fell into arrears, even if every word on that document implied otherwise.

- What if she refuses? Obviously I wouldn’t blame her, but then I’d probably have to ‘revenge evict‘ her for not complying.

I joke. I think.

I just don’t know anymore.

All I do know is that I would lose a lot of money if this mortgage fell through because my tenant wasn’t willing to play ball, at which point my tenant would become a very undesirable investment.

- Where’s my fucking therapist?

What to do, what to do…

When in doubt, ignore it!

I should have contacted my broker and asked him what the deal is; that probably would have been the most sensible option. But the deed in itself, from a landlord/tenant perspective, seemed too ridiculous to warrant serious action. So I returned the ‘Mortgage Deed’ and ‘Questionnaire Authority Form’, while slipping the ‘Occupier’s Consent & Postponement Deed’ under my bed, among my stack of smutty mags and wet-wipes. Nice.

I really, really, really didn’t want to try and explain to my tenant why she should sign a consent deed for my mortgage, especially when I didn’t even understand myself. Trying to ‘blag it’ seemed like the only sensible solution.

Did I just delay the process and create complications? No idea. Maybe. Probably.

5 days later…

And… EVERYONE… BREATH…and… RELAX!!

Turns out I experienced a loss of sexual desire, irritated my complexion, lost my appetite, shit my pants, and then ironically lapsed into a state of chronic constipation and nausea… all for nothing.

I received confirmation that completion will take place next week. There was no word of the missing deed nor were there any problems flagged.

Now, the question begs to be asked, WTF is the deed for and why was it even sent to me if it’s not required (at least, it wasn’t in my case)? Was it one of those hilarious jokes that’s sole reason for existing is to scare the living shit out of people? Perhaps.

Conclusion

If you receive the same document under the same circumstances and consequently find yourself in a similar state of fiery despair, you probably needn’t worry. That’s what I did anyways!

I suspect the deed is not required for BTL remortgaging and therefore tenants don’t need to sign it. However, I could be wrong; I could have just been extremely lucky by ending up with an incompetent tool handle my case/paperwork. If that’s the case, I owe someone who is terrible at their job a large drink. Cheers!

You probably should seek legal advice, just like the document says. That should set you back a cool £100, or whatever the going rate is for one minute’s worth of legal advice from a random pretentious, condescending twit :)

On a final note, I advise ALL landlords (and homeowners) to regularly scour the market for new BTL mortgage products, because you could end up saving a beautiful buttload of cheese! Remortgaging is probably one of the best ways of saving money and being a lucrative landlord.

My new policy means I’ll save £200 a month on interest payments alone, while also shortening the loan period. I’ll probably dedicate a blog post to my new mortgage at some point, most likely when I’ve lost the will to live, and have nothing better to do than compare before and after mortgage rates (I’m sure that will be orgasmic for you)! I’ll even show you mugshots of the cheap women that will benefit from my new surplus of disposable income!

I can’t imagine this post will prompt much empathy, interest and/or response… but can someone say something, please? Anything. Please!

But seriously, has anyone else received this document and consequently been rendered totally baffled and mortified?

Until next time, God bless and stay safe (it’s a bit creepy when I say stuff like that, ain’t it? And that’s precisely why I do it). I love you xo

Disclaimer: I'm just a landlord blogger; I'm 100% not qualified to give legal or financial advice. I'm a doofus. Any information I share is my unqualified opinion, and should never be construed as professional legal or financial advice. You should definitely get advice from a qualified professional for any legal or financial matters. For more information, please read my full disclaimer.

Landlord Products / Services

Landlord Products / Services

Well you could "seek legal advise" or you could talk to your mortgage broker.

This document is not for tenants to sign.

Put simply it is mainly for residential and those that reside with you. Say children over 17, or wife, a friend? etc.. they have implied rights and this document is to ensure later on they don't come back and bite the lender.

They are giving consent for you to proceed. Not because they own the property but to protect the later of potential future claims - if lender has to repossess etc..

Its not realy for tenants, as there rights end after Section 8 notice is served on them by a lender.

Here is a snippit from a lenders internal document for you:

http://i.imgur.com/QUNWnaW.png